| Back to Tax School Homepage |

|

Reading |

| New Reporting Requirement on Retirement Income Form

- Form 502R:

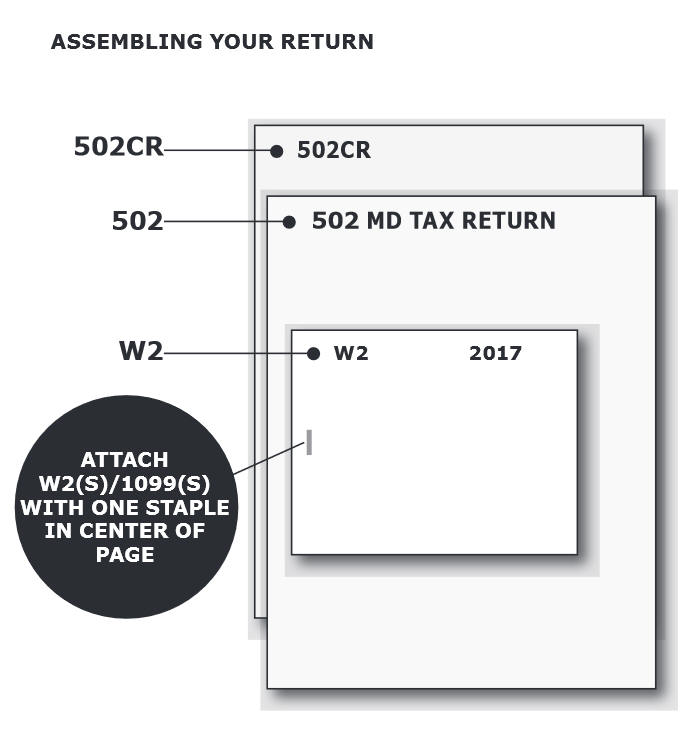

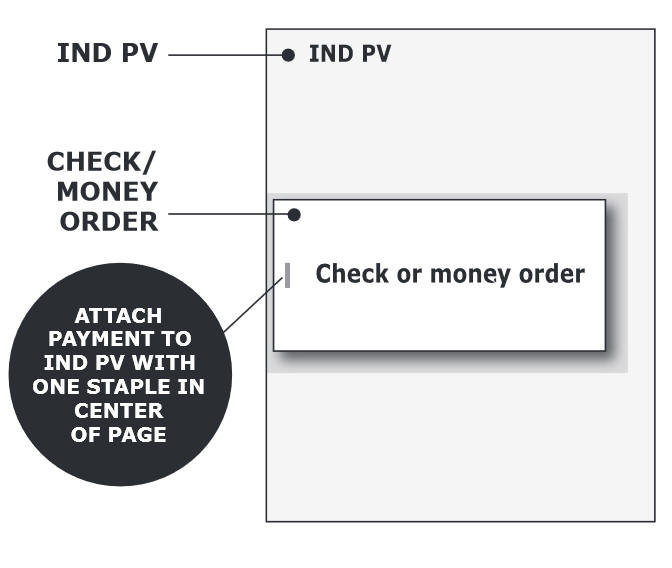

If you claimed the new Retired Law Enforcement Officer or Fire, Rescue, or Emergency Services Personnel pension exclusion, complete Part 7 of Form 502R. Interest Rate Decrease: Interest is due at a rate of 11.5% annually or 0.9583% per month for any month or part of a month that a tax is paid after the original due date of the 2017 return but before January 1, 2019. New Addition Modification: There is one new addition modification. New Subtraction Modifications: There are four new subtraction modifications available. New Refundable Tax Credit: There is one new refundable tax credit available. Senate Bill 36, Acts of 2017: This bill passed by the Maryland General Assembly, gives the Comptroller of Maryland authority to grant a taxpayer a waiver from the requirement to file for certain tax credit(s) by electronic means. In order to request a waiver, a taxpayer must complete Form 500CRW “Waiver Request for Electronic Filing of Form 500CR” that establishes reasonable cause for not filing the claim for credit by electronic means or that there is no feasible means of filing the claim by electronic means without creating an undue hardship. Form 500CRW must be submitted with the paper Form 500CR in order for the paper Form 500CR to be accepted for processing. New Business Tax Credits: There are three new business tax credits available. Form 502AE-Arts and Entertainment: • Oakland has been designated as a new arts and entertainment district. • Salisbury has been approved for re-designation as of June 1, 2017. As of July 1, 2017 there will be 25 designated arts and entertainment districts in Maryland. RECEIVING YOUR REFUND • Direct Deposit: To have your refund deposited to your bank or other financial account, enter your account and routing numbers at the bottom of your return • Deposit of Income Tax Refund to more than one account: Form 588 allows income tax refunds to be deposited to more than one account. Check with your financial institution to make sure your direct deposit will be accepted and to get the correct routing and account numbers. The State of Maryland is not responsible for a lost refund if you enter the wrong account information. • Check: Unless otherwise requested, we will mail you a paper check. • Refund Information: To request information about your refund, see OnLine Services at www.marylandtaxes.gov , or call 1-800-218-8160 or from Central Maryland 410-260-7701. FILING ELECTRONICALLY • Go Green! eFile saves paper. In addition, you will receive your refund faster; receive an acknowledgement that your return has been received; and, if you owe, you can extend your payment date until April 30th if you both eFile and make your payment electronically. • Security: Your information is transmitted securely when you choose to file electronically. It is protected by several security measures, such as multiple firewalls, state-of-the-art threat detection and encrypted transmissions. • iFile: Free Internet filing is available for Maryland income tax returns with no income limitation. Visit www.marylandtaxes. gov and click iFile for eligibility. • PC Retail Software: Check the software requirements to determine eFile eligibility before you purchase commercial off- the-shelf software. Use software or link directly to a provider site to prepare and file your return electronically. • eFile: Ask your professional tax preparer to eFile your return. You may use any tax professional who participates in the Maryland Electronic Filing Program. • IRS Free File: Free Internet filing is available for federal income tax returns; some income limitations may apply. Visit www.irs.gov for eligibility. Fees for state tax returns also may apply; however, you may always return to www. marylandtaxes.gov to use the free iFile Internet filing for Maryland income tax returns after using the IRS Free File for your federal return. AVOID COMMON ERRORS • Social Security Number(s): Enter each Social Security Number in the space provided at the top of your tax return. Also enter the Social Security Number for children and other dependents. The Social Security Number will be validated by the IRS before the return has completed processing. • Local Tax: Use the correct local income tax rate, based on your county of residence on the last day of the tax year for where you lived on December 31, 2017, or the last day of the year for fiscal filers. See Instruction 19. • Original Return: Please send only your original completed Maryland tax return. Photocopies can delay processing of your refund. If you filed electronically, do not send a paper return. • Federal Forms: Do not send federal forms, schedules or copies of federal forms or schedules unless requested. • Photocopies: Remember to keep copies of all federal forms and schedules and any other documents that may be required later to substantiate your Maryland return. • Ink: Use only blue or black ink to complete your return. Do not use pencil. • Attachments: Please make sure to send all wage statements such as W-2s, 1099s and K-1s. Ensure that the state tax withheld is readable on all forms. Ensure that the state income modifications and state tax credits are clearly shown on all K-1s. • Colored Paper: Do not print the Maryland return on colored paper. • Bar Codes: Do not staple or destroy the bar code. PAYING YOUR TAXES • Direct Debit: If you file electronically and have a balance due, you can have your income tax payment deducted directly from your bank account. This free service allows you to choose your payment date, anytime until April 30, 2018. Visit www.marylandtaxes.gov for details. • Bill Pay Electronic Payments: If your paper or electronic tax return has a balance due, you may pay electronically at www.marylandtaxes.gov by selecting BillPay. The amount you designate will be debited from your bank or financial institution on the date that you choose. • Checks and Money Orders: Make check or money order payable to Comptroller of Maryland. We recommend you include your Social Security Number on your check or money order. ALTERNATIVE PAYMENT METHODS For alternative methods of payment, such as a credit card, visit our Web site at www.marylandtaxes.gov . GET YOUR 1099-G ELECTRONICALLY Go to our web site www.marylandtaxes.gov to sign up to receive your 1099-G electronically. Once registered, you can view and print your 1099-G from our secure Web site www. marylandtaxes.gov . PRIVACY ACT INFORMATION The Tax-General Article of the Annotated Code of Maryland authorizes the Revenue Administration Division to request information on tax returns to administer the income tax laws of Maryland, including determination and collection of correct taxes. Code Section 10-804 provides that you must include your Social Security Number on the return you file. This is so we know who you are and can process your return and papers. If you fail to provide all or part of the requested information, exemptions, exclusions, credits, deductions or adjustments may be disallowed and you may owe more tax. In addition, the law provides penalties for failing to supply information required by law or regulations. You may look at any records held by the Revenue Administration Division which contain personal information about you. You may inspect such records, and you have certain rights to amend or correct them. As authorized by law, information furnished to the Revenue Administration Division may be given to the United States Internal Revenue Service, an authorized official of any state that exchanges tax information with Maryland and to an officer of this State having a right to the information in that officer’s official capacity. The information may be obtained in accordance with a proper legislative or judicial order. WHAT YOU SHOULD SEND • Your original , completed Maryland income tax return (Form 502) and Dependent Form 502B as applicable. • Form IND PV for returns with payment by check or money order. Attach the payment to the Form IND PV. The Form IND PV and payment are placed before the Form 502 for mailing purposes. The Form IND PV and payment are not attached to the Form 502. • Form 502R if you have taxable retirement income. • Form 588 if you elect to have your refund direct deposited to more than one account. • W-2(s)/1099(s) showing Maryland tax withheld. • Schedules K-1 showing Maryland tax withheld and or Maryland tax credit. • If you have a balance due, and if not filing and paying electronically, please include a check or money order payable to Comptroller of Maryland with your Social Security Number on the check or money order. • Maryland schedules or other documents may be required according to the instructions if you claim certain credits or subtractions. These include: 500DM, 502CR, 502TP, 502UP, 502V, 502S and 502SU. • A copy of the tax return you filed in the other state or locality if you’re claiming a tax credit on Form 502CR, Part A DO NOT SEND• Photocopies of your Maryland return. • Federal forms or schedules unless requested. • Any forms or statements not requested. • Returns by fax. • Returns on colored paper. • Returns completed in pencil. • Returns with the bar code stapled or destroyed.

You should carefully read the Plan Disclosure Statement, available online, which describes the investment objectives, risks, expenses, and other important information that you should consider before you invest in a Maryland 520 ABLE account. Also, if you or the ABLE account beneficiary live outside of Maryland, you should consider before carefully before investing whether your state or your beneficiary's state offers state tax or other benefits for investing in its ABLE plan, Tax benefits may be conditioned on meeting certain requirements, such as residency, purpose for or timing of distributions, or other factors, as applicable. Consult all your sources to make sure you are making the right decision.

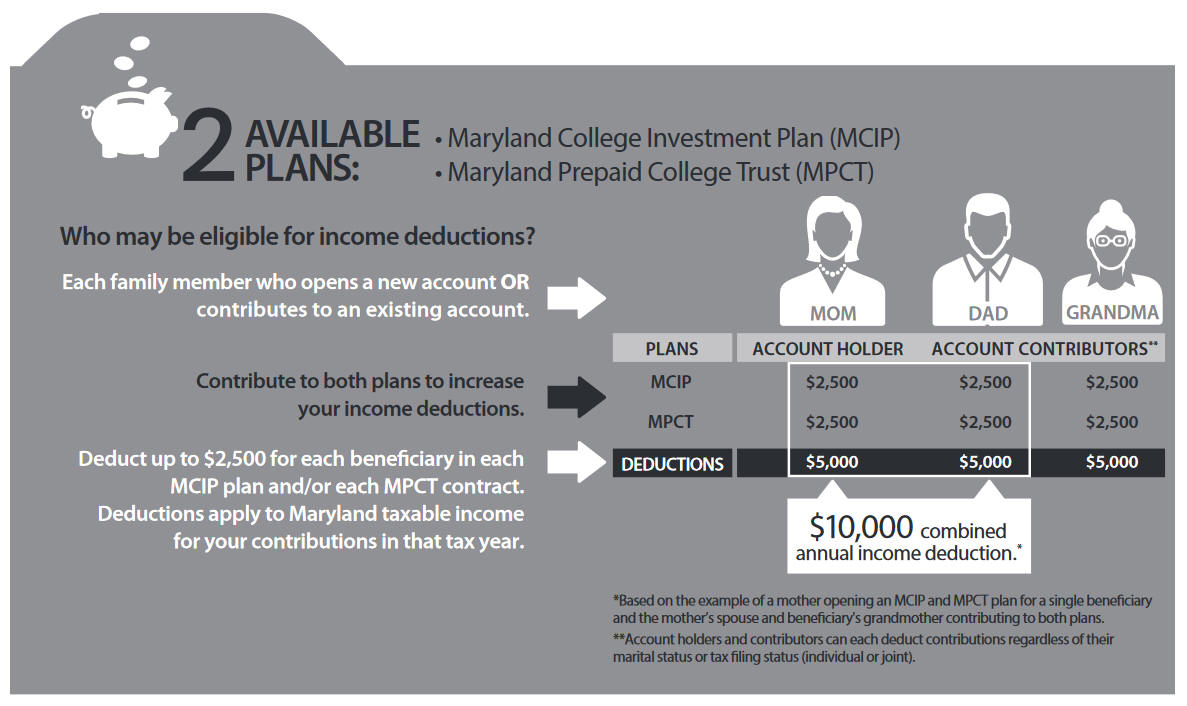

Visit Maryland529.com for complete details. Be careful to read the Enrollment Kit, available online, which describes the investment objectives, risks, expenses, and other important information that you should consider before you invest in a Maryland 529 plan. Also, if you or your beneficiary live outside of Maryland, you should consider carefully before investing whether your state or your beneficiary's state offers state tax or other benefits for investing in its 529 plan. Tax benefits may be conditioned on meeting certain requirements, such as residency, purpose for or timing of distributions or other factors, as may be applicable. Make sure you look at your sources carefully as you make the decision to invest in a Maryland 529 plan. DUE DATE Your return is due by April 17, 2018. If you are a fiscal year taxpayer, see Instruction 25. If any due date falls on a Saturday, Sunday or legal holiday, the return must be filed by the next business day. To speed up the processing of your tax refund, consider filing electronically. You must file within three years of the original due date to receive any refund. COMPLETING THE RETURN You must write legibly using blue or black ink when completing your return. DO NOT use pencil or red ink. Submit the original return, not a photocopy. If no entry is needed for a specific line, leave blank. Do not enter words such as “none” or “zero” and do not draw a line to indicate no entry. Failure to follow these instructions may delay the processing of your return. You may round off all cents to the nearest whole dollar. Fifty cents and above should be rounded to the next dollar. State calculations are rounded to the nearest penny. ELECTRONIC FILING INSTRUCTIONS The instructions in this booklet are designed specifically for filers of paper returns. If you are filing electronically and these instructions differ from the instructions for the electronic method being used, you should comply with the instructions appropriate for that method. Free internet filing is available for Maryland income tax returns. SUBSTITUTE FORMS You may file your Maryland income tax return on a computer-prepared or computer-generated substitute form provided the form is approved in advance by the Revenue Administration Division. The fact that a software package is available for retail purchase does not guarantee that it has been approved for use. PENALTIES There are severe penalties for failing to file a tax return, failing to pay any tax when due, filing a false or fraudulent return, or making a false certification. The penalties include criminal fines, imprisonment and a penalty on your taxes. In addition, interest is charged on amounts not paid. To collect unpaid taxes, the Comptroller is directed to enter liens against the salary, wages or property of delinquent taxpayers. DO I HAVE TO FILE? This booklet and forms are for residents of Maryland. In general, you must file a Maryland return if you are or were a resident of Maryland AND you are required to file a federal return. Information in this section will allow you to determine if you must file a return and pay taxes as a resident of Maryland. If you are not a resident but had Maryland tax withheld or had income from sources in Maryland, you must use Form 505 or 515, Nonresident Tax return. WHO IS A RESIDENT? You are a resident of Maryland if: a. Your permanent home is or was in Maryland (the law refers to this as your domicile). OR b. Your permanent home is outside of Maryland, but you maintained a place of abode (a place to live) in Maryland for more than six months of the tax year. If this applies to you and you were physically present in the state for 183 days or more, you must file a full-year resident return. PART-YEAR RESIDENTS If you began or ended residence in Maryland during the tax year, you must file a Maryland resident income tax return.

MILITARY AND OTHERS WORKING OUTSIDE OF MARYLAND Military and other individuals whose domicile is in Maryland, but who are stationed or work outside of Maryland, including overseas, retain their Maryland legal residence. Maryland residence is not lost because of duty assignments outside of the State; see Administrative Release 37. Military personnel and their spouses should see Instruction 29. TO DETERMINE IF YOU ARE REQUIRED TO FILE A MARYLAND RETURN a. Add up all of your federal gross income to determine your total federal income. Gross income is defined in the Internal Revenue Code and, in general, consists of all income regardless of source. It includes wages and other compensation for services, gross income derived from business, gains (not losses) derived from dealings in property, interest, rents, royalties, dividends, alimony, annuities, pensions, income from partnerships or fiduciaries, etc. If modifications or deductions reduce your gross income below the minimum filing level, you are still required to file. IRS Publication 525 provides additional information on taxable and nontaxable income. b. Do not include Social Security or railroad retirement benefits in your total federal income. c. Add to your total federal income any Maryland additions to income. Do not include any additions related to periods of nonresidence. This is your Maryland gross income. d. If you are a dependent taxpayer, add to your total federal income any Maryland additions and subtract any Maryland subtractions. This is your Maryland gross income.

e. You must file a Maryland return if your Maryland gross income equals or exceeds the income levels in the MINIMUM FILING LEVEL TABLE 1. f. If you or your spouse is 65 or over, use the MINIMUM FILING LEVEL TABLE 2.

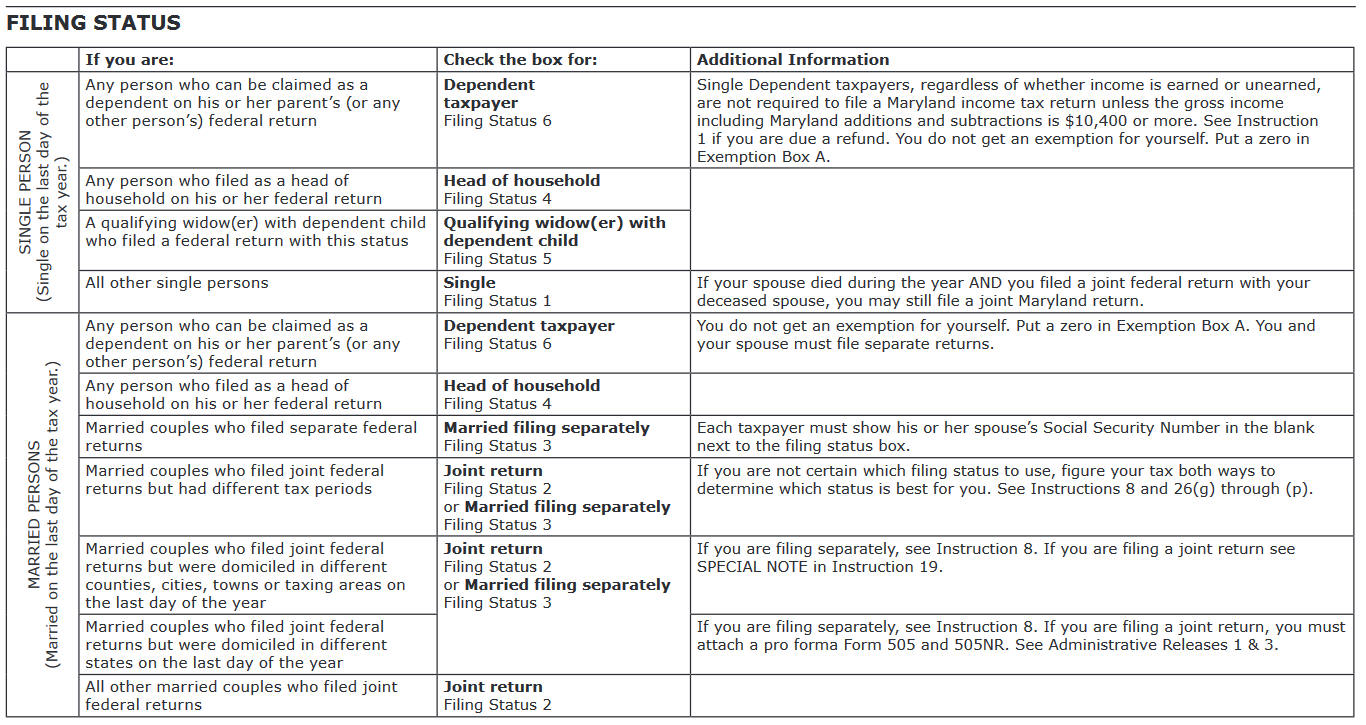

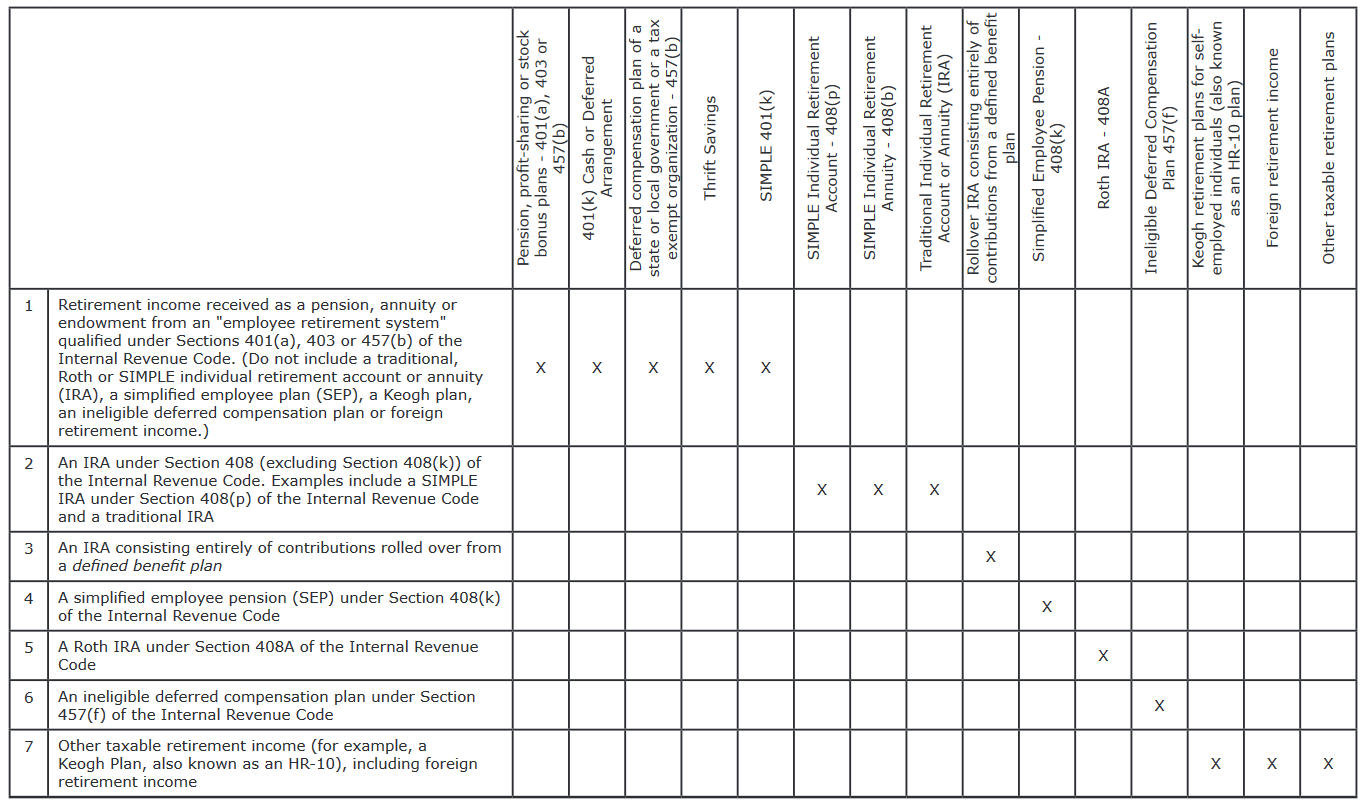

IF YOU ARE NOT REQUIRED TO FILE A MARYLAND RETURN BUT HAD MARYLAND TAXES WITHHELD To get a refund of Maryland income taxes withheld, you must file a Maryland return. Taxpayers who are filing for refund only should complete all of the information at the top of Form 502 and the following lines: 1-16 22*, 29* 35-44 46, 48 *Enter a zero unless you claim an earned income credit on your federal return. Sign the form and attach withholding statements (all W-2 and 1099 forms) showing Maryland and local tax withheld equal to the withholding you are claiming. Your form is then complete. USE OF FEDERAL RETURN. First complete your 2017 federal income tax return. You will need information from your federal return to complete your Maryland return. Complete your federal return before you continue beyond this point. Maryland law requires that your income and deductions be entered on your Maryland return exactly as they were reported on your federal return. All items reported on your Maryland return are subject to verification, audit and revision by the Maryland State Comptroller’s Office. FORM 502. Form 503 is no longer available. All taxpayers must use Form 502. Note: You must file Form 502 electronically if you are claiming business income tax credits on Form 500CR. NAME AND ADDRESS. Print using blue or black ink. Enter your name exactly as entered on your federal tax return. If you changed your name because of marriage, divorce, etc., be sure to report the change to the Social Security Administration before filing your return. This will prevent delays in the processing of your return. Enter your current address using the spaces provided. On Current Mailing Address Line 1, enter the street number and street name of your current address. If using a PO Box address, enter “PO Box” and the PO Box number on Current Mailing Address Line 1. On Current Mailing Address Line 2, if applicable, enter the floor, suite, or apartment number for your current mailing address. If using a PO Box address, leave Current Mailing Address Line 2 blank. Enter City or Town, State and ZIP Code. If using a foreign address, enter the city or town and state or province and ZIP Code or postal code on the Current Mailing Address Line 2. Enter the name of the country on the “City or Town” line. Leave the “State” line and “ZIP Code” line blank. SOCIAL SECURITY NUMBER(S) (SSN). It is important that you enter each Social Security Number in the space provided. You must enter each SSN legibly because we validate each number. If not correct and legible, it will affect the processing of your return. The Social Security Number(s) (SSN) must be a valid number issued by the Social Security Administration of the United States Government. If you or your spouse or dependent(s) do not have a SSN and you are not eligible to get a SSN, you must apply for an Individual Tax Identification Number (ITIN) with the IRS and you should wait until you have received it before you file; and enter it wherever your SSN is requested on the return. A missing or incorrect SSN or ITIN could result in the disallowance of any credits or exemptions you may be entitled to and result in a balance due. A valid SSN or ITIN is required for any claim or exemption for a dependent. If you have a dependent who was placed with you for legal adoption and you do not know his or her SSN, you must get an Adoption Taxpayer Identification Number (ATIN) for the dependent from the IRS. If your child was born and died in this tax year and you do not have a SSN for the child, complete just the name and relationship of the dependent and enter code 322 , on one of the code number lines located to the right of the telephone number area on page 3 of the form; attach a copy of the child’s death certificate to your return.POLITICAL SUBDIVISION INFORMATION (REQUIRED). Fill in the lines for your physical address, including political subdivision lines, based on your residence on the last day of the taxable period. Part-year residents fill in the lines for your physical address, including political subdivision lines, based on your last day of residence in Maryland in the taxable period. Military personnel who are legal residents of Maryland should fill in the lines for your physical address, including political subdivision lines, based on the physical address that is used for claiming Maryland as your Home of Record on file with the Defense Finance and Accounting Service for tax year 2 017. 1. Find your 4 Digit Political Subdivision Code in the LIST OF INCORPORATED CITIES, TOWNS AND TAXING AREAS IN MARYLAND and enter this number on the 4 DIGIT POLITICAL SUBDIVISION CODE line. When selecting the 4 Digit Political Subdivision Code, be sure that you have selected the proper political subdivision from the LIST OF INCORPORATED CITIES, TOWNS AND TAXING AREAS IN MARYLAND. Do not rely on your ZIP Code to identify the proper political subdivision. For example, most residents within the ZIP Code of Upper Marlboro do not reside in the political subdivision of the Town of Upper Marlboro. Therefore, entering the Town of Upper Marlboro on the 4 DIGIT POLITICAL SUBDIVISION CODE line for those with a ZIP Code in Upper Marlboro may not be correct. Also, some political subdivisions have similar names such as Bel Air in Allegany County and Town of Bel Air in Harford County or Town of Chevy Chase and Town of Chevy Chase View. You may contact your county seat for further information relating to the incorporated boundaries of incorporated cities, towns and taxing areas in your county. 2. If you lived within the incorporated tax boundaries of one of the areas listed under your county as found in the LIST OF INCORPORATED CITIES, TOWNS AND TAXING AREAS IN MARYLAND, write the name of the city, town or taxing area on the MARYLAND POLITICAL SUBDIVISION line. If you did not live within the incorporated tax boundaries of one of the areas listed under your county as found in the LIST OF INCORPORATED CITIES, TOWNS AND TAXING AREAS MARYLAND, write the name of your county on the MARYLAND POLITICAL SUBDIVISION line. If you lived in Baltimore City, enter “Baltimore City” on the MARYLAND POLITICAL SUBDIVISION line. 3. Enter your street number and street name on PHYSICAL STREET ADDRESS LINE 1. DO NOT ENTER A PO BOX NUMBER. 4. If applicable, enter the floor, suite, or apartment number on PHYSICAL STREET ADDRESS LINE 2. DO NOT ENTER A PO BOX NUMBER. 5. Enter the city or town in which you resided on the CITY line. 6. Enter the ZIP Code in which you resided on the ZIP Code line. 7. Enter the name of your county on the MARYLAND COUNTY line. If you lived in Baltimore City, leave the MARYLAND COUNTY line blank. FILING STATUS.Use the FILING STATUS chart to determine your filing status. Check the correct FILING STATUS box on the return. SPECIAL INSTRUCTIONS FOR MARRIED PERSONS FILING SEPARATELY. If you and your spouse file a joint federal return but are filing separate Maryland returns according to Instruction 7, follow the instructions below. If you and your spouse file a joint federal return but are filing separate Maryland returns according to Instruction 7, you should report the income you would have reported had you filed a separate federal return. The income from jointly held securities, property, etc., must be divided evenly between spouses. If you itemized your deductions on the joint federal return, one spouse may use the standard deduction and the other spouse may claim those deductions on the federal return that are “attributable exclusively” to that spouse, plus a prorated amount of the remaining deductions. If it is not possible to determine these deductions, the deduction must be allocated proportionately based on your share of the income. “Attributable exclusively” means that the individual is solely responsible for the payment of an expense claimed as an itemized deduction, including compliance with a valid court order or separation agreement; or the individual jointly responsible for the payment of an expense claimed as an itemized deduction can demonstrate payment of the full amount of the deduction with funds that are not attributable in whole or in part, to the other jointly responsible individual. If both spouses choose to itemize on their separate Maryland returns, then each spouse must determine which deductions are attributable exclusively to him or her and prorate the remaining deductions using the Maryland Income Factor. If it is not possible to determine deductions in this manner, they must be allocated proportionately based on their respective shares of the income. The total amount of itemized deductions for both spouses cannot exceed the itemized deductions on the federal return. If you choose to use the standard deduction method, use STANDARD DEDUCTION WORKSHEET (16A) in Instruction 16. Each spouse must claim his or her own personal exemption. Each spouse may allocate the dependent exemptions in any manner they choose. The total number of exemptions claimed on the separate returns may not exceed the total number of exemptions claimed on the federal return except for the additional exemptions for being 65 or over or blind. Complete the remainder of the form using the instructions for each line. Each spouse should claim his or her own withholding and other credits. Joint estimated tax paid may be divided between the spouses in any manner provided the total claimed does not exceed the total estimated tax paid. PART-YEAR RESIDENTS. If you began or ended legal residence in Maryland in 2017 go to Instruction 26.Military taxpayers. If you have non-Maryland military income, see Administrative Release 1. EXEMPTIONS. Determine what exemptions you are entitled to and complete the EXEMPTIONS area on Form 502. Form 502B must be completed and attached to Form 502 if you are claiming one or more dependents. EXEMPTIONS ALLOWED You are permitted the same number of exemptions which you are permitted on your federal return; however, the exemption amount is different on the Maryland return. Even if you are not required to file a federal return, the federal rules for exemptions still apply to you. Refer to the federal income tax instructions for further information. The amount of your Maryland exemption may be limited by the amount of your federal adjusted gross income. See Exemption Amount Chart (10A).

Enter the number of exemptions in the appropriate boxes based upon your entries in parts A, B, and C of the exemption area of the form. Enter the total number of exemptions in Part D. The number of exemptions for Part C is from Total Dependent Exemptions, Line 3 of Form 502B. PART-YEAR RESIDENTS AND MILITARY You must prorate your exemptions based on the percentage of income subject to Maryland tax. See Instruction 26 and Administrative Release 1. INCOME.Line 1. Copy the figure for federal adjusted gross income from your federal return onto line 1 of Form 502. Line 1a. Copy the total of your wages, salaries and tips from your federal return onto line 1a of Form 502. Use the chart below to find the figures that you need. If you and your spouse file a joint federal return but are filing separate Maryland returns, see Instruction 8.

Line 1c. Enter on line 1c the amount of capital gains and losses reported as income on line 13 on your federal Form 1040. Line 1d. Enter on line 1d the total amount of pension, IRA, and annuities reported as income on lines 15b and 16b of your federal Form 1040, or lines 11b and 12b of your federal Form 1040A. As required by House Bill 1148 (Chapter 648) of the 2016 Session of the General Assembly, taxpayers with an entry on line 1d must complete and attach Form 502R. See the Form 502R for additional information. Line 1e. Place a “Y” in the box if the amount of your investment income is more than $3,450. You DO NOT qualify for the earned income tax credit. Investment income generally includes, but is not limited to, interest, dividends, capital gains, and other types of distributions including mutual fund distributions. ADDITIONS TO INCOME.Determine which additions to income apply to you. Write the correct amounts on lines 2-5 of Form 502. Instructions for each line: Line 2. TAX EXEMPT STATE OR LOCAL BOND INTEREST. Enter the interest from non-Maryland state or local bonds or other obligations (less related expenses). This includes interest from mutual funds that invest in non-Maryland state or local obligations. Interest earned on obligations of Maryland or any Maryland subdivision is exempt from Maryland tax and should not be entered on this line. Line 3. STATE RETIREMENT PICKUP. Pickup contributions of a State retirement or pension system member. The pickup amount will be stated separately on your W-2 form. The tax on this portion of your wages is deferred for federal but not for state purposes.Line 4. LUMP SUM DISTRIBUTION FROM A QUALIFIED RETIREMENT PLAN. If you received such a distribution, you will receive a Form 1099R showing the amounts distributed. You must report part of the lump sum distribution as an addition to income if you file federal Form 4972. Use the LUMP SUM DISTRIBUTION WORKSHEET (12A) to determine the amount of your addition.

Line 5. OTHER ADDITIONS TO INCOME. If one or more of these apply to you, enter the total amount on line 5 and identify each item using the code letter: CODE LETTER a. Part-year residents: losses or adjustments to federal income that were realized or paid when you were a nonresident of Maryland. b. Net additions to income from pass-through entities not attributable to decoupling. c. Net additions to income from a trust as reported by the fiduciary. d. S corporation taxes included on lines 13 and 14 of Maryland Form 502CR, Part A, Tax Credits for Income Taxes Paid to Other States and Localities. (See instructions for Part A of Form 502CR.) e. Total amount of credit(s) claimed in the current tax year to the extent allowed on Form 500CR for the following Business Tax Credits: Enterprise Zone Tax Credit, Maryland Disability Employment Tax Credit, Small Business Research & Development Tax Credit, Maryland Employer Security Clearance Costs Tax Credit (do not include Small Business First-Year Leasing Costs Tax Credit), and Cellulosic Ethanol Technology Research and Development Tax Credit. In addition, include any amount deducted as a donation to the extent that the amount of the donation is included in an application for the Endow Maryland Tax Credit on Form 500CR or 502CR. f. Oil percentage depletion allowance claimed under IRC Section 613. g. Income exempt from federal tax by federal law or treaty that is not exempt from Maryland tax. h. Net operating loss deduction to the extent of a double benefit. See Administrative Release 18 at www.marylandtaxes. gov. i. Taxable tax preference items from line 5 of Maryland Form 502TP. The items of tax preference are defined in IRC Section 57. If the total of your tax preference items is more than $10,000 ($20,000 for married taxpayers filing joint returns) you must complete and attach Maryland Form 502TP, whether or not you are required to file federal Form 6251 (Alternative Minimum Tax) with your federal Form 1040. j. Amount deducted for federal income tax purposes for expenses attributable to operating a family day care home or a child care center in Maryland without having the registration or license required by the Family Law Article. k. Any refunds of advanced tuition payments made under the Maryland Prepaid College Trust, to the extent the payments were subtracted from federal adjusted gross income and were not used for qualified higher education expenses, and any refunds of contributions made under the Maryland College Investment Plan or the Maryland Broker-Dealer College Investment Plan, to the extent the contributions were subtracted from federal adjusted gross income and were not used for qualified higher education expenses. See Administrative Release 32. l. Net addition modification to Maryland taxable income when claiming the federal depreciation allowances from which the State of Maryland has decoupled. Complete and attach Form 500DM. See Administrative Release 38. m. Net addition modification to Maryland taxable income when the federal special 5-year carryback period was used for a net operating loss under federal law compared to Maryland taxable income without regard to federal provisions. Complete and attach Form 500DM. See Administrative Release 38. n. Amount deducted on your federal income tax return for domestic production activities (line 35 of federal Form 1040). o. Amount deducted on your federal income tax return for tuition and related expenses. Do not include adjustments to income for Educator Expenses or Student Loan Interest deduction. p. Any refunds received by an ABLE account contributor under the Maryland ABLE Program or any distribution received by an ABLE account holder, to the extent the distribution was not used for the benefit of the designated beneficiary for qualified disability expense, that were subtracted from federal adjusted gross income. q. If you sold or exchanged a property for which you claimed a subtraction modification under Senate Bill 367 (Chapter 231, Acts of 2017) or Senate Bill 580/House Bill 600 (Chapter 544 and Chapter 545, Acts of 2012), enter the amount of the difference between your federal adjusted gross income as reportable under the federal Mortgage Forgiveness Debt Relief Act of 2007 and your federal adjusted gross income as claimed in the taxable year.cd. Net addition modification to Maryland taxable income resulting from the federal deferral of income arising from business indebtedness discharged by reacquisition of a debt instrument. See Form 500DM and Administrative Release 38. dm. Net addition modification from multiple decoupling provisions. See the table at the bottom of Form 500DM for the line numbers and code letters to use. dp. Net addition decoupling modification from a pass-through entity. See Form 500DM. SUBTRACTIONS FROM INCOME. Determine which subtractions from income apply to you. Write the correct amounts on lines 8–14 of Form 502. Instructions for each line: Line 8. STATE TAX REFUNDS . Copy onto line 8 the amount of refunds of state or local income tax included in line 1 of Form 502. Line 9. CHILD CARE EXPENSES . You may subtract the cost of caring for your dependents while you work. There is a limitation of $3,000 ($6,000 if two or more dependents receive care). Copy onto line 9 the amount from line 6 of federal Form 2441. You may also be entitled to a credit for these taxable expenses. See instructions for Part B of Form 502CR. Line 10. PENSION EXCLUSION . You may be able to subtract some of your taxable pension and retirement annuity income. This subtraction applies only if: a. You were 65 or over or totally disabled, or your spouse was totally disabled, on the last day of the tax year, AND b. You included on your federal return taxable income received as a pension, annuity or endowment from an “employee retirement system” qualified under Sections 401(a), 403 or 457(b) of the Internal Revenue Code. [A traditional IRA, a Roth IRA, a simplified employee plan (SEP), a Keogh plan, an ineligible deferred compensation plan or foreign retirement income does not qualify.

To be considered totally disabled, you must have a mental or physical impairment which prevents you from engaging in substantial gainful activity. You must expect the impairment to be of long, continued or indefinite duration or to result in your death. You must attach to your return a certification from a qualified physician stating the nature of your impairment and that you are totally disabled. If you have previously submitted a physician’s certification, attach your own statement that you are still totally disabled and that a physician’s certification was submitted before. If you are a part-year resident, complete PENSION EXCLUSION COMPUTATION WORKSHEET (13A) using total taxable pension and total Social Security and railroad retirement benefits as if you were a full-year resident. Prorate the amount on line 5 by the number of months of Maryland residence divided by 12. However, if you began to receive your pension during the tax year you became a Maryland resident, use a proration factor of the number of months you were a resident divided by the number of months the pension was received. For example, Pat Taxpayer moved to Maryland on March 1. If he started to receive his pension on March 1, he would prorate the pension exclusion by 10/10, which would mean he would be entitled to the full pension exclusion. However, if he began to receive his pension on February 1, Pat would prorate his pension by 10/11. Please note that, in either case, the proration factor may not exceed 1. Complete the PENSION EXCLUSION COMPUTATION WORKSHEET (13A). Copy the amount from line 5 of the worksheet onto line 10 of Form 502. Note: You must complete and attach Form 502R to the Form 502 if you or your spouse are claiming a pension exclusion on line 10 of the Maryland Form 502. See the Form 502R for additional information. Line 11. FEDERALLY TAXED SOCIAL SECURITY AND RAILROAD RETIREMENT BENEFITS. If you included in your federal adjusted gross income Social Security, Tier I, Tier II and/or supplemental railroad retirement benefits, then you must include the total amount of such benefits on line 11. Social Security and railroad retirement benefits are exempt from state tax. Note: You must complete and attach Form 502R to the Form 502 if you or your spouse received any income during the tax year (taxable or nontaxable) from Social Security or Railroad Retirement (Tier I or Tier II). See the Form 502R for additional information. Line 12. NONRESIDENT INCOME. If you began or ended your residence in Maryland during the year, you may subtract the portion of your income received when you were not a resident of Maryland. See Instruction 26 for part-year residents and Administrative Release 1 for military personnel. If your state of residence or your period of Maryland residence was not the same as that of your spouse and you filed a joint return, follow Instruction 26 (c) through (p). Line 13. SUBTRACTIONS FROM INCOME ON FORM 502SU. Other certain subtractions for which you may qualify will be reported on Form 502SU. Determine which subtractions apply to you and enter the amount for each on Form 502SU. Enter the sum of all applicable subtractions from Form 502SU on line 13 of Form 502, and enter the code letters that represent the four highest dollar amounts in the code letter lines. If multiple subtractions apply, be sure to identify all of them on Form 502SU and attach it to your Form 502. Note: If only one of these subtractions applies to you, enter the amount and the code letter on line 13 of Form 502; then the use of Form 502SU may be optional. CODE LETTER a. Payments from a pension system to firemen and policemen for job related injuries or disabilities (but not more than the amount of such payments included in your total income).b. Net allowable subtractions from income from pass-through entities, not attributable to decoupling. c. Net subtractions from income reported by a fiduciary. d. Distributions of accumulated income by a fiduciary, if income tax has been paid by the fiduciary to the State (but not more than the amount of such income included in your total income). e. Profit (without regard to losses) from the sale or exchange of bonds issued by the State or local governments of Maryland. f. Benefits received from a Keogh plan on which State income tax was paid prior to 1967. Attach statement. g. Amount of wages and salaries disallowed as a deduction due to the work opportunity credit allowed under the Internal Revenue Code Section 51. h. Expenses up to $5,000 incurred by a blind person for a reader, or up to $1,000 incurred by an employer for a reader for a blind employee. i. Expenses incurred for reforestation or timber stand improvement of commercial forest land. Qualifications and instructions are on Form DNR393, available from the Department of Natural Resources, telephone 410-260-8531. j. Amount added to taxable income for the use of an official vehicle by a member of a state, county or local police or fire department. The amount is stated separately on your W-2 form. k. Up to $6,000 in expenses incurred by parents to adopt a child with special needs through a public or nonprofit adoption agency and up to $5,000 in expenses incurred by parents to adopt a child without special needs. l. Purchase and installation costs of certain enhanced agricultural management equipment as certified by the Maryland Department of Agriculture. Attach a copy of the certification. m. Deductible artist’s contribution. Attach Maryland Form 502AC. n. Payment received under a fire, rescue, or ambulance personnel length of service award program that is funded by any county or municipal corporation of the State. o. Value of farm products you donated to a gleaning cooperative as certified by the Maryland Department of Agriculture. Attach a copy of the certification. p. Up to $15,000 of military pay included in your federal adjusted gross income that you received while in the active service of any branch of the armed forces and which is attributable to service outside the boundaries of the U.S. or its possessions. To compute the subtraction, follow the directions on the MILITARY OVERSEAS INCOME WORKSHEET (13B). If your total military pay exceeds $30,000, you do not qualify for the subtraction

q. Unreimbursed vehicle travel expenses for: 1. A volunteer fire company; 2. Service as a volunteer for a charitable organization whose principal purpose is to provide medical, health or nutritional care; AND 3. Assistance (other than providing transportation to and from the school) for handicapped students at a Maryland community college. Attach Maryland Form 502V. r. Amount of pickup contribution shown on Form 1099R from the state retirement or pension systems included in federal adjusted gross income. The subtraction is limited to the amount of pickup contribution stated on the 1099R or the taxable pension, whichever is less. Any amount not allowed to be claimed on the current year return may be carried forward to the next year until the full amount of the State pickup contribution has been claimed. s. Amount of interest and dividend income (including capital gain distributions) of a dependent child which the parent has elected to include in the parent’s federal gross income under Internal Revenue Code Section 1(g)(7). t. Payments received from the State of Maryland under Title 12 Subtitle 2 of the Real Property Article (relocation and assistance payments). u. Up to $5,000 of military retirement income received by a qualifying individual during the tax year if the taxpayer has not yet attained the age of 65; or up to $10,000 of military retirement income received by a qualifying individual if the taxpayer is age 65 or over. To qualify, you must have been a member of an active or reserve component of the armed forces of the United States, an active duty member of the commissioned corps of the Public Health Service, the National Oceanic and Atmospheric Administration, the Coast and Geodetic Survey, a member of the Maryland National Guard, or the member’s surviving spouse or exspouse. va. The Honorable Louis L. Goldstein Volunteer Fire, Rescue and Emergency Medical Services Personnel Subtraction Modification Program. $4,500 for each taxpayer who is a qualifying volunteer as certified by a Maryland fire, rescue or emergency medical services organization. $4,500 for each taxpayer who is a qualifying member of the U.S. Coast Guard Auxiliary, Maryland Defense Force or Maryland Civil Air Patrol as certified by these organizations. Attach a copy of the certification. vb. The Honorable Louis L. Goldstein Volunteer Police Personnel Subtraction Modification Program. $4,500 for each taxpayer who is a qualifying police auxiliary or reserve volunteer as certified by a bona fide Maryland police agency. Attach a copy of the certification. w. Up to $1,500 of unreimbursed expenses that a foster parent incurs on behalf of a foster child. The foster parent must be approved by a local department to provide 24-hour care for a foster child in the house where the foster parent resides. A treatment foster parent licensed by a child placement agency may not claim the subtraction modification. Foster parent includes a kinship parent. The expenses must be approved as necessary by the local department of social services or the Montgomery County Department of Health and Human Services and may not include an expense for which the foster parent receives an allowance or reimbursement from any public or private agency. xa. Up to $2,500 per contract purchased for advanced tuition payments made to the Maryland Prepaid College Trust. See Administrative Release 32. xb. Up to $2,500 per contributor per beneficiary of the total of all amounts contributed to investment accounts under the Maryland College Investment Plan and Maryland Broker-Dealer College Investment Plan. This subtraction modification may not be claimed if the account holder received a State contribution under § 18-19A-04.1 of the Education Article during the taxable year. xc. Any amount included in federal adjusted gross income as a result of a distribution to a designated beneficiary from a Maryland ABLE account, unless it is a refund or nonqualified distribution. Designated beneficiary means a designated beneficiary as defined in § 18–19C–01 of the Education Article. xd. Up to $2,500 per ABLE account contributor per beneficiary of the total of all amounts contributed under the Maryland ABLE Program. Subject to the $2,500 annual limitation, any amount disallowed as a subtraction because it exceeds $2,500 may be carried over until used to the next 10 succeeding taxable years as a subtraction. xe. An amount included in federal adjusted gross income contributed by the State into an investment account under § 18-19A-04.1 of the Education Article during the taxable year. This includes amounts included in federal adjusted gross income contributed by the State into an investment account under the Maryland College Investment Plan. y. Any income of an individual that is related to tangible or intangible property that was seized, misappropriated or lost as a result of the actions or policies of Nazi Germany towards a Holocaust victim. For additional information, contact the Revenue Administration Division. z. Expenses incurred to buy and install handrails in an existing elevator in a health care facility (as defined in Section 19- 114 of the Health General Article) or other building in which at least 50% of the space is used for medical purposes. aa. Payments from a pension system to the surviving spouse or other beneficiary of a law enforcement officer or firefighter whose death arises out of or in the course of their employment. ab. Income from U.S. Government obligations. Enter interest on U.S. Savings Bonds and other U.S. obligations. Capital gains from the sale or exchange of U.S. obligations should be included on this line. Dividends from mutual funds that invest in U.S. Government obligations also are exempt from state taxation. However, only that portion of the dividends attributable to interest or capital gain from U.S. Government obligations can be subtracted. You cannot subtract income from Government National Mortgage Association securities. See Administrative Releases 10 and 13. bb. Net subtraction modification to Maryland taxable income when claiming the federal depreciation allowances from which the State of Maryland has decoupled. Complete and attach Form 500DM. See Administrative Release 38. cc. Net subtraction modification to Maryland taxable income when the federal special 5-year carryback period was used for a net operating loss under federal law compared to Maryland taxable income without regard to federal provisions. Complete and attach Form 500DM. See Administrative Release 38. cd. Net subtraction modification to Maryland taxable income resulting from the federal ratable inclusion of deferred income arising from business indebtedness discharged by 9 reacquisition of a debt instrument. Complete and attach Form 500DM. See Administrative Release 38. dd. Income derived within an arts and entertainment district by a qualifying residing artist from the publication, production, or sale of an artistic work that the artist created, wrote, composed or executed. Complete and attach Form 502AE. dm. Net subtraction modification from multiple decoupling provisions. See the table at the bottom of Form 500DM. dp. Net subtraction decoupling modification from a pass- through entity. See Form 500DM. ee. The amount received as a grant under the Solar Energy Grant Program administered by the Maryland Energy Administration (but not more than the amount included in your total income). ff. Amount of the cost difference between a conventional on-site sewage disposal and a system that uses nitrogen removal technology, for which the Department of Environment’s payment assistance program does not cover. An individual must have applied to the Department of the Environment for assistance to claim the subtraction modification on the Form 502SU. Also, in order to claim the subtraction modification, the system that is purchased must be a system that utilizes nitrogen removal technology as per Environment Article of the Annotated Code of Maryland § 9-1108. hh. Exemption adjustment for certain taxpayers with interest on U.S. obligations. If you have received income from U.S. obligations and your federal adjusted gross income exceeds $100,000 ($150,000 if filing Joint, Head of Household, or Qualifying Widow(er)), enter the difference, if any, between the exemption amount based on your federal adjusted gross income and the exemption amount based upon your federal adjusted gross income after subtracting your U.S. obligations using the EXEMPTION ADJUSTMENT WORKSHEET (13C).

Example: Pat and Chris Jones had a federal adjusted gross income of $180,000. They also had $40,000 on interest from U.S. Savings Bonds and had a dependent son whom they claimed on the Maryland tax return. Using Instruction 10, they found the exemption amount on their Maryland return (based upon $180,000 of income) was $2,400 ($800 for three exemptions). If it were not for the $40,000 of U.S. Savings Bonds, their federal adjusted gross income would have been $140,000 and their exemption amount would have been $9,600 ($3,200 for three exemptions). Therefore, Pat and Chris Jones are entitled to claim a subtraction of $7,200 ($9,600 - $2,400) on line hh of Form 502SU. ii. Interest on any Build America Bond that is included in your federal adjusted gross income. See Administrative Release 13. jj. Gain resulting from a payment from the Maryland Department of Transportation as a result of the acquisition of a portion of the property on which your principal residence is located. kk. Qualified conservation program expenses up to $500 for an application approved by the Department of Natural Resources to enter into a Forest Conservation and Management Plan. ll. Payment received as a result of a foreclosure settlement negotiated by the Maryland Attorney General. mm. Amount received by a claimant for noneconomic damages as a result of a claim of unlawful discrimination under Internal Revenue Code Section 62(e). nn. Amount of student loan indebtedness. Attach a copy of the notice stating that the loans have been discharged. oo. Up to $5,000 of income earned by a law enforcement officer residing in the Maryland political subdivision in which the officer is employed if the crime rate in that political subdivision exceeds the State’s crime rate. Law enforcement officer means an individual who in an official capacity is authorized by law to make arrests, and is a member of a Maryland law enforcement agency, including an officer who serves in a probationary status or at the pleasure of the appointing authority of a county or municipal corporation. Federal law enforcement officers do not qualify. pp. Any amount included in federal adjusted gross income for: 1) the value of any medal given by the International Olympic Committee, the International Paralympic Committee, the Special Olympics International Committee, or the International Committee of Sports for the Deaf; and 2) any prize money or honoraria received from the United States Olympic Committee from a performance at the Olympic Games, the Paralympic Games, the Special Olympic Games, or the Deaflympic Games. qq. Amount of qualified principal residence indebtedness included in federal adjusted gross income that was allowable as an exclusion under the Mortgage Forgiveness Debt Relief Act of 2007, as amended. The subtraction may not exceed $100,000 for taxpayers who file single or married filing separately, and may not exceed $200,000 for married filing joint, head of household, or qualifying widow(er). Qualified principal residence indebtedness is debt used to buy, build or substantially improve your principal residence, or to refinance debt incurred for those purposes but only if the debt is secured by the home. rr. PENSION EXCLUSION FOR RETIRED LAW ENFORCEMENT OFFICER OR FIRE, RESCUE, OR EMERGENCY SERVICES PERSONNEL. Note: An individual taxpayer may not claim BOTH the standard Pension Exclusion and the Pension Exclusion for Retired Law Enforcement Officer or Fire, Rescue, or Emergency Services Personnel. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have received qualified pension income, you should complete the Pension Exclusion Computation Worksheet (13A) regardless of your prior work history. It is permissible for one spouse to claim the standard Pension Exclusion and the other spouse to claim the Pension Exclusion for Retired Law Enforcement Officer or Fire, Rescue, or Emergency Services Personnel if each spouse meets the applicable required criteria. If you meet the below criteria, use the Pension Exclusion Worksheet (13E) to calculate your eligible pension exclusion: a. You were 55 or over on the last day of the tax year, AND b. You were not 65 or older, or totally disabled, or have spouse who is totally disabled, AND c. You included on your federal return taxable income received as a pension, annuity or endowment from an “employee retirement system” qualified under Section 401(a), 403 or 457(b) of the Internal Revenue Code, AND d. The retirement income is attributable to your service as a law enforcement officer or fire, rescue, or emergency services personnel of the United States, the State of Maryland, or a political subdivision of Maryland. Each spouse who meets the above requirements may be entitled to the exclusion. If each spouse is eligible, complete a separate column on the RETIRED LAW ENFORCEMENT OFFICER OR FIRE, RESCUE, OR EMERGENCY SERVICES PERSONNEL PENSION EXCLUSION COMPUTATION WORKSHEET (13E). Combine your allowable exclusions from line 8 of the worksheet and enter the total amount on line rr, Form 502SU. If you are a part-year resident, complete the RETIRED LAW ENFORCEMENT OFFICER OR FIRE, RESCUE, OR EMERGENCY SERVICES PERSONNEL PENSION EXCLUSION COMPUTATION WORKSHEET (13E) using total taxable pension and total Social Security and railroad retirement benefits as if you were a full-year resident. Prorate the amount on line 8 by the number of months of Maryland residence divided by 12. However, if you began to receive your pension during the tax year you became a Maryland resident, use a proration factor of the number of month you were a resident divided by the number of months the pension was received. Copy the prorated amount from line 8 of the worksheet onto line rr of Form 502SU. For example, Pat Taxpayer moved to Maryland on March 1. If he started to receive his pension on March 1, he would prorate the pension exclusion by 10/10, which would mean he would be entitled to the full pension exclusion. However, if he began to receive his pension on February 1, Pat would prorate his pension by 10/11. Please note that, in either case, the proration factor may not exceed 1. Note: You must complete and attach Form 502R to the Form 502 if you or your spouse are claiming a pension exclusion on line rr of the Maryland Form 502SU. See the Form 502R for additional information.

Line 14. TWO-INCOME SUBTRACTION. You may subtract up to $1,200 if both spouses have income subject to Maryland tax and you file a joint return. To compute the subtraction, complete the TWO-INCOME MARRIED COUPLE SUBTRACTION WORKSHEET (13D). ITEMIZED DEDUCTIONS. If you figure your tax by the ITEMIZED DEDUCTION METHOD, complete line 17a and b on Maryland Form 502. (See Instruction 16 to see if you will use the ITEMIZED DEDUCTION METHOD.) Copy the amount from federal Form 1040, Schedule A, line 29, Total Itemized Deductions, on line 17a of Form 502. Certain items of federal itemized deductions are not eligible for State purposes and must be subtracted from line 17a. State and local income taxes used as a deduction for federal purposes must be entered on line 17b. Also, any amounts deducted as contributions of Preservation or Conservation Easements for which a credit is claimed must be added to line 17b. Note: Certain high-income taxpayers are required to reduce their federal itemized deductions. If you had to reduce your total federal itemized deductions, use the Itemized Deduction Worksheet (14A) to calculate the amount of state and local income taxes to enter on line 17b of Form 502. You are not required to itemize deductions on your Maryland return because you have itemized deductions on your federal return. Figure your tax each way to determine which method is best for you. If your unreimbursed business expenses include depreciation to which an adjustment is required for Maryland purposes, complete Form 500DM to calculate the addition modification “l” or subtraction modification “bb. FIGURE YOUR MARYLAND ADJUSTED GROSS INCOME. Complete lines 1–16 on Form 502. Line 16 is your Maryland adjusted gross income. FIGURE YOUR MARYLAND TAXABLE NET INCOME. To find your taxable income you must subtract either the standard deduction from the worksheet or the itemized deductions you have entered on line 17 of Form 502. The ITEMIZED DEDUCTION METHOD will lower your taxes if you have enough deductions. If you are not certain about which method to use, figure your tax both ways to determine which method is best for you. Check the box on line 17 of Form 502 to show which method you will use. STANDARD DEDUCTION METHOD (Check the box on line 17 of Form 502) The STANDARD DEDUCTION METHOD gives you a standard deduction of 15% of Maryland adjusted gross income (line 16) with minimums of $1,500 and $3,000 and maximums of $2,000 and $4,000, depending on your filing status. Use STANDARD DEDUCTION WORKSHEET (16A) for your filing status to figure your standard deduction. Write the result on line 17 of Form 502. Then follow the instructions for EXEMPTIONS. ITEMIZED DEDUCTION METHOD (Check the box on line 17 of Form 502) You may itemize your deductions only if you itemized deductions on your federal return. See Instruction 14 for completing lines 17a and b of Form 502. Enter the result on line 17b. You are not required to itemize deductions on your Maryland return simply because you itemized on your federal return. Figure your tax each way to determine which method is best for you. EXEMPTIONS After completing the EXEMPTIONS area on your return, enter the total exemption amount on line 19 of Form 502. PART-YEAR RESIDENTS AND NONRESIDENT MILITARY TAXPAYERS You must adjust your standard or itemized deductions and exemptions. If you are a part-year resident, see Instruction 26. If you are a nonresident military member filing a joint return with your civilian spouse, see Administrative Release 1. FIGURE YOUR MARYLAND TAX. You must use the tax tables if your taxable income is less than $100,000. The 2017 Maryland tax rate schedules are shown so you can see the tax rate that applies to all levels of income; however, do not use them to figure your tax. Instead, use the tax tables if your income is under $100,000; otherwise, use the appropriate row in the MARYLAND TAX COMPUTATION WORKSHEET SCHEDULES (17A) at the end of the tax tables to figure your tax. The tax tables and the MARYLAND TAX COMPUTATION WORKSHEET SCHEDULES I AND II have been based on these tax rate schedules. Find the income range in the tax table that applies to the amount on line 20 of Form 502. Find the Maryland tax corresponding to your income range. Enter the tax amount on line 21 of Form 502. If your taxable income is $100,000 or more, use the MARYLAND TAX COMPUTATION WORKSHEET (17A) at the end of the tax table.

18 EARNED INCOME CREDIT, POVERTY LEVEL CREDIT, CREDITS FOR INDIVIDUALS AND BUSINESS TAX CREDITS. If you claim earned income credit or poverty level credit, see Instruction 19 for your local credit calculation. Form 500CR Instructions are available online at www. marylandtaxes.gov. You must file Form 500CR electronically to claim a business income tax credit. Line 22 of Form 502. EARNED INCOME CREDIT. If you claimed an earned income credit on your federal return, then you may claim one-half (50%) of the federal credit on your Maryland return. If you are a part-year resident or a member of the military, see Instruction 26(o) before completing this worksheet. If you filed a joint federal return but a separate Maryland return, you may claim a combined total of up to one- half the federal credit. Complete the STATE EARNED INCOME CREDIT WORKSHEET (18A) to calculate the amount to enter on line 22 of Form 502.

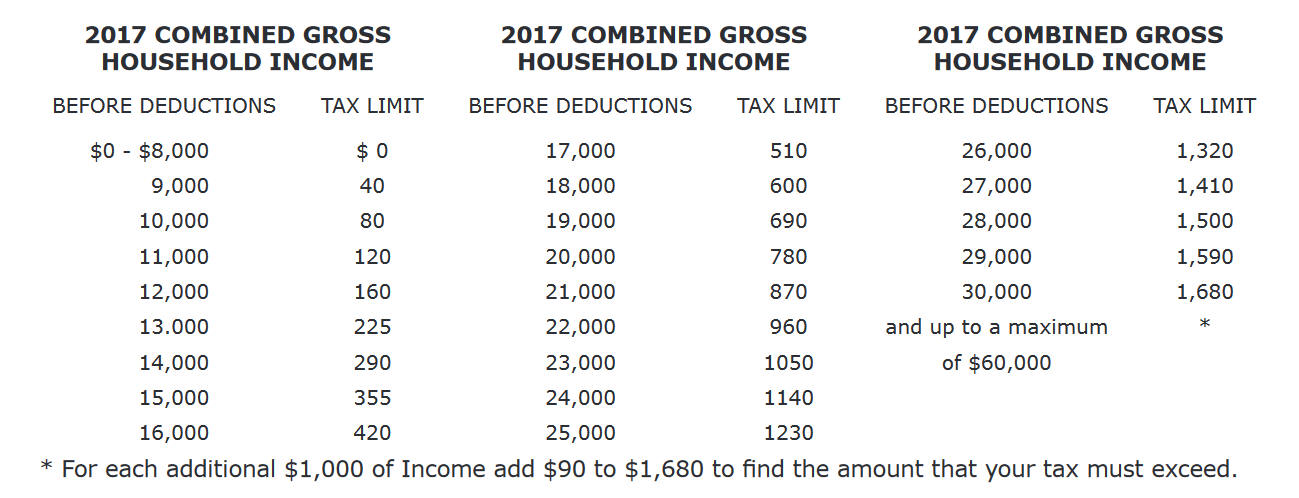

Line 23 of Form 502. STATE POVERTY LEVEL CREDIT. If your earned income and federal adjusted gross income plus additions are below the poverty level income for the number of exemptions on your federal tax return, you may be eligible for the poverty level credit. You are not eligible for this credit if you checked filing status 6 (dependent taxpayer) on your Maryland income tax return. Generally, if your Maryland state tax exceeds 50% of your federal earned income credit and your earned income and federal adjusted gross income are below the poverty income guidelines from the STATE POVERTY LEVEL CREDIT WORKSHEET (18B), you may claim a credit of 5% of your earned income. Complete the STATE POVERTY LEVEL CREDIT WORKSHEET (18B) to calculate the amount to enter on line 23 of Form 502. This is not a refundable credit.

Line 24 of Form 502. OTHER INCOME TAX CREDITS FOR INDIVIDUALS. Enter the total of your income tax credits as listed below. Complete and attach Form 502CR with Form 502. a. CREDITS FOR INCOME TAXES PAID TO OTHER STATES. If you have income subject to tax in Maryland and subject to tax in another state and/or another state’s locality, you may be eligible for a tax credit. Note : You must attach a copy of Form 502CR and also a copy of the tax return(s) filed in the other state and/or other state’s locality. If these are not attached, no credit will be allowed. b. CREDIT FOR CHILD AND DEPENDENT CARE EXPENSES. If you were eligible for a Child and Dependent Care Credit on your federal income tax return and your income is below certain thresholds, you are entitled to a tax credit equal to a percentage of the federal credit. c. QUALITY TEACHER INCENTIVE CREDIT. If you are a qualified teacher who paid tuition to take graduate level courses required to maintain certification, you may be eligible for a tax credit. d. CREDIT FOR AQUACULTURE OYSTER FLOATS. If you purchased a new aquaculture oyster float during the tax year, you may be entitled to a credit of up to $500 for the cost of the float. e. LONG-TERM CARE INSURANCE CREDIT. If you paid a premium for a long-term care insurance policy for yourself or certain Maryland resident family members, you may be eligible for a tax credit. f. CREDIT FOR PRESERVATION AND CONSERVATION EASEMENTS. Individuals may be eligible for a tax credit for an easement conveyed to the Maryland Environmental Trust, the Maryland Agricultural Land Preservation Foundation, or the Maryland Department of Natural Resources to preserve open space, natural resources, agriculture, forest land, watersheds, significant ecosystems, view sheds or historic properties. Individuals who are eligible to claim the Credit for Preservation and Conservation Easements and who are not PTE members must claim this credit on Part F of the Form 502CR. PTE members who are eligible for this credit must electronically claim the credit on Business Income Tax Credit Form 500CR. h. COMMUNITY INVESTMENT TAX CREDIT. Businesses that contribute to approved Neighborhood and Community Assistance Programs may be eligible for a tax credit of 50% of approved contributions with a maximum credit of $250,000 on Business Income Tax Credit Form 500CR (See Line 25 instructions, letter code d). Individuals who make a nonbusiness contribution may also be eligible for this tax credit, and may elect to claim this credit on Part H of Form 502CR instead of Form 500CR. The credit may not be claimed on both Form 500CR and Form 502CR. PTE members claim this credit on Business Income Tax Credit Form 500CR (See Line 25 instructions, letter code d). i. ENDOW MARYLAND TAX CREDIT. Businesses that donate $500 of cash or publicly traded securities to a qualified permanent endowment fund at an eligible community foundation may be eligible for a tax credit of 25% of the approved donation with a maximum credit of $50,000 on Business Income Tax Credit Form 500CR (See Line 25 instructions, letter code q). Individuals who make an approved donation may also be eligible for this tax credit, and may elect to claim this credit on Part I of Form 502CR instead of Form 500CR. The credit may not be claimed on both Form 500CR and Form 502CR. PTE members claim this credit on Business Income Tax Credit Form 500CR (See Line 25 instructions, letter code q). Note: If you claim the Endow Maryland tax credit, the amount of approved donations which qualify you for this credit is an addition to income and must be included on line 5. See Instruction 12, letter code e. j. PRECEPTORS IN AREAS WITH HEALTH CARE WORKFORCE SHORTAGES TAX CREDIT If you are a qualified licensed physician or a qualified nurse practitioner who served without compensation as a preceptor, you may be eligible to claim a nonrefundable credit against your State tax liability. Line 25 of Form 502. BUSINESS TAX CREDITS. You must file your Form 502 electronically to claim the following nonrefundable business tax credits from Form 500CR. a. ENTERPRISE ZONE TAX CREDIT. Businesses located in an enterprise zone may be eligible for tax credits based upon wages paid to qualifying employees. b. MARYLAND DISABILITY EMPLOYMENT TAX CREDIT . Businesses employing persons with disabilities as certified by the State Department of Education or veterans with disabilities as certified by the Department of Labor, Licensing and Regulation may be eligible for tax credits based upon wages paid to and child care and transportation expenses paid on behalf of those employees. c. JOB CREATION TAX CREDIT. Certain businesses that create new qualified positions in Maryland may be eligible for a tax credit based on the number of qualified positions created or wages paid for these positions. d. COMMUNITY INVESTMENT TAX CREDIT. Businesses that contribute to approved Neighborhood and Community Assistance Programs may be eligible for a tax credit of 50% of approved contributions with a maximum credit of $250,000. Individuals who make a nonbusiness contribution may also be eligible for this tax credit, and may elect to claim this credit on Form 502CR instead of Form 500CR (See Line 24 instructions, letter code h). The credit may not be claimed on both Form 500CR and Form 502CR. PTE members claim this credit on Business Income Tax Credit Form 500CR. e. BUSINESSES THAT CREATE NEW JOBS TAX CREDIT. Certain businesses located in Maryland that create new positions or establish or expand business facilities in the state may be entitled to an income tax credit if a property tax credit is granted by Baltimore City or any county or municipal corporation of Maryland. f. EMPLOYER-PROVIDED LONG-TERM CARE INSURANCE TAX CREDIT. A credit may be claimed for costs incurred by an employer who provides long-term care insurance as part of an employee benefit package. g. SECURITY CLEARANCE COSTS TAX CREDIT. Businesses that incur costs certified by the Maryland Department of Commerce to construct or renovate Sensitive Compartmented Information Facilities (SCIF) or for certain Security Clearance Administrative Costs may be eligible to claim a credit for security costs. h. FIRST YEAR LEASING COSTS TAX CREDIT FOR QUALIFIED SMALL BUSINESSES. Certain small businesses performing security-based contracting that incur expenses for rental payments owed during the first year of a rental agreement for spaces leased in Maryland costs may be eligible to claim a credit for security costs certified by the Maryland Department of Commerce. i. RESEARCH AND DEVELOPMENT TAX CREDIT. Businesses may claim a credit for certain qualified research and development expenses. j. COMMUTER TAX CREDIT. Businesses may claim a credit for the cost of providing qualifying commuter benefits to the business entities’ employees. k. MARYLAND-MINED COAL TAX CREDIT. A qualifying cogenerator, small power producer or electricity supplier may claim a credit for the purchase of Maryland-mined coal. l. ONE MARYLAND ECONOMIC DEVELOPMENT TAX CREDIT. Businesses may claim a credit against the project cost and start-up cost to establish, relocate or expand a business in a distressed county in Maryland. m. OYSTER SHELL RECYCLING TAX CREDIT. An individual or business may claim a credit in an amount of $5 for each bushel of oyster shells recycled during the taxable year with a maximum credit of $750. n. BIO-HEATING OIL TAX CREDIT. Businesses and individuals may claim a credit of 3 cents for each gallon of bio-heating oil purchased for space or water heating with a maximum credit of $500. o. CELLULOSIC ETHANOL TECHNOLOGY RESEARCH AND DEVELOPMENT TAX CREDIT. Businesses and individuals may claim a credit of up to 10% of the qualified research and development expenses incurred in Maryland for technology that is used to develop cellulosic biomass for conversion to ethanol fuel. p. WINERIES AND VINEYARDS TAX CREDIT. Businesses and individuals may claim a credit of 25% of qualified capital expenses, approved by the Maryland Department of Commerce, made in connection with the establishment of new wineries or vineyards or capital improvements to existing wineries or vineyards. q. ENDOW MARYLAND TAX CREDIT. Businesses that donate $500 of cash or publicly traded securities to a qualified permanent endowment fund at an eligible community foundation may be eligible for a tax credit of 25% of the approved donation with a maximum credit of $50,000. Individuals who make an approved donation may also be eligible for this tax credit, and may elect to claim this credit on Form 502CR instead of Form 500CR (See Line 24 instructions, letter code i). The credit may not be claimed on both Form 500CR and Form 502CR. PTE members claim this credit on Business Income Tax Credit Form 500CR. r. QUALIFIED VEHICLE TAX CREDIT (Tractor-Trailer Vehicle Registration Tax Credit). A credit may be claimed for the expense of registering a qualified Class F (Tractor) vehicle that is titled and registered in Maryland. s. CREDIT FOR PRESERVATION AND CONSERVATION EASEMENTS. Members of a Pass-Through Entity (PTE) may be eligible for a tax credit for an easement conveyed to the Maryland Environmental Trust, the Maryland Agricultural Land Preservation Foundation, or the Maryland Department of Natural Resources to preserve open space, natural resources, agriculture, forest land, watersheds, significant ecosystems, view sheds or historic properties. The credit may not be claimed on both Form 500CR and Form 502CR. PTE members claim this credit on Business Income Tax Credit Form 500CR. t. APPRENTICE EMPLOYEE TAX CREDIT. Certain taxpayers may be eligible for an income tax credit for the first year of employment of eligible apprentices. u. QUALIFIED FARMS TAX CREDIT. Qualified farms that make an eligible food donation may be eligible for an income tax credit. v. QUALIFIED VETERAN EMPLOYEES TAX CREDIT. A credit may be claimed by a small business for each qualified veteran employee hired. For additional information regarding any of the above income tax credits, see the Business Tax Credits Form 500CR Instructions available at www.marylandtaxes.gov . NOTE: If you claim a business tax credit for items a, b, g, i, o, or q, an addition to income must be included on line 5. See Instruction 12. LOCAL INCOME TAX AND LOCAL CREDITS. Maryland counties and Baltimore City levy an income tax which is a percentage of Maryland taxable net income. Use the LOCAL TAX RATE CHART and the LOCAL TAX WORKSHEET (19A) to figure your local income tax. Use the county (or Baltimore City) you resided in on the last day of the tax year and which you showed in the box at the top of Form 502. Military taxpayers should refer to Instruction 29.

SPECIAL NOTE: If you and your spouse were domiciled in different taxing jurisdictions, you should file separate Maryland returns even though you filed a joint federal return. (See Instruction 7.) However, if you choose to file a joint Maryland return, please use the following instructions. Enter both counties and/or local jurisdictions in the county, city, town or special taxing area box of your return. If the local tax rates are the same, complete the worksheets as instructed and attach a schedule showing the local tax for each jurisdiction based on the ratio of each spouse’s income to the total income. Also note the words “separate jurisdictions” on line 28 of Form 502. If the local tax rates are different, calculate a ratio of each spouse’s income to total income. Then apply this ratio to the taxable net income and calculate the local tax for each spouse separately using the appropriate local tax rates. Enter the combined local tax on line 28 of Form 502 and write the words “separate jurisdictions” on that line. Attach a schedule showing your calculations. Local earned income credit. If you entered an earned income credit on line 22 of Form 502, complete the LOCAL EARNED INCOME CREDIT WORKSHEET (19B).

Local poverty level credit. If you entered a poverty level credit on line 23 of Form 502, complete the LOCAL POVERTY LEVEL CREDIT WORKSHEET (19C).

TOTAL MARYLAND TAX, LOCAL TAX AND CONTRIBUTIONS. Add your Maryland tax from line 27 of Form 502 and your local tax from line 33 of Form 502. Enter the result on line 34 of Form 502. Add to your tax any contribution amounts and enter the total on line 39 of Form 502. CHESAPEAKE BAY AND ENDANGERED SPECIES FUND You may contribute any amount you wish to this fund. The amount contributed will reduce your refund or increase your balance due. DEVELOPMENTAL DISABILITIES SERVICES AND SUPPORT FUND You may contribute any amount you wish to this fund. The amount contributed will reduce your refund or increase your balance due. MARYLAND CANCER FUND You may contribute any amount you wish to this fund. The amount contributed will reduce your refund or increase your balance due. FAIR CAMPAIGN FINANCING FUND You may contribute any amount you wish to this fund. The amount contributed will reduce your refund or increase your balance due. IMPORTANT : If there are not sufficient credits or other payments to satisfy both your tax and the contribution you have designated, the contribution amount will be reduced. If you have entered amounts for contributions to multiple funds, any reduction will be applied proportionately. TAXES PAID AND REFUNDABLE CREDITS. Write your taxes paid and credits on lines 40-43 of Form 502. Instructions for each line: Line 40 of Form 502. MARYLAND TAX WITHHELD. Write the total Maryland and local tax withheld as shown on the wage and tax statements (Forms W-2, W-2G or 1099) you have received. Add the amounts identified as Maryland and local tax withheld on each form and write the total on this line. Attach Forms W-2, W-2G and 1099 to your return if Maryland tax is withheld . You will not get credit for your withholding if you do not attach Forms 1099, W-2 or W-2G, substantiating Maryland withholding. IMPORTANT: Your wage and tax statements contain many numbers. Be sure you add only the amounts identified as Maryland and local tax withheld. Line 41. ESTIMATED TAX PAYMENTS. Enter on line 41 the total of: a. Maryland estimated tax payments; b. Amount of overpayment applied from 2016 return; c. Payment made with a request for an automatic extension of time to file your 2017 return. (See the instructions on Form 502E); AND d. Reported income tax withheld on your behalf as an estimated payment, if you participated in a nonresident real estate transaction as an individual. Enter code number 506 on one of the code number lines to the right of the telephone number area. The tax will be identified as Maryland tax withheld on Form MW506NRS. Please attach a copy of your federal return and all relevant schedules that report the sale of the property. NOTE: Estimated tax payments are required if you expect to receive any income (like pensions, business income, capital gains, lottery, etc.) from which no tax or not enough Maryland tax will be withheld. Read the instructions for Form 502D, Maryland Personal Declaration of Estimated Income Tax. Line 42 of Form 502.REFUNDABLE EARNED INCOME CREDIT. If one-half of your federal earned income credit is greater than your Maryland tax, you may also be eligible for a refundable earned income credit. This credit is the amount by which 27% of your federal earned income credit exceeds your Maryland tax liability. Complete the REFUNDABLE EARNED INCOME CREDIT WORKSHEET (21A) and enter the result on this line.