|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Tax School Homepage | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(bring 1 friend no additional cost) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

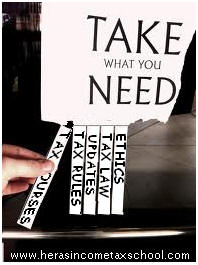

All Tax Topics

2025-2026 Topic List For preparing 2024 tax returns by April 2025 2025-2026 TAX COURSE AVAILABLE NOW

Choose from the following Independent study

Courses:

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Please note: You must attain a score of at least 70% in order to pass and for certificate of complete to be issued. This applies to all courses. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You will be able to attempt the exams 3 times. Special arrangements will be required to try the exams more than 3 times. Every time you try, you will get a different test. This applies to all courses. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(IRS, Enrolled Agents and all states, including California (CTEC), Maryland, and Oregon Tax Professionals)

Select from the list to compile your total hours needed to complete your new tax education requirements for tax professionals. Each tab is a separate course. Please read

it and study it carefully

as the pertinent information is there as to how many hours and which kind of

course it is. Some of the following choices have more hours than you may

need. You may complete more hours to satisfy your requirement. read

it and study it carefully

as the pertinent information is there as to how many hours and which kind of

course it is. Some of the following choices have more hours than you may

need. You may complete more hours to satisfy your requirement.

Some of the topics are for people who just need a few hours in just one topic area. For example, if you just need 2 hours of ethics you have the option in the following list. Furthermore, if you just need 5 California hours you also have that option in the list. If you don't make the proper choice you can always choose the right one later. The only thing is that choosing the wrong course would cause you a little more work , so choose appropriately from the start.

Copyright

2024 [Hera's Income

Tax School].

All rights reserved. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||