|

|

||

|

Topic 10 - Tax Deduction for Casualties and Theft Losses

|

||

In this topic you will learn what is a casualty and theft loss and how to figure the amount of your loss. You will learn what to do when you receive insurance reimbursements for your loss and when and how to report a casualty or theft loss. You will also become aware of the special rules for the disaster area losses such as when your property is damaged due to storm, fire, car accident and events of that sort. In addition, you will explore what to do when someone steals your property or when you have a loss of deposit as in the event that your bank becomes insolvent or files bankruptcy.Tax School Homepage Student Instructions: Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online

Most forms are in Adobe Acrobat PDF format.

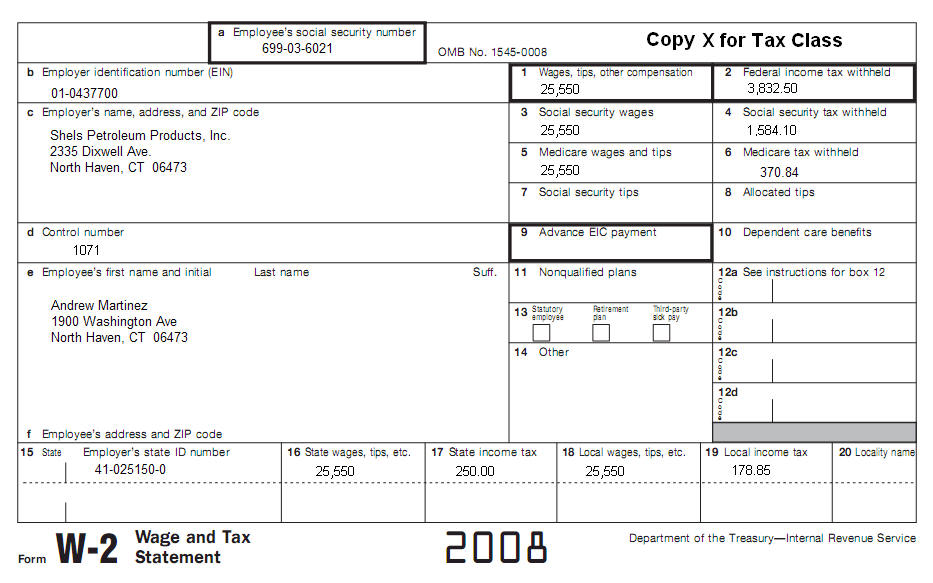

Use IRS Publication 547 to complete this topic. Complete a Form 4684 for Andrew Martinez (699-03-6021). On August 30, 2008, a tremendous storm caused extensive property damage to Andrew's home. He had originally purchased the home for $90,000. The purchase price was allocated between the land ($18,000) and the building ($72,000). Andrew planted trees and ornamental shrubs on the grounds surrounding his home at a cost of $1,200. The fair market value immediately before the storm was $98,000 ($80,000 for building and $18,000 land); immediately afterwards the value was $70,000 ($52,000 for building and $18,000 for the land). The fair market value of the trees and shrubs immediately before the casualty was $2,000 and immediately afterwards; $100. Insurance of $15,000 is received to cover the total damage. Complete a Schedule A using the results from Form 4684. After that prepare a Federal Form 1040. Andrew and his girlfriend have been together for 1 year. They do not have any children and are not married. They lived together all of 2008. Her name is Cindy Thomson (SSN: 012-92-8910). Cindy did not work because she was a student for all of 2008. They plan to get married when Cindy graduates from school. In addition to his earnings, Andrew had the following for 2008:

Use this Form W-2 for address and income information. All information is current. Don't forget to also fill in line 5 of Schedule A.

|

||

| Back to Tax School Homepage |