|

|

||||||||

|

Part 6 - Apply Your California Tax Knowledge

In this tax school part, you will be able to apply tax knowledge you have for California and review the new information for the year. Tax School Home Page Student Instructions: Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online

Most forms are in Adobe Acrobat PDF format.

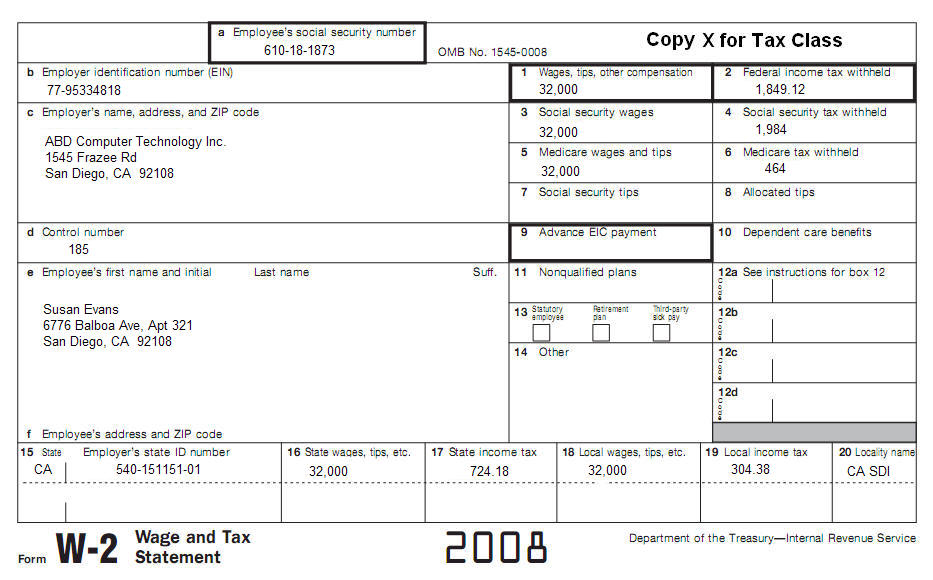

Use publication FTB 540/540A Booklet to complete this topic. FTB Form 540A FTB Form 3506 Prepare the appropriate California tax forms for Susan Evans. Her address is current on Form W-2. Get all her basic information from the following W2, including income information.

Susan Evans (DOB 03/04/1955) is a single woman. For tax year 2008 she received the following:

Susan Evans is divorced and has two children:

Her children lived with her all of 2008 and she is the only person that can claim her children.

Susan paid $13,200 rent for tax year 2008. Susan noticed that too much money was withheld for California SDI on her W-2. Susan's younger child (Laura) stays at her employer's on-site care center while she works. The benefits from this child care center qualify to be excluded from her income. Her employer reports the value of this service as $3,000 for the year and it is shown on Susan's Form W-2 in box 10, but not included in taxable wages in box 1. A neighbor cares for Susan's older child (Sean) after school, on holidays, and during the Summer while Susan is at work. Susan pays her neighbor Consuelo Echeverria (SSN 612-34-3453) $2,900 for this care. Her address is 3424 Cesar Chavez Ave, San Diego, CA 92108.

1. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 13?

a.

$ 32,000. 2. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 14a?

a.

$ 430. 3. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 14b?

A. $ 32,000 4. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 14g?

A. $ 180. 5. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 18?

A. $ 309 6. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 20?

A. $ 24,616 7. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 21?

A. $ 120 8. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 28?

A. $ -0- 9. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 29?

A. $ 837 10. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 39?

A. $ -0- 11. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 66?

A. $ 1,167 12. Look at the Form 540A you prepared for Susan Evans. What is the amount on Form 540A, Line 44?

A. $ 1,101 13. For the child and dependent care expenses credit, the following is true regarding claiming the credit for California.

A. California allows this credit only for care provided in California.

14. California includes California lottery winnings in taxable income. True False 15. For California, you may be able to file as head of household if your child lived with you and you lived with your spouse/RDP during the entire last six months of 2008. True False 16. Use the same filing status for California that you used for your federal income tax return, unless you A.

Itemize your deductions. 17. Beginning in 2005 (conformity with Federal), for a child to qualify as your foster child for head of household purpose, the child must A.

Be placed with you by an authorized placement agency. 18. You must use the same filing status for California that you used for your federal income tax return unless in cases when a spouse is a member of the Armed forces or a nonresident for the entire year and no income from California source. According to federal law, if you are living together in a common law marriage that is recognized in the state where you now live or in the state where the common law marriage began you are considered married for tax purposes. You are considered married for California purposes if A.

You were married as of December 31, 2008, even if you did not live with

your spouse/RDP at the end of 2008. 19. You normally must use the same filing status for California that you used for your federal income tax return. However, if you filed a joint return for federal you may file separately if either spouse was: A.

An active member of the United State armed forces or any auxiliary

military branch during 2008. 20. If you file a joint return for federal, you may file separately for California if either spouse was a nonresident for the entire year and had no income from California sources during 2008. However, if the spouse earning the California source income is domiciled in a community property state, community income will be split equally between the spouses. Therefore, they will not qualify for the nonresident spouse exception because

A.

Both spouses were domiciled out of California.

|

||||||||

| Back to Tax School Homepage |