| Tax School Homepage | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Continuing Education Tax Course | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Update Tax Course | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Update Tax Course on FaceBook | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal Tax Updates - Reading Material | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2018 Filing a Tax Return Tax Updates This information will cover two tax years this early in the year. It will cover 2017 tax returns to be filed this year in 2018. Because of all the commotion and all the publicity with the new tax law overhaul, this information will also cover 2018 tax year tax returns to be filed in 2019. By the way, this tax law overhaul is not going to be a postcard tax return plan as constantly declared by the Trump government – their statements are instances of the many inaccuracies and exaggerations made by the new government. Never in history has any administration gotten away with so many inaccuracies and exaggerations. You probably already know this regardless if you are for the new Trump administration or if you are against it – all you need to do is do fact checking. It seems that there are just too many instances of untruths and many straight out lies. Please understand that this tax updates course is not meant to be an anti-Trump guide and that we are merely stating facts. The facts are that this new administration says one thing and does another. This is so very much true with the promised law changes and how these law changes will or will not affect Americans. Remember the wall? Who did Trump say was going to pay for this wall? Mexico. What is Trump trying to negotiate right now? He will agree to a DACA deal in exchange for funding for the wall! Okay, what happened to “Believe me, Mexico will pay for the wall”? This is just to give you an example of what is going on with the new administration and likewise this is also happening with the new tax code overhaul.

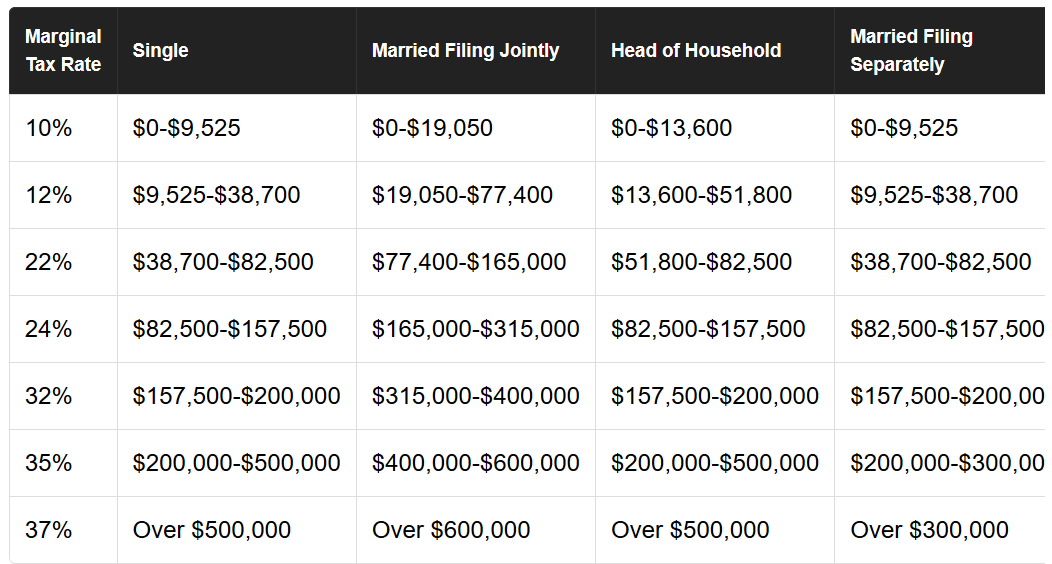

What’s happening for 2018 tax returns? The new administration

campaign tax plan was that the number of tax brackets would reduce from

seven to three. Similarly, the House of Representatives’ original tax reform

bill contained four brackets. Ultimately, common sense interceded and we are

still at the seven-bracket structure. There is just no way, we will ever

have a postcard tax return with all these tax brackets! The tax rates are

lower with about 2 % less than with the previous tax brackets but starting

at 10%.

The marriage penalty is almost gone. What is the marriage penalty? This penalty does not really exist as a specified penalty anywhere but it is widely talked about. Why? The marriage penalty is a concept that takes place with the change is the tax bill after a couple marries. The “marriage penalty” or the higher tax bill is due to the combined income of the couple and as a result of the combined income, the couple is changed to a new tax bracket and thus new tax rate which will usually result in paying more taxes than if the couple remained single. In a few instances the opposite can be true. Instead of a marriage penalty, the couple could incur a bonus which means that the couple fairs better by filing their tax returns as married filing jointly than when they file their tax returns as single. Thus, the couple will have a gain resulting in a bonus instead of a penalty. Again, these are widely spoken about, but there is not per say a “marriage penalty” or “marriage bonus” and these are merely the result of calculations after applying the different tax brackets at the married rates and at the single rates. Other items also affect couples that would cause a “marriage penalty” such as the ability of the individual to file as head of household when the individual is single and thus would not qualify for this HOH filing status once the individual gets married. Additionally, the individual will no longer qualify for the Earned Income Credit because of the combined income as a married individual. Remember this, the marriage penalty is not an actual penalty. It is something that happens as a result of the different tax bracket (7 tax brackets). The only thing a taxpayer can do to completely eliminate this penalty or the possibility of the marriage penalty is plan your taxes before marriage. It is a well-known fact that when couples plan to marry, the last thing on their mind is the marriage penalty. If you earn more, your income tax bracket will be higher and that only makes sense. An individual who is not married is single for tax purposes. A couple who is married is considered one individual for tax purposes and thus their income is taken together as one individual. When the couple gets married, the income will usually increase tremendously unless one of the individuals in the marriage is not working. If the income increases, then the tax bracket and the tax rate also increases. The higher tax as a result of getting married is the marriage penalty. The marriage penalty would be the higher tax and the loss of credits and deductions as a result of the marriage.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Tax Facts, Updates and Review: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2017 Filing Requirements Chart

for Most Taxpayers

* If you were born before January 2, 1953, you are considered to be 65 or older at the end of 2017. ** Gross income means all income you received in the form of money, goods, property, and services that is not exempt from tax, including any income from sources outside the United States or from the sale of your main home (even if you can exclude part or all of it). 2017 Filing Requirements for Dependents:

Other Situations When You Must File a 2017 Return:

Cost of Keeping Up a Home: Keep for Your Records

Who Is a Qualifying Person Qualifying You To File as Head of Household?

There are are five tests that must be met for a child to be qualifying child. The five tests are:

Relationship Test To meet this test, a child must be:

Age Test: To meet this test, a child must be:

Residency Test: To meet this test, your child must have lived with your for more than half of the year. There are exceptions for temporary absences, children who were born or died during the year, kidnapped children, and children of divorced or separated parents. Support Test (to be a qualifying child): To meet this test, the child cannot have provided more than half of his or her own support for the year. This test is different from the support test for a qualifying relative. Joint Return Test (to be a qualifying child): To meet this test, the child cannot file a joint return for the year unless the joint return was filed only as a claim of refund. Qualifying Relative: There are four tests that must be met for a person to be your qualifying relative. The four tests are:

Not a qualifying child test: A child is not your qualifying relative if the child is your qualifying child or the qualifying child of any other taxpayer. Member of household or relationship test: To meet this test, a person must either:

If at any time during the year the person was your spouse, that person cannot be your qualifying relative. Gross Income Test: To meet this test, a person's gross income for the year must be less than $4,050. Support Test (to be a qualifying relative): To meet this test, you generally must provide more than half of a person's total support during the calendar year. Overview of the Rules for Claiming an Exemption for a Dependent:

When filing your return, you must

choose the appropriate filing status from the five filing statuses

available for 1040A and 1040 users. (Users of Form 1040EZ must file

as single or as married filing jointly, with no dependents.) You

select a status by checking the appropriate box directly below your

name on page 1 of Form 1040 or Form 1040A, where it says “Filing

Status”:

Standard Deduction Chart for Most People*:

Standard Deduction Chart for

People Born

Standard Deduction Worksheet for Dependents

More Tax Facts and Updates: Submit a Budget to Congress There are certain

items that must happen before the tax year before any laws can take affect

they must be passed before the start of the year. Any tax laws should be

ready to go by the first of January. On or before the

first Monday in February of each year the President

is required by law to submit to the Congress a budget proposal for the

fiscal year that begins the following October.

Information Requested The IRS collects certain information to determine what needs to be done and what new laws to propose. Additionally, tax information is collected on tax returns that is needed to process the tax return. The tax return information is needed to carry out the tax laws of the United States and to figure and collect the right amount of tax. The tax professional must know that filling out those forms completely is necessary. It is necessary to avoid trouble for both the tax professional and the taxpayer. If you leave information requested out of the tax return, it will be considered an error and the IRS does keep track of errors committed by tax professional. The Internal Revenue Service could even pay you a visit and offer to help you with advice. This is not always a bad thing but it is probably better to keep the IRS at arms length. Everything must be filled out. Which brings us to discuss the presidential election campaign. The presidential election campaign Fund reduces candidate's dependence on large contributions from individuals and group and places candidates on an equal financial footing in the general election. If you check a box for $3 to go to this fund, your tax refund will not be lowered by the $3. You are not obligated to fill this box in and leaving it blank will not affect your tax return at all. Many tax professionals feel that they have to fill this in because they want to thoroughly fill out everything on the tax return. The IRS is not going to audit your tax return just because you leave the presidential election campaign blank. Tax Breaks come and go. It is important that you know about credits available to you and it is also important to know about credits that have expired. There are many reasons for this. First, taxpayers have questions for you and specially if you are new tax professional, you need to be able to tell your client a bit about the credit that no longer exists. Credits such as the First-time Homebuyer credit which expired in 2010. The First-Time home buyer credit was created in 2008 by the Housing and Economic Recovery Act and the intention was to encourage Americans to purchase homes by creating a credit which was worth up to $7,500 for first time homebuyers. The credit was increased to $8,000 by Congress. This credit is no longer available and there is another reason why you need to know about expired credits. You need to petition congress for credits that you believe are good for us. Like they say - One person can make a difference. Another one of these credits was the Making Work Pay credit. This credit expired for tax year 2010 and can not longer be claimed. Filing Status You must determine your filing status before you can determine whether you must file a tax return, your standard deduction and your tax. Your filing status determines almost every deduction, credit and tax situation. For example, your filing status is single if on December 31, 2017 if you never were married, you were legally separated, according to your state law, under a decree of divorce or separate maintenance or you were widowed before January 1, 2017, and did not remarry in 2017. State law is usually the determinant whether you are married or legally separated under divorce decree. A while back, couples would divorce at the end of the year and then would remarry when the tax storm was over. The Internal Revenue Service caught up with this hack and no longer allowed it. So if you obtain a divorce for the sole purpose of filing tax returns as unmarried individuals, and if you intention is to remarry and in fact do remarry, you must file as married individuals even for the time for which you were divorced. There are many rules in place and they are there for a purpose. Usually these rules emerge out of need to safeguard against abuse of the tax code. One of these is that if you file a joint return, you cannot choose to file separate returns for that year after the due date of the tax return. Some of these also just make sense - once you decide to file certain way and you separate it will create a mess trying to catch up with your estrange spouse to retrieve paperwork to amend your tax return. When we change our tax return in IRS terminology we say amend. In addition, to prevent abuse and prevent the inventing wives or husbands for tax purposes, the IRS requires that if your spouse is a nonresident alien, he or she must have either a Social Security number or an ITIN. You need a SSN or ITIN for everything you do with the Internal Revenue Service nowadays. ITINs are for identification purposes only and these numbers do not entitle you to Social Security benefits or to work legally under U.S. law. You, as a tax professional, need to know this especially if you help individual apply for these ITIN numbers in your office. If you are a nonresident or resident alien and you do not have and are not eligible to get an SSN, you must apply for an ITIN. You can apply to become an authorized ITIN application agent by visiting the IRS website. You would usually use the Married Filing jointly filing status if you were married at the end of 2017, even if you did not live with your spouse at the end of 2017. You would also use the Married filing jointly filing status if your spouse died in 2017 and you did not remarry in 2017 or you were married at the end of 2017 and your spouse died in 2018 before filing a 2017 tax return. A dependent could help you qualify for the Head of Household filing status. If you are single, the Head of Household filing status can give you a higher tax break. Really quick to be considered for the Head of household filing status you must maintain a household, be considered unmarried and have a qualifying child. The child must be your biological child, stepchild, foster child, sibling and more. The child must have lived within your home for more than six months during the tax year, to be younger than you and not have provided more than half of his living expenses during the year. Additionally, a qualifying child must be under 19 or if over 19, he must be under 24 and a full-time student who is registered in a full-time education program. Furthermore, a student is a child who during any part of 5 calendar months in 2017 was not enrolled as a full-time student at a school that offers an on the job training course, correspondence school or a school offering courses through the Internet. Form W2s Must be sent out early in the year Every employer is required to send out or give a Form W2 to each of its employees. Your employer must provide or send Form W-2 to you no later than January 31, 2018. If you don't get a Form W2, your obligation to report your earnings on your tax return are still an obligation.

Other Forms such as Form 1099s required to be sent out Employers and company must also send out or give Form 1099s to individual recipients. If the employee is considered independent or an independent contractor, the employer must give that independent employee a Form 1099-Misc. Banks also have likewise obligations not only for their employees but also for their account holders. They usually send out or give each account holder Form 1099-Int or Form 1099-DIV. When you receive interest income you would normally get a Form 1099-Int from the bank. When you receive interest income as a nominee, it means that the income is in your name, but it actually belongs to someone else. For 2017, report on your tax return unemployment compensation paid to you in 2017 on Form 1099-G. As you can see, if you receive income, there is a form for that. There is also a Form 1099 if you are a recipient of Social Security benefits. That form is Form SSA-1099. For example, you and your spouse (both over age 65) are filing a joint tax return for 2017 and you both received Social Security benefits during the year. In January 2018, you received a Form SSA-1099 showing ent benefits of $9,700 in box 5 for the 2017 tax year. Your spouse received a Form SSA-1099 showing net benefits of $1,400 in box 5. You also received unemployment compensation of $1,800 and taxable interest income of $450. You did not receive any tax-exempt interest income. You guessed it, there is also a form for that. Form 1099-INT or Form 1099-OID. You will soon learn that you can figure out in your head since these Social Security benefits are not taxable because of the Married Filing Jointly base amount of $32,000 for Social Security benefits.

If you receive income that requires

to be reported on any kind of Form 1099 this usually means that you

cannot prepare Form 1040EZ to file your tax return. You must use Form 1040A or 1040 if,

you receive interest as a nominee, for example.

Likewise, if you receive a 2017 Form 1099-INT for U.S. savings bond interest

that includes amounts you reported before 2017 or if you owned or had authority over one or more foreign financial

accounts with a combined value over $10,000 at any time during

2017 you must most definately use Form 1040A or Form 1040 but not

Form 1040EZ.

Earned Income Credit Penalties Tax professionals have a lot of work to do. Work that requires due diligence. Issues credits and deductions requires that the tax professional apply careful and persistent work or effort. As a tax professional it is your job to prevent fraud or tax code abuse. For example, if you allow the taxpayer to take the EIC even though he or she is not eligible and it is determined that the error is due to reckless or intentional disregard of the EIC rules, the taxpayer will not be allowed to take the credit for 2 years even if at that time he or she would normally otherwise be eligible to do so. If you as the tax professional do too many of these, the IRS can determine that it is your nature not to be applying due diligence in doing and there will also be penalties for you too as a tax professional. By the way, the taxpayer will be required to file Form 8862 if his or her EIC for a year after 1996 was reduced or disallowed for any reason other than a math or clerical error. Form 8862 is the form that taxpayers must file if their Earned Income Credit (EIC) was reduced or disallowed for any reason other than a math or clerical error for a year after 1986, and they want to take the EIC and they meet all the requirements after the disallowance punishment period is over. It is important that you do not file form 8862

More Penalties for not following the

rules.

You will be penalized if you don't follow the rules. Following the rules means that you will pay your tax and also pay them on time. If you cannot pay the full amount when you file, you can ask for an installment agreement or can ask for an extension of time to pay. You may have to pay a penalty if the amount owed is at least $1,000 and it is more than 10% of the tax shown on your return. However, you will not owe the penalty if your 2016 tax return was for a tax year of 12 full months and you had no tax shown on your 2016 return and you were a U.S. citizen or resident for all of 2016 or line 7 on your 2017 return is at least as much as the tax shown on your 2016 return.

If you cannot file on time, you can get an automatic

6 month extension if no later than the date your return is due, you

file Form 4868. If you get an automatic extension, you have until October

15, 2018 to file but you must pay the tax you owe with the extension.

There is no extension of time to pay. You can make a payment plan but

you will have to pay penalties and interest.

A frivolous return is one that does not contain information needed to figure the correct tax or shows a substantial incorrect tax because you take a frivolous position or desire to delay or interfere with the tax laws. In addition to any other penalties, there is a penalty of $5,000 for filing a frivolous return. Earned Income Credit The Earned Income Credit is not just for married individuals or only for individuals with children. This credit is also for single individuals with no children. Many people have a misconception that this credit is only for people with children and head of household. There are rules you must follow and worksheets to fill out to determine if you qualify. Just to illustrate, in 2017, you were 24, single, and you were living at home with your parents. You worked and were not a student. You earned $7,500. Your parents cannot claim you as a dependent. When you file your tax return, you cannot claim the Earned Income Credit because you are not at least 25. One of the requirements is that you are over the age of 25. The Earned Income Credit is about earned income. This means that any refund you receive as a result of taking the EIC will not be used to determine if you are eligible for temporary assistance for needy families, Medicaid and SSI, or supplemental Nutrition Assistance Program or low income housing. The refund you receive because of the EIC can count as an asset if not spent within a certain period of time, however. Credit for the Elderly and the Disabled. Another credit we will cover in this course is the Credit for the Elderly and the Disabled. You must remember that this credit is also for the disabled which means that there are people who are under age 65 who also qualify for this credit. To claim the credit for the elderly or the disabled and if you are under age 65, you must have your physician complete a statement certifying that you were permanently and totally disabled on the date you retired, and you do not have to file this statement with your tax return, but you must keep it for your records. Taxable Income Most income for which you perform services in exchange for compensation is taxable income. That is, unless the income is specifically excludable. Wages received as a household employee have special withholding arrangements in reference to Social Security withholding and Medicare tax. Usually wages received as a household employee for which you did not receive a Form W-2 because your employer paid you less than $2,100 in 2018 must still be included in line 1 as taxable income. Just because you do not receive a form reporting the income this does not mean that the income in automatically excludable from your taxable income tally. There are circumstance and clues to certain income not being taxable, but not alway. For example, your state refund could be taxable. You can use the worksheet to figure this out or if you received the state refund of your taxes in 2017, and for the year the tax was to the state, you did not file (or were not required to file Form 1040 and instead you filed Form 1040EZ or Form 1040A, then none of your refund is taxable. If you are a child or other dependent, you must file a tax return if your gross income was more than the larger of $1,050 or your earned income (of up to $6,000) plus 350. Direct Deposit is better. It is better to use Direct Deposit because your get your refund faster by direct deposit than you do by check and payment is more secure and there is no check to get lost. This is more convenient and you do not have to make a trip to the bank to deposit your check and it saves tax dollars because it costs the government less to refund by direct deposit. Your direct deposit request will be rejected and a check will be sent instead if any numbers or letters are crossed out or whited out, your financial institution will not allow a joint refund to be deposited to an individual account or if you request a deposit of your refund to an account that is not in your name. Starting January 1, 2012, many tax return preparers were required to use IRS e-file and most returns have to be filed like this. As a tax professional, you will not be able to work in this business if you don't file the tax returns electronically. To file your tax return electronically, you must sign the tax return electronically using a personal identification number (PIN). Keeping records. You must remember a

number one rules in accounting work - you must keep records. Your tax

returns must be substantiated with hard copies of items claimed. You could

also adopt virtual backup systems that are approved by the Internal Revenue

Service to keep records. The original hard copy books and records may be

destroyed provided that the electronic storage system has been tested to

establish that the hard copy books and records are being reproduced in

compliance with IRS requirements. The system must be in compliance with the

IRS.

There are many reasons to keep records. In addition to

tax purposes, you may need to keep records for insurance purposes or for

getting a loan. Good records will help you identify sources of income,

keep track of expenses and basis of properties and support items reported on your tax return.

You should keep copies of your tax returns as part of

your tax records. They can help you prepare future tax returns, if you

need to prepare an amended tax return or provide information to your survivor or the executor or

administrator of your estate.

You must keep your records for as long as they may be needed for the administration of any provision of the Internal Revenue Code, until the period of limitations for that return runs out and for the period of time in which you can amend your tax return to claim a credit or refund or the IRS can assess additional tax.

Keeping a copy of Form W-2 until you

begin to receive social security benefits will help you protect your

benefits in case there is a question about your work record or earnings

in a particular year. Keep a copy of your tax return, worksheets you used, and

records of all items appearing on your tax return until the statute of limitations runs out for that tax return.

Remember, proof of payment alone is not sufficient proof that the item you claim

on your tax return is allowable.

When your records are no longer needed for tax purposes, do not discard them until you check to see if they should be kept longer for other purposes.

If you want to claim one of the tax incentives for the

purpose of energy-efficient products, you must keep records to prove

when and how you acquired the property, the purchase price of the

property and that the property qualified for the credit. In addition to records you keep of regular medical and

dental expenses, you should keep records of transportation expenses that are primarily for and essential to

medical care.

More on keeping records. If you deducted actual state and local general sales taxes instead of using the optional state sales tax tables, you must keep a diary showing the actual taxes paid. We cannot stress too much the importance of keeping record for tax purposes. You need to keep records for everything. For example, if you paid mortgage interest of $600, you should receive Form 1098, Mortgage Interest Statement. Keep this form and your mortgage statement and loan information in your records. Name Changes. Name changes are common with women when they get married. However, nowadays, more and more women are keeping the last name they have had from their childhood. Other than that, women usually change their name for marriage or dissolution of marriage reasons. If you changed your name because of marriage, divorce, etc., be sure to report the change to the Social Security Administration (SSA) before you file your return. This prevents delays in processing your tax return, prevents delays in issuing tax refunds and safeguards your social security benefits. Casualties and theft losses

One of the many deductions that you will

be able to claim on your tax return is the casualties and theft losses.

To deduct a casualty or theft loss, you must be able to prove that you

had a casualty or theft. Your records also must be able to support the

amount you claim. For a casualty loss, your records should show the type

of casualty and when it occurred, that the loss was a direct result of

the casualty and that you were the owner of the property. To deduct a

casualty or theft loss, you must be able to prove that you had a

casualty or theft. For a theft loss, your records should show when you

discovered your property was missing, that your property was stolen and

that you were the owner of the property.

Identity Theft.

Identity theft occurs when someone uses your personal

information, such as your name, social security number (SSN), or other

identifying information, without your permission, to commit fraud or

other crimes such as getting a job or filing a tax return to receive a

refund. To reduce your risk, protect your SSN, ensure your employer is protecting your SSN

and be careful when choosing a tax preparer. You know that your clients

will be careful when they choose their tax preparer. Therefore, you must

always make your clients comfortable with your trust. Your clients must

know that you safeguard their information and that they can trust you with

this information. The security lock companies have done a great job at

instilling fear in people by highly advertising their services to the

public. As a result of this, taxpayer are very careful about trusting the

right individuals with their identity such as social security and credit

card numbers.

IRAs and Tax Planning

Part of tax preparation is tax planning.

Tax planning is as simply as seeing into the future a little bit and to

try to plan how certain tax items will affect your tax return. One of

the most common way to safeguard from from paying taxes is investing

into an IRA. For example, you and your spouse (under 50 years old), each may be

able to contribute up to $5,500 to a traditional IRA or Roth IRA

in 2017. If you are age 50 or older, you may owe a penalty if your

contributions to an IRA or Roth IRA exceed $6,500.

This topic is intended as an introduction and an overview of taxes and items you should expect in the coming topics. You need to know many things about taxes in order to be a professional tax specialist. You need to be well informed in order to help your clients who come to you for your protection. You will protect your clients against the Internal Revenue Service by being armed with the proper tax knowledge. By the end of this course you will have gained 70% tax knowledge or more. This is the knowledge you will acquire by completing this tax course. It will be up to you to pass on tax information to your clients in order for them to make the right tax decisions. It will be your turn to offer your clients more information that just deciding to tell them that you will take care of them. Think about and decide now what kind of tax professional you will be. Will you be the kind of tax professional who tells your clients "I will take care of this". As opposed to "I will take care of this like this and like this..." You don't need to give your customers all the tax information, only enough for them to be prepared and plan ahead for tax time. You need to provide them with knowledge about being prepared for tax season by keeping records and collecting all their receipts that are necessary to prepare the tax return.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

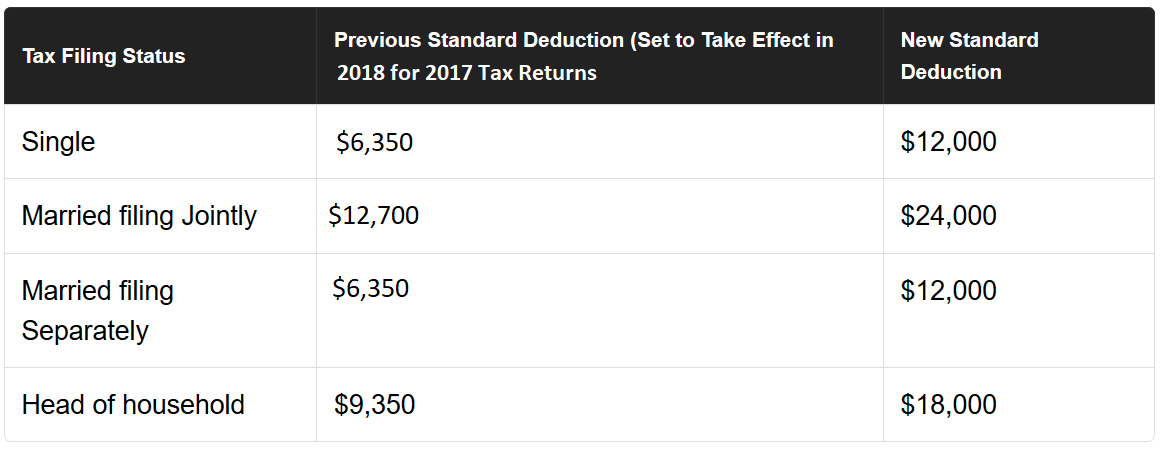

The standard deduction and personal exemption So what is new? The standard deduction and the personal exemptions will be done away with. That is simple. However, will this ever happen? The new administration is trying to simplify the tax code. Remember the talks about being able to file your taxes on a postcard? Really? With all the rules and tax code regulations we will have to re-define the meaning of a postcard. There is no way it will be ever that simple. Double the standard deduction for all taxpayers, but at what price? The elimination of the personal exemption will damp any benefit of doubling the standard deduction for sure.

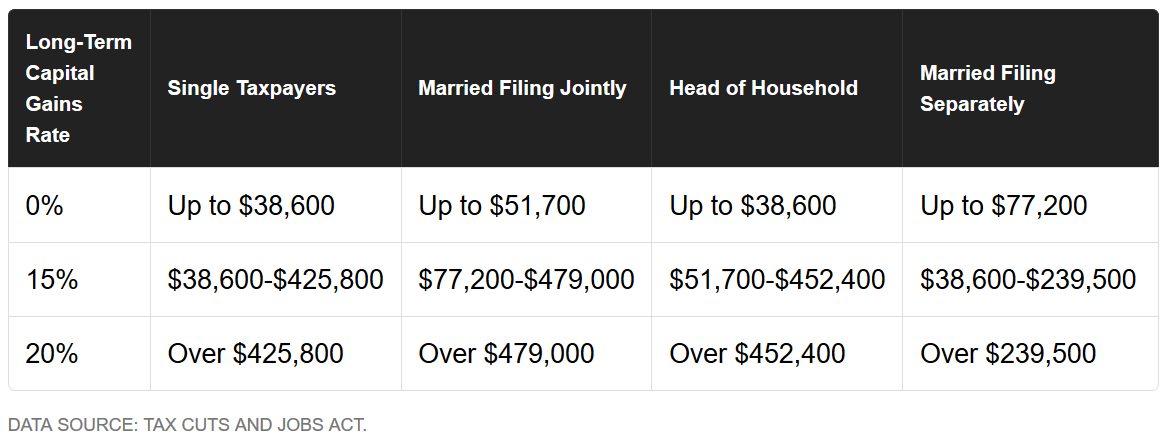

Capital gains To understand capital gains and the taxation of capital gains you must first understand what is taxed under capital gains. A capital gain tax is taken on any capital gain assets you sell. It can be said that a capital asset is anything and everything you own and use for personal or investment purposes. That is the easy way to put it. For example, capital assets include your home, household furnishings and stocks and bonds that are held as investments. So if you sell one of these items for a profit and after determining how it cost you to acquire it, you will have a capital gain that is taxable under the capital gain tax rules. Then after this you would have to figure out if your capital gain was short term or long term gain. Short term would be if you held the asset for a year or less and long term would be if you held the property for more than a year. Then you use Form 8949, Sales and Other Dispositions of Capital Assets along with Schedule D, Capital Gains and Losses to report it. Why is short term and long term even matter? Short term-term capital gains are subject to taxation as ordinary income at graduated tax rates while long-term have their own capital gains tax rate. The following show such capital gain tax rates which remains the same as in the old tax law:

There is no change to the 3.8% net investment income tax which applies to high earners. These have the same exact income thresholds as before. Repealing of the Affordable Care Act this will all be done away with but not for now.

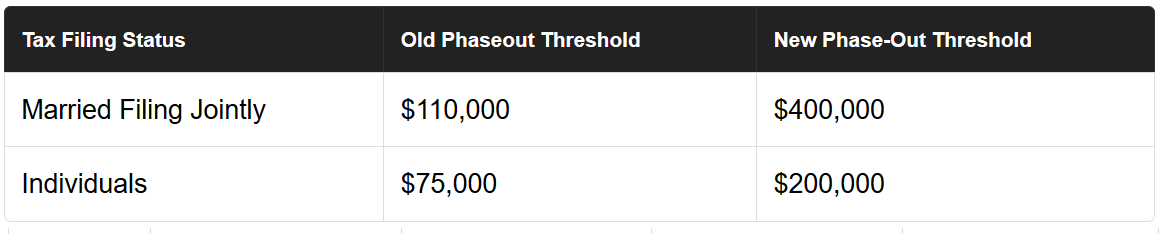

Tax Breaks for parents Larger families will definitely be affected by the elimination of the personal exemption. The good news is that larger families will dramatically benefit from the expanded Child Tax Credit available for each child who is under age 17. This Child Tax Credit will be doubled to $2,000 from the $1,000 amount that has been static for years. The best part for many is that the Child Tax Credit or part of it will be a refundable credit. Sadly, only up to $1,400 of it will be a refundable credit and the rest will be non-refundable which will count against any tax due. The phaseout threshold for the credit will be increase tremendously as shown in the following table:

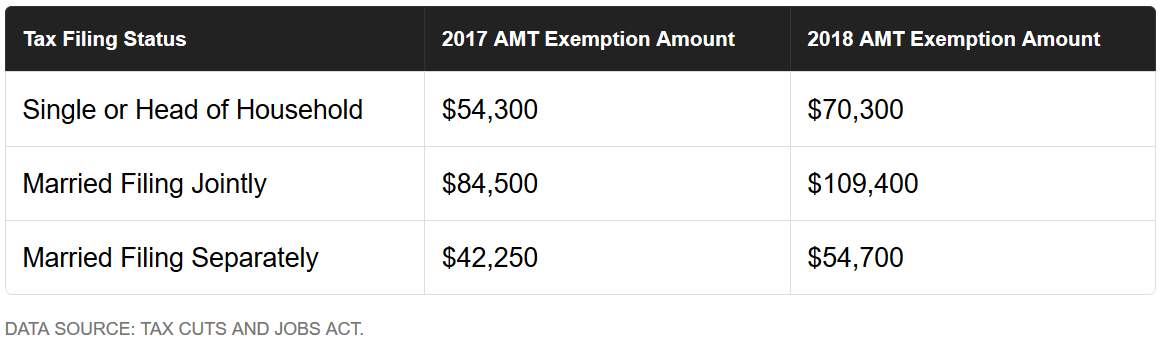

Additionally, there is a nonrefundable credit of $500 if your child is 17 or older or if you take care of elderly relatives and this is subject to the same income thresholds as shown in the above chart. Luckily there is no change to the Child and Dependent Care Credit. Individuals who qualify are allowed a credit of as much as $1,050 for one child under 13 or $2,100 for two children under 13. Up to $5,000 of income can still be sheltered in a dependent care flexible spending account on point of care expenses which the IRS allows to be up to $5,000 per year per family. The contributions are deducted before any paycheck deductions to federal, state and social security taxes. You are not taxed on the contributions and thus you save money. This Dependent Care FSA (DCFSA) is a pre-tax benefit account used to pay for eligible dependent care services, such as preschool, summer day camp, before and after school programs, and child or adult daycare. It is a very smart way to save an average of 30 percent on dependent care services and a very good way to reduce your overall tax burden because none of the money you contribute to a Dependent Care FSA is subject to any payroll taxes, not even FICA. For example, if you are single, this could save you up to $1,400 and if you are married this could save you up to $2,050 based on the $5,000 contribution. Education tax breaks The new tax bill had plans of eliminating or reducing education tax breaks. However, when the bill became final no reducing or eliminating of any education tax breaks happened. We still have the benefit of the Lifelong Learning Credit and the Student Loan Interest Deduction and so is the exclusion for graduate school tuition waivers. One change to the bill is that it includes the available use of funds saved in 529 college savings plans to include other levels of education and not just college. For example, you can use these funds for private school and even for tutoring expenses for your child in K-12 grade levels. Mortgage interest, charitable contributions, and medical expenses The mortgage interest, charitable contributions and medical expenses are still used as deductions with the exception of a few modifications made to them. What are these modifications? The mortgage interest deduction can only be for mortgage interest deduction on mortgage debts of up $750,000. Consequently now for taxes filed in 2019 for tax year 2018 the mortgage interest deduction excludes mortgage debts that are above $750, 000 when before the exclusion was for debts over $1 million. The new rule only applies to mortgages taken after December 15, 2017 and not affecting mortgages that were taken before this date. The new rules do not allow deducting interest on home equity debt - the debt you incurr by using your home as collateral. Before this you and still for tax year 2017 tax returns filed in 2018 you can deduct up to $100,000 in home equity debt. There are two notable changes to the charitable contribution deduction. Other than that, the deduction will be the same as before. Taxpayers can deduct donations of as much as 60% of their income. Previously there was a 50% cap. You can no longer deduct donations to a college in exchange for the right to purchase athletic tickets. Remember when the threshold for the medical expenses deduction was 7.5% of adjusted gross income before it was changed to 10%? Well, we are back to the 7.5% threshold. Additionally, with the new tax rules, this rule is retroactive to the 2017 tax year. You understand this, I assume. You can only deduct medical expenses that are over the 7.5% of your AGI. Deduction for State and local taxes The state and local taxes have been reduced. The deduction is limited to $10,000 and includes the deduction for income, sales and property taxes. The problem is that in some states like California with the high prices of homes and other property, the amount goes way beyond the $10,000. Deductions that will no longer be There are deductions that will no longer be. For tax year 2018 we will no longer be able to take a deduction for Casualty and theft losses unless the casualty is due to a federally declared disaster. We will no longer be able to deduct unreimbursed employee expenses along with employer-subsidized parking and transportation reimbursements. A deduction for tax preparation expenses will no longer be allowed for tax year 2018. For those of us who move a lot, we no longer will be able to get a deduction for moving. Itemized Deductions You take the larger of the two deductions – your standard deduction or your itemized deductions. You don’t have to, but you will most likely the bigger of the two. Why? Because you will most likely get a higher tax benefit if you take the larger of the two. You know that, already. So the itemized deductions such as for the mortgage interest, charitable contributions, medical expenses and the deduction for state and local taxes which you must list and have backup proof for are most probably will not be worth your time calculating. Why? That is because the standard deduction for your filing status already allowed will most probably be large enough and larger than the itemized deduction figure. For example, your standard deduction for married filing jointly is $24,000. If your itemized deduction total calculates at $19,000, which will you choose? The larger of the two is the standard deduction and that in turn will give you a higher tax advantage. Consequently, your tax client will save time and your client’s tax preparation bill will be less. We need to figure out a new definition of long form and short form because most taxpayers will be opting for the standard deduction. Consequently, we need to advise our tax client that although they can file a long form and pay us more money for tax preparation, that they really only need to file a short form and that we will prepare for them a short form instead. No more Obamacare penalties It seems that now Obamacare is voluntary. All efforts by Republicans to do away with the Affordable Care Act were futile. Great news! However, the new tax code did away with the individual mandate to buy health insurance and be penalized if they fail to maintain health insurance and they will be no tax penalty if they fail to buy health insurance. It is important that this new rule goes into effect until 2019 for tax returns filed in 2020. We are still liable for the Obamacare penalty for tax year 2018 which we file in 2019. Pass-through deduction The way that pass-through business income is taxed is part of the new tax code for 2018. Pass-through income is income earned as a sole proprietorship, LLC, partnership and S corporations. In 2018, you will be able to deduct 20% of your pass-through income or income from these business forms. You will be able to deduct 20% of your pass-through income before any ordinary income tax rates are applied. Professional services business owners such as lawyers, doctors and consultants have a phase out income limit of $157,500 for single files and $315,000 for filers who are married filing jointly. Just to refresh, pass-through entities are businesses organized under the owner in which the profit (or loss) is passed through to the owner and who in turn report the income as personal income. Most of these are professionals like lawyers, doctors, accountants or very simply put – professionals and wealthy investors. Many people will pay a lower tax on their taxable income and these lower rates in many cases reach up to include higher incomes. Many will pay a lower tax rate with the new tax code and many won’t. For example, individuals with taxable income between $200,000 and about $425,000 which includes some of these business owners such as lawyers, doctors, accountants and the wealthy investors will face a rate hike – from 33 percent to 35 percent. Married individuals with income between $400,000 and $417,000 will experience the same tax rate hike. Hopefully, the pass-through income deduction of 20% off their earnings before taxes (even FICA taxes) will ameliorate the pain. Calculating the pass-through deduction can get complicated because an investment in the business in tied to the deduction and takes into account both wages and capital investment in addition to purchase prices or unadjusted basis and all of the business qualified property and only property that can be depreciated. Alternative minimum tax Taxpayers use tax benefits to significantly reduce their regular tax amount. The alternative minimum tax (AMT) reduces or sets limits on certain benefits and it usually applies to taxpayers with high income. The alternative minimum tax tries to ensure that certain high income taxpayers pay at least a minimum amount of tax and do not totally benefit and do not misuse the tax benefits. There are two tax systems in place when calculating the alternative minimum tax. One calculation is using the AMT rules and the other calculation is using the regular taxable income tax. The AMT is the excess of the tentative minimum tax over the regular tax. If the tentative minimum tax is greater than the regular tax, then AMT is owed. Both taxes systems are figured separately. First, compute taxable income by eliminating or reducing certain exclusions and deductions and taking into account differences with respect to when certain items are taken into account for the two different kinds of taxable incomes. Secondly, subtract the AMT exemption amount. Third, multiply the amount remaining after you subtract the AMT exemption amount by the appropriate AMT tax rates. Lastly, you subtract the AMT foreign tax credit. The AMT exemptions amounts and the AMT tax rates are set by law. Taxpayers may have the option to use special capital gain rates if they are lower than the AMT tax rates. So to recap, the alternative minimum tax (AMT) is there to insure that high-income Americans pay their fair share of taxes taking into account the deductions which they can claim. Individuals in higher-income brackets have to calculate their taxes twice under two different tax systems – once using the standards tax system and the other using the AMT and pay the higher of the two. The new tax reform attempts to adjust the AMT exemption amounts for inflation in order to not affect the middle class but will make the exemption amounts significantly higher at first in 2018. The following shows the changes in tax year 2018:

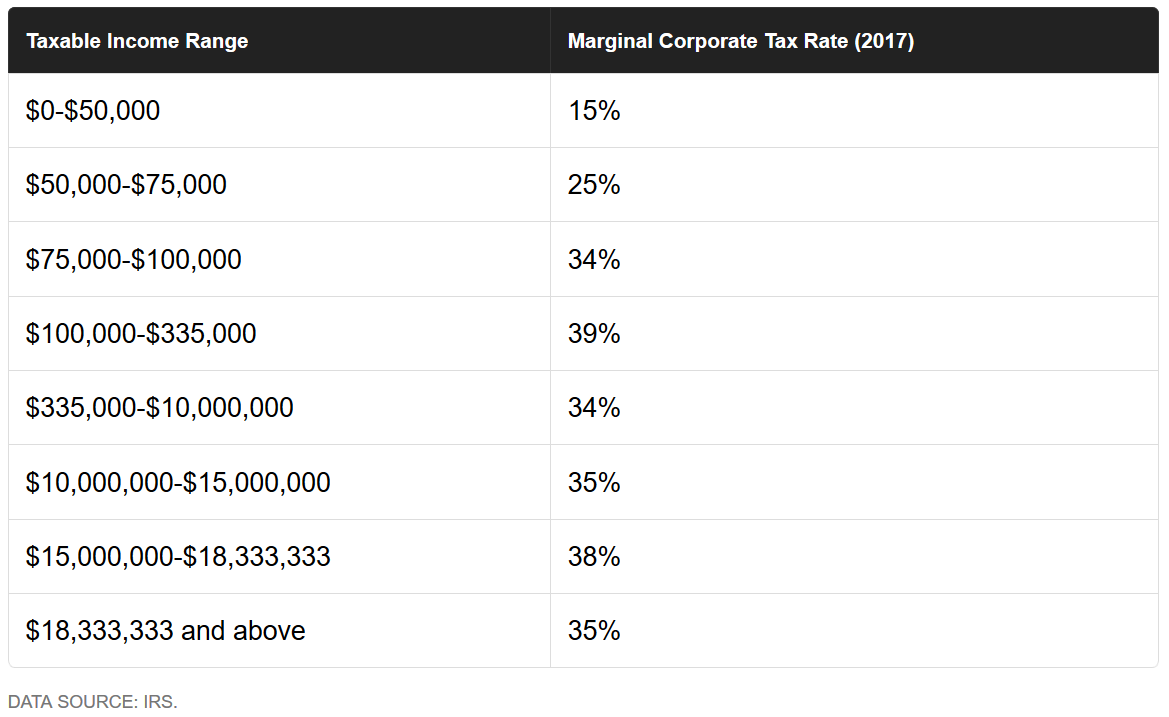

The income thresholds which the exemption begin to phase out are increased. Now they are set at $160,900 for married filing jointly and $120,700 for individual filers and are increased to $1,000,000 for MFJ and to $500,000 for individual filers for 2018. Calculation of Inflation New tax law – new way to calculate inflation. We can measure the consumer price index by looking at the average price of the most common household goods and services. The results compared to previous results give us information about our economy – inflation or deflation. This tells us if the economy is good or if it is not doing so well. By inflation we mean rising prices and by deflation we mean falling prices. However, for our purpose of tax law changes, the new tax law will disregard the CPI index as a measure of inflation. The new tax bill will switch the calculation of inflation. The new tax law will now use the Chained CPI which grows slower than the traditional consumer price index. The Chained CPI use the same common household goods but if the particular goods or services get to expensive, it is assumed that consumers will select other cheaper products and thus use a cheaper alternative. The Chained CPI as a means to calculate inflation is supposed to be one of the positive items in the new tax law changes. What that means to individuals is that the income thresholds for each marginal tax bracket will rise more slowly than in previous years. Or is it? At first maybe, but this will not be so in later years. The new way will make a greater portion of each worker’s income subject to higher marginal tax rates in the long run. This could turn out to be disastrous for the middle class as it is expected to result in higher taxes. Temporary Individual Tax Breaks It may be some kind of hack that the new administration is using to not alarm the nation and therefore is offering big size tax breaks. However, these tax breaks will end soon. These tax breaks will expire after the 2025 tax year. The new administration is trying to ease its new American ways unto the middle and lower class. Corporate Tax Rates The IRS and the

individual states levy the corporate income taxes on business profits. It is

the goal of the tax accountant to use every possible legal means in the tax

law to lower the corporate tax rate. Usually this is done with proper tax

planning. We hear many people say that the new administration is very

pro-corporation and very pro-rich and that any tax changes are geared to

benefit the rich. We can definitely see that all this is true since the

corporate tax rate has lowered to a flat 21% on corporate profits. The

corporate tax rate has been both simplified and dramatically lowered from

before as you can see from the 2017 tax rate chart below.

Furthermore, the corporate tax rate has changed at the global stage to an average of 25%. The U.S. will be become more globally competitive. The end result is to keep more of the corporate profits and hopefully the jobs in the U.S. To top it off, the corporate AMT of 20% has been repealed which means will no longer be. No More Corporate Double Taxation for Foreign Corporations A U.S. Corporation that had to pay taxes on their profits earned abroad will no longer have to do so. The new tax system will end the double taxation of foreign profits. Foreign Cash and Assets Have to Come Back Home The new system is trying to influence or force corporations to come back home to the United States. The new tax system has set a one-time repatriation rate of 15.5% on cash and foreign held assets and a rate of 8% on assets such as equipment. Companies like Apple could tremendously benefit from this new tax law. All This is for 2018 Taxes Filed in 2019 The reason that the new administration was frantically trying to get everything done before the end of the year was? Well. Every tax law has to cover an entire year – the entire 12 months. Therefore tax changes have to be in place on January 1, 2018 to apply to 2018 tax year. That means that we will be doing 2018 tax returns which are due by April 15, 2019. So in essence there are minor changes to 2017 tax year taxes that are due to be filed by April 2018. All the big fuss is the 2019 filing season. However, employers, the companies, corporations and other agencies have to worry about applying the new tax law all throughout 2018. We are in a pay-as –you go tax system which means that we apply rules gradually at every stage of the process. For example, employees get deducted from their paychecks applying the new tax system every week or every two weeks or whatever pay period they fall under. Tax professionals who also do accounting and payrolls have to know how the new rules work in and out. All of this is for 2018 taxes filed in 2019 but, hold on, you need to plan your 2018 taxes and the best planning is done in 2018 before the end of the year. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

References: Your Complete Guide to the 2018 Tax Changes by Matthew Frankel Found at https://www.fool.com/taxes/2017/12/29/your-complete-guide-to-the-2018-tax-changes.aspx Understanding the Marriage Penalty and Marriage Bonus by Kyle Pomerleau found at https://taxfoundation.org/understanding-marriage-penalty-and-marriage-bonus/ Topic Number: 409 – Capital Gains and Losses by IRS Found at https://www.irs.gov/taxtopics/tc409 The Savings Power of This FSA by FSA Feds Found at https://www.fsafeds.com/explore/dcfsa Publication 503 – Child and Dependent Care Expenses by IRS Found at https://www.irs.gov/pub/irs-pdf/p503.pdf Dependent Care Flexible Spending Account by WageWorks Found at https://www.wageworks.com/employees/dependent-care-fsa/dependent-care-flexible-spending-account/ Topic Number 602 – Child and Dependent Care Credit by IRS Found at https://www.irs.gov/taxtopics/tc602 Flexible Spending Account – Dependent Care Account by CPA Inc. Found at https://www.cpa125.com/FSA-Dependent%20Care.htm What The GOP’s Final Pass-Through Tax Cut Means For Business Owners by Robb Mandelbaum Found at https://www.forbes.com/sites/robbmandelbaum/2017/12/22/what-the-gops-final-pass-through-tax-cut-means-for-business-owners/#6c979ebb52b2 Topic Number: 556 – Alternative Minimum Tax by IRS Found at https://www.irs.gov/taxtopics/tc556 Consumer Price Index: How It’s Calculated, Why It’s Important by Kimberly Amadeo Found at https://www.fool.com/taxes/2017/12/29/your-complete-guide-to-the-2018-tax-changes.aspx Corporate Income Tax: Definition, History, Effective Rate by Kimberly Amadeo Found at https://www.thebalance.com/corporate-income-tax-definition-history-effective-rate-3306024 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

7 Tax Breaks Every First-Time Homebuyer Must Know by

Sarita Harbour Found at

https://www.gobankingrates.com/taxes/9-tax-breaks-first-time-home-buyer-must-know/ First-Time Home Buyer Tax Credit Ended but Help Exists by Emily Starbuck Crone found at https://www.nerdwallet.com/blog/mortgages/happened-first-time-home-buyer-tax-credit/ Exemptions, Standard Deduction, and Filing Information by IRS found at https://www.irs.gov/pub/irs-pdf/p501.pdf Are Social Security Benefits Taxable? by IRS found at https://www.irs.gov/newsroom/are-social-security-benefits-taxable About Form 8862, Information to Claim Earned Income Credit After Disallowance by IRS found at https://www.irs.gov/forms-pubs/about-form-8862 Guide to Filing Taxes as Head of Household by Turbofound at https://turbotax.intuit.com/tax-tips/family/guide-to-filing-taxes-as-head-of-household/L4Nx6DYu9 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Back to Tax School Homepage |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Copyright © 2018 [Hera's Income Tax School]. All rights reserved. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revised: 03/03/18 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||