|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Tax School Homepage | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Tax Segment I-3 - Job Related Tax Deductions

In this topic you will cover which expenses are subject to the 2% limit and which expenses are not. You will also learn which expenses you cannot deduct and how to report the expenses that are deductible. For example, some of the expenses that are deductible are unreimbursed employee expenses that are incurred during the year and that are ordinary and necessary. You may be able to deduct the the ordinary and necessary business-related expenses you have for travel, entertainment, gifts, or expenses for transportation. An expense does not have to be required to be considered necessary. This topic will cover what expenses are deductible and how to report them on a tax return. In addition you will become aware of which records you need to prove your deduction and what to do with reimbursements. Student Instructions:Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online

Most forms are in Adobe Acrobat PDF format.

His profession requires special white uniforms consisting of a white cap, white shirt (or jacket for cold weather), white bib overalls, and white work shoes required by his union to wear on the job. The following is the itemized list of expenses.

Dave paid a total of $ 9, 600 in rent for his 1 bedroom apartment for 2011. Dave used his automobile (2003 Ford Pick-up) for his job and used a total of 23,000 miles for the whole year. He started using his car car for work on January 1, 2011. His daily roundtrip miles are about 15 per day for a total of 5,400 for the whole year. Other miles were 2,600. He sometimes uses this pick-up truck to help his friends when they are moving. He kept a detailed record of his miles to and from work and his miles used at work to and from jobs. He has another car (2011 Dodge Ram) that he purchased in November of 2010. He does not use this car for his job. In addition to his earnings from work, Dave had the following:

Dave also had educational expenses. He is trying to become a real estate agent. His total investment was the following:

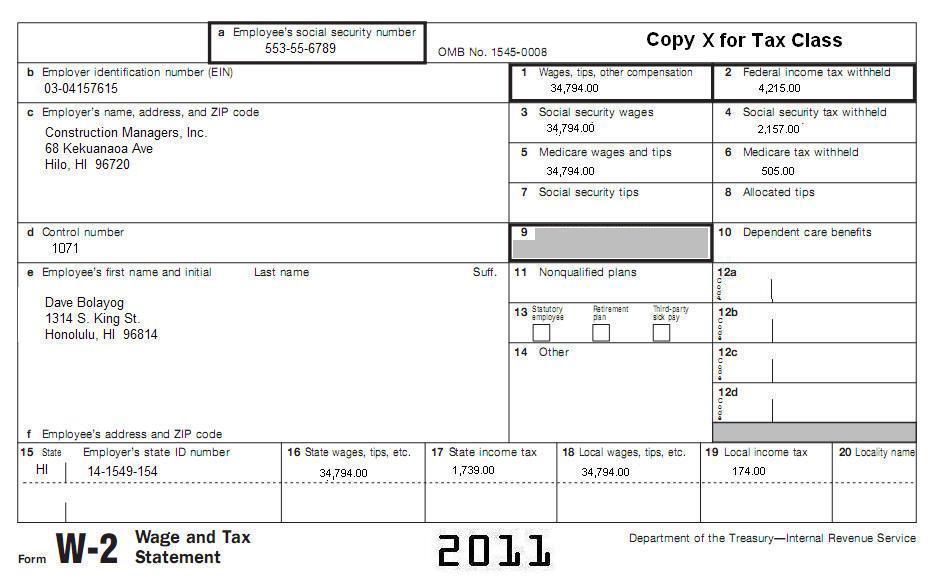

In addition, Dave has resume printing and distributing costs for a total of $120.00 to land him a job in his new chosen real estate career. Mr. Bolayog is not married and has no children. All information on the following W-2 is current. Tax Return Situation 2: Complete a Form 2106, Schedule A, Form 1040 for Jorge Morales (SSN: 604-10-6710). Jorge is getting a promotion. He will undergo training to become store manager. On behalf of his employer, he will attend training for 6 days for managerial training at the main restaurant. The company is paying for half of all his expenses. Jorge has to bring a statement of his expenses and his receipts to his employer. None of the expenses were included on line 1 of his W-2. Jorge's employer reimbursement was $1,408 (including $375.00 for meals and entertainment). His expenses incurred are the following.

Jorge is single and has no dependents. Get all their basic information from the following W2, including income information. All information is current.

1. Look at the Form 1040 you prepared for Dave. What is the amount on Form 1040, Line 40a?

A. $13,003. 2. Look at the Form 1040 you prepared for Dave. What is the amount on Form 1040, Line 43?

A. $20,288. 3. Look at the Form 2106 you prepared for Jorge Morales. What is the amount on Form 2106, Line 9 column B?

A. $1,032. 4. Look at the Form 2106 you prepared for Jorge Morales. What is the amount on Form 2106, Line 10?

A. $1,032.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Tax School Homepage |