|

|

| Back to Tax School Homepage |

|

Task CA-1 - Filing a California Tax Return

Determining the filing status can be a little complicated. Although you may be the head of your house, you may not qualify for the head of household (HOH) filing status under state and federal tax laws. Tax School Homepage Student Instructions:Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online

Most forms are in Adobe Acrobat PDF format.

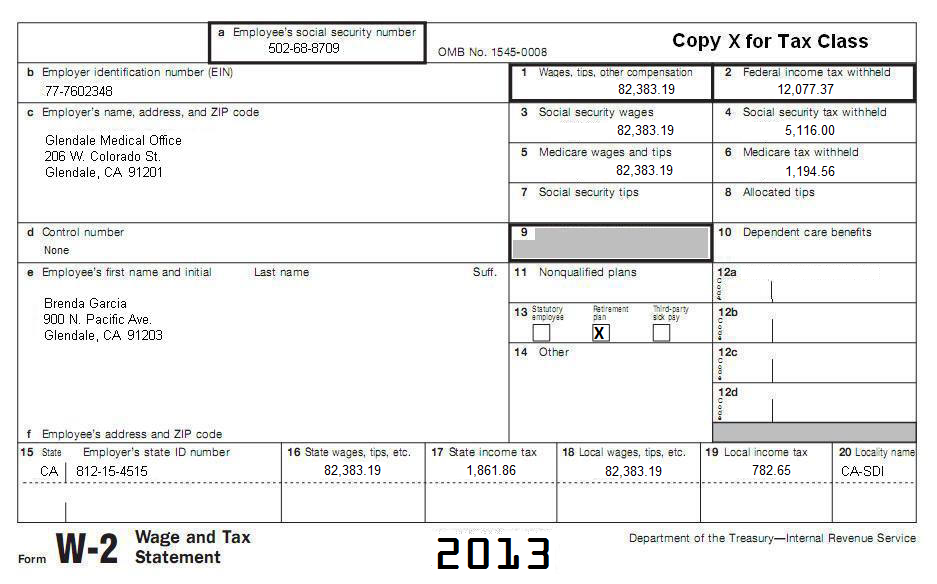

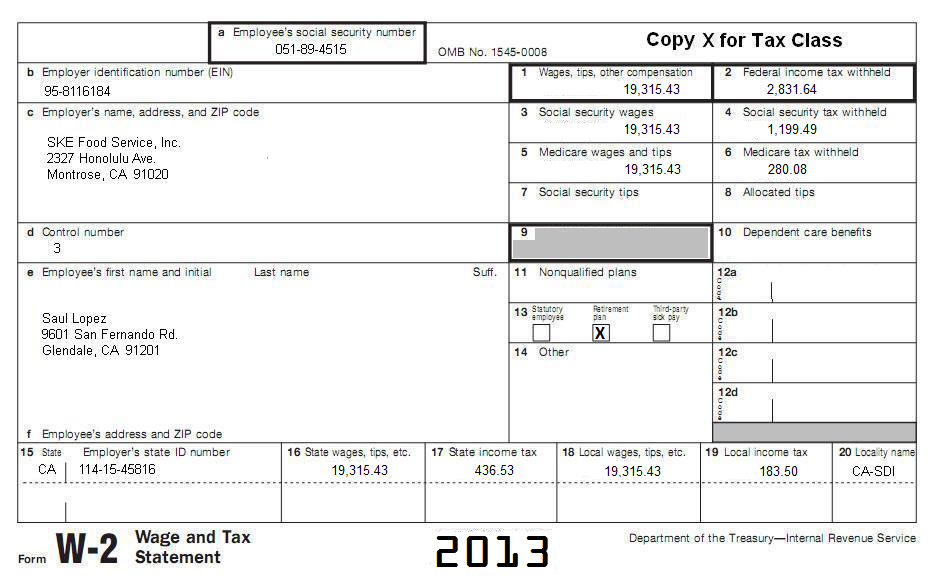

Tax Return filing situation 1: Use the following W-2's and information to prepare a tax return for Saul Lopez and Brenda Garcia. Saul (Date of Birth 9/15/1947) and Brenda (Date of birth 7/10/1957) were married throughout the year lived together for the entire year. They will file their tax returns as Married filing separate. Saul and Brenda lived together for all 2013. So you need to file a tax return for Saul and another one for Brenda. They did not transfer any of their earned income between themselves. During the year their income (including W-2's) were as follows: Saul received dividends from stock he owned before their marriage of $2,436.74. Brenda received dividends of $3,391.31 from stock she owned before the marriage. Brenda contributed $6,500 to an IRA for an IRA deduction on her 2013 tax return. Saul and Brenda received interest from an interest bearing account held jointly of $2,034.15. Saul paid $2,490 rent per month for a 3 bedroom house for all of 2013. Saul uses one of the bedrooms as an office. This office is not used in any way for Saul's work. The other bedroom is used as a guest room. The property was not exempt from tax. Saul received $27,969.53 Social Security benefits reported on box 5 of Form SSA-1099.

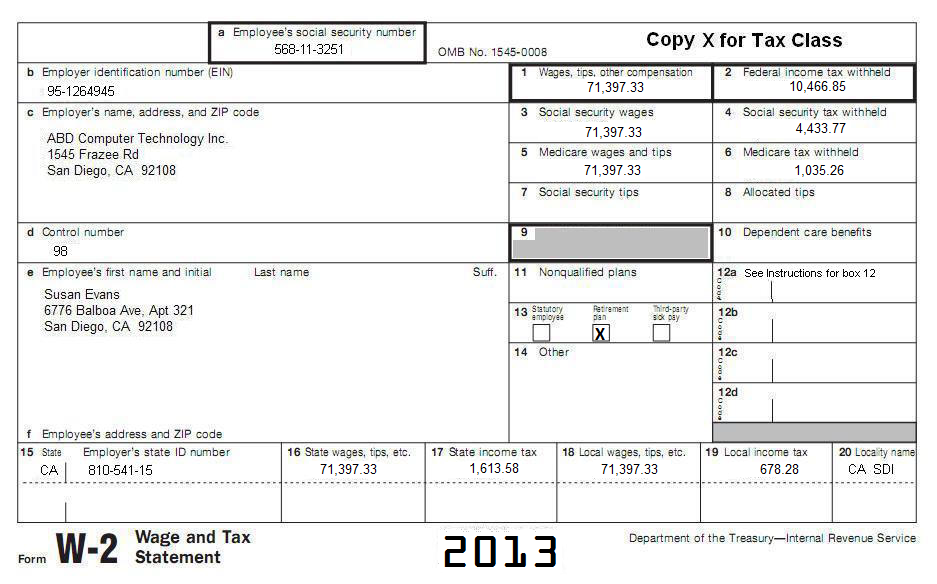

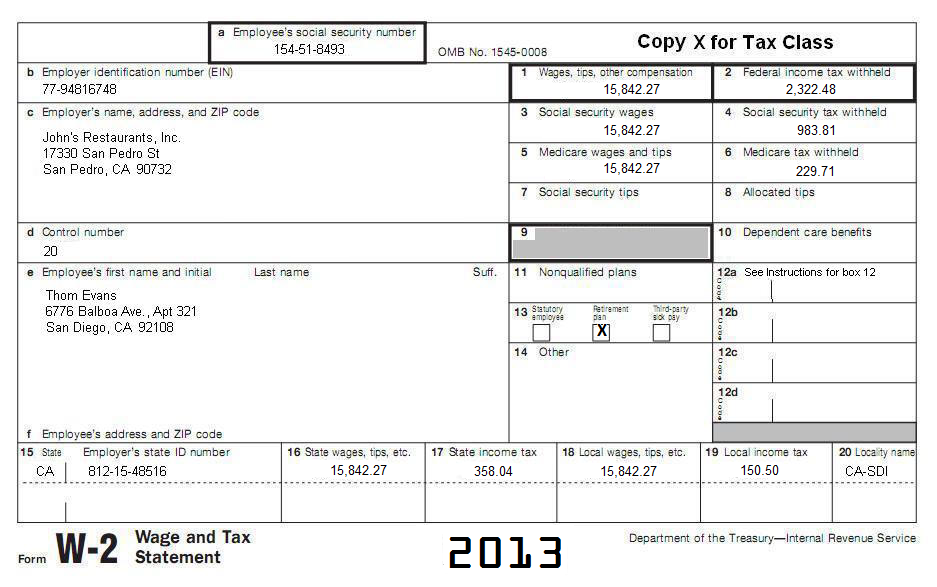

Tax Return filing situation 2: Thom (Date of birth 6/19/1948) and Susan Evans (Date of birth 4/16/1950) are married. Their two children Sara Evans (DOB 01/10/1995 and SSN (DOB 11/25/1995 and SSN 611-09-0921), Samantha Evans (SSN 612-02-0352) and Susan's mother Sara Winston (SSN 015-52-7785), lived with them and qualify as their dependents. Amounts paid for their support where paid out of community funds. Thom and Susan have decided that Thom will claim the mom and that Susan will claim the girls. Thom received $1,710.84 in dividends from stock that he owned before the marriage. Susan received $1,287.90 in dividends from stock that she owned before the marriage. Susan contributed $5,300 to an IRA for an IRS deduction on her 2013 tax return. Thom received $23,903.63 Social Security benefits reported on box 5 of Form SSA-1099. Thom and Susan paid $11,400 rent for the whole year for a 4 bedroom house for all of 2013. The property was not exempt from tax. Use the following information to file a tax return for Thom and Susan. They need to file separate returns. They have lived together for all of 2013. The address and personal information is current and correct on the W-2's. They will not itemize their deductions.

After you have completed the above tax returns, answer the following questions as accurate as possible:

1. Look at the Form 540 that you prepared for Saul. What is the amount on Line 12?

A. $18,232 2. Look at the Form 540 that you prepared for Saul. What is the amount on Line 13?

A. $88,078 3. Look at the Form 540 that you prepared for Saul. What is the amount on Line 14?

A. $3,322 4. Look at the Form 540 that you prepared for Saul. What is the amount on Line 17?

A. $20,122

5. Look at the Form 540 that you prepared for Saul. What is the amount on Line 19?

A. $50,397 6. Look at the Form 540 that you prepared for Saul. What is the amount on Line 31?

A. $2,605

7. Look at the Form 540 that you prepared for Saul. What is the amount on Line 32?

A. $93 8. Look at the Form 540 that you prepared for Saul. What is the amount on Line 48?

A. $2,038 9. Look at the Form 540 that you prepared for Saul. What is the amount on Line 71?

A. $1,307 10. Look at the Form 540 that you prepared for Saul. What is the amount on Line 111?

A. $1,307 11. Look at the Form 540 that you prepared for Brenda. What is the amount on Line 12?

A. $87,590 12. Look at the Form 540 that you prepared for Brenda. What is the amount on Line 13?

A. $65,257

A. $87,590 14. Look at the Form 540 that you prepared for Brenda. What is the amount on Line 19?

A. $52,457 15. Look at the Form 540 that you prepared for Brenda. What is the amount on Line 31?

A. $2,343 16. Look at the Form 540 that you prepared for Brenda. What is the amount on Line 48?

A. $5,609 17. Look at the Form 540 that you prepared for Brenda. What is the amount on Line 71?

A. $2,391.56

18. Look at the Form 540 that you prepared for Brenda. What is the amount on Line 75?

A. $1,149 19. Look at the Form 540 that you prepared for Brenda. What is the amount on Line 94?

A. $3,527 20. Look at the Form 540 that you prepared for Brenda. What is the amount on Line 111?

A. $3,527 21. Look at the Form 540 that you prepared for Thom. What is the amount on Line 12?

A. $14,945.54 22. Look at the Form 540 that you prepared for Thom. What is the amount on Line 13?

A. $15,842 23. Look at the Form 540 that you prepared for Thom. What is the amount on Line 14?

A. $19,168. 24. Look at the Form 540 that you prepared for Thom. What is the amount on Line 17?

A. $45,868 25. Look at the Form 540 that you prepared for Thom. What is the amount on Line 19?

A. $41,425 26. Look at the Form 540 that you prepared for Thom. What is the amount on Line 31?

A. $1,522 27. Look at the Form 540 that you prepared for Thom. What is the amount on Line 32?

A. $806 28. Look at the Form 540 that you prepared for Thom. What is the amount on Line 35?

A. $1,064 29. Look at the Form 540 that you prepared for Thom. What is the amount on Line 48?

A. $182

30. Look at the Form 540 that you prepared for Thom. What is the amount on Line 71?

A. $986 31. Look at the Form 540 that you prepared for Thom. What is the amount on Line 111?

A. $0 32. Look at the Form 540 that you prepared for Susan. What is the amount on Line 12?

A. $75,955 33. Look at the Form 540 that you prepared for Susan. What is the amount on Line 13?

A. $75,955 34. Look at the Form 540 that you prepared for Susan. What is the amount on Line 17?

A. $71,322 35. Look at the Form 540 that you prepared for Susan. What is the amount on Line 19?

A. $67,553 36. Look at the Form 540 that you prepared for Susan. What is the amount on Line 31?

A. $1,490 37. Look at the Form 540 that you prepared for Susan. What is the amount on Line 32?

A. $1,215 38. Look at the Form 540 that you prepared for Susan. What is the amount on Line 35?

A. $2,054.34 39. Look at the Form 540 that you prepared for Susan. What is the amount on Line 71?

A. $986 40. Look at the Form 540 that you prepared for Susan. What is the amount on Line 115?

A. $2,806 Please Note: If you filled out the answers directly on this page, please print this page or write down the answers before you proceed to submit them by clicking on "Assignment" in step 3 above.

|

| Back to Tax School Homepage |