| $320.00 in interest income from Bank of America. | |

| $2,800.00 in Unemployment Compensation. | |

| $ 250.00 refund from his state (He did not itemize last year). | |

| $450 bonus promised to be paid by his employer in February 2010. | |

| Turkey valued at $47 for the December holidays. | |

| $78 gift certificate for Thanksgiving. |

James owed Sears & Roebuck (Department store) $1,600. He fell behind on the bill and could not pay. Sears offered to cancel $700 of the debt to have James settle the debt. James paid only $900 and the rest was forgiven.

He paid rent at a government owned building that is exempt from tax.

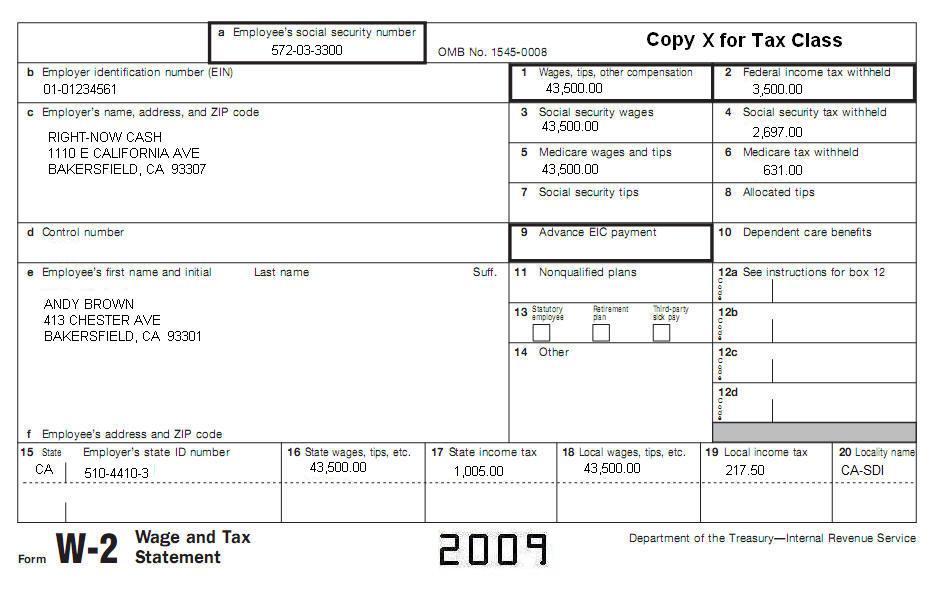

Get all their basic information from the following W2, including income information.

9. Look at the Form 540A you prepared for James Mulugeta. What is the amount on Form 540A, Line 13?

A. $18,917.

B. $20,415.

C. $20,015.

D. $20,337.

10. Look at the Form 540A you prepared for James Mulugeta. What is the amount on Form 540A, Line 19?

A. $16,778.

B. $ 16,093.

C. $ 15,513.

D. $ 16,323.

11. Round cents to the nearest whole dollar. For example, round $50.50 up to $51 or round $25.49 down to $25. If you do not round, FTB (California) will

A. Process your return more quickly and accurately.

B. Round for you.

C.

Disregard the cents.

D. Not process your return.

Tax Return 4

Use California 540/540A Booklet to complete this topic. You may also need to refer to IRS publications (such as Instructions for Form 1040).

Prepare a Federal Schedule A (Form 1040) return for Rodolfo Ramirez with the following deductible expenses.

| Medical Expenses $3,500 | |

| Real estate taxes $950 | |

| Other taxes (DMV tax part only) $500 | |

| Home Mortgage Interest $9,860 | |

| Union dues $700 | |

| Tax Preparation fee $207 |

Prepare a California Form 540 and Schedule CA return for Rodolfo Ramirez. Get all their basic information from the following W2, including income information.

They did not itemize in 2008.

Rodolfo is married and his wife is Anna Ramirez (SSN 505-57-9464).

12. Look at the Form 540 you prepared for Rodolfo and Anna Ramirez. What is the amount on Form 540, Line 18?

A. $262.

B. $13,084.

C. $12,663.

D. $32,143.

13. Look at the Form 540 you prepared for Rodolfo and Anna Ramirez. What is the amount on Form 540, Line 31?

A. $298.

B. $0.

C. $205.

D. $213.

14. For California, if married or an RDP and filing separate returns, you and your spouse/RDP must either both itemize your deductions or both must take the standard deduction.

True False

Tax Return 5

Complete a Schedule A for Mukesh (216-20-1334) and Sarita Bhargava (342-06-1213). Their property was exempt from property tax.

Sarita did not work. They had the following medical expenses for the year:

| Doctor $6,750.00 | |

| Dentist $3,280.00 | |

| Prescription Medicine $1,480.00 |

Prepare a California Form 540 and Schedule CA for Mukesh Bhargava. Use the Schedule A that you filled out to complete the return.

15. Look at the Form 540 you prepared for Mukesh and Sarita. What is the amount on Form 540, Line 18?

A. $9,530.

B. $7,032.

C. $9,330.

D. $9,816.

16. Look at the Form 540 you prepared for Mukesh and Sarita. What is the amount on Form 540, Line 31?

A. $131.

B. $302.

C. $2.

D. $135.

17. For California, RDPs have the same legal benefits, protections, and responsibilities as married couples unless otherwise specified.

True False

Tax Return 6

Complete a Schedule A, Schedule CA and Form 540.

Use the following expenses:

| Home mortgage interest $13,000.00 | |

| Real Estate Taxes $1,750.00 | |

| Personal Property Tax (2 cars) $895.00 (this is the tax part of the whole fee) |

John is not married and has no children or other dependents.

Use W2's that are included; all information is current.

18. Look at the Form 540 you prepared for John Soler. What is the amount on Form 540, Line 19?

A. $3,637.

B. $15,645.

C. $12,068.

D. $16,058.

19. Look at the Form 540 you prepared for John Soler. What is the amount on Form 540, Line 31?

A. $430.

B. $202.

C. $28.

D. $19.

20. If you did not itemize deductions on your federal tax return but still itemize deductions on your California tax return, first complete federal Schedule A (Form 1040) and then complete Schedule CA (Form 540).

True False

Complete a Schedule A, Schedule CA and Form 540 for Maria Garcia (Age 24).

She also has the following payments in 2009.

| Home mortgage interest $9,622.00 | |

| County Property taxes $1,211.00 | |

| Car license tax (only tax part) $210.00 |

Maria is not married and she has no children or other dependents.

Maria paid her mortgage interest for her home to an individual (not to a bank):

Melvin R. Smitt

250 E Main Street

San Diego, CA 92123

Social Security Number: 556-57-6811

Maria won $1,500 as a result of her bets place at a casino. Her total expenses for betting expenses were a total of $1,768.

Get all basic information from the following W2, including income information.

21. Look at the Form 540 you prepared for Maria. What is the amount on Form 540, Line 18?

A. $11,217.

B. $11,456.

C. $11,043.

D. $12,543.

22. Look at the Form 540 you prepared for Maria. What is the amount on Form 540, Line 31?

A. $290.

B.

$256.

C. $294.

D. $273.

23. Your California deduction for investment interest may be different from your federal deduction. Use __________ to figure the amount to enter on line 41.

A. FTB 3526.

B. FTB 3807.

C. FTB

3506.

D. FTB 2441.

Complete a Schedule A, Form 8283, Schedule CA and Form 540 for Martin Perez (699-03-6021) and Norma Perez (554-09-3000).

Martin claims his parents on his return.

Paul Perez (SSN 580-16-6733).

Lucy Perez (SSN 580-16-7683) .

They had the following expenses for the 2009 tax year:

| Tithe donation to their church $7,835.00 |

November 15, 2009, they donated the following items to Goodwill (1530 San Isidro Blvd, San Isidro, CA):

| Living room furniture (acquired new September 14, 2001 for $4,500. Current yard sale value is $900). | |

| Bedroom linens and bedding (acquired new on September 15, 2001 for $1,500. Current yard sale value is $180). | |

| Old antique car (acquired new July 2, 1975 for $20,000. Current market value as compared to others is $2,000). |

Additionally, they had the following in 2009:

| Interest from their bank $100. | |

| State refund $198.00 (they did not itemize last year) |

Martin and Norma paid $14,400 in rent for the whole year. The property they rented from is exempt from tax.

24. Look at the Form 540 you prepared for Martin and Norma. What is the amount on Form 540, Line 18?

A. $11,607.

B. $10,915.

C. $11,200.

D. None of the above.

25. Look at the Form 540 you prepared for Martin and Norma. What is the amount on Form 540, Line 40?

A. $120.

B. $15

C. $0

D. $358.

26. If deducting a prior year charitable contribution carryover, and the California carryover is larger than the federal carryover, enter the additional amount as a positive number on line 41 of Schedule CA (Form 540).

True False

Tax Return 9

Complete a tax return for Joseph Cuevas and Sara S. Cuevas (her SSN: 670-82-6160).

Their Children who lived with them all year are:

| Name: | SSN | DOB |

| Ulysses Cuevas | 626-12-6525 | 4-17-1998 |

| Yesenia Cuevas | 688-54-5661 | 6-18-1996 |

Joseph was the only person who worked in the family. Complete a California Form 540A (you may also need IRS Form 1040A) using the following W-2. All information on W-2 is current.

27. Look at the Form 540A you prepared for Joseph and Sara Cuevas. What is the amount on Form 540A, Line 18?

A.

$7,274.

B. $7,032.

C. $0.

D. $3,637.

28. Look at the Form 540A you prepared for Jose and Sara Cuevas. What is the amount on Form 540A, Line 70?

A. $0.

B. $60.

C. Owe $90.

D. $120.

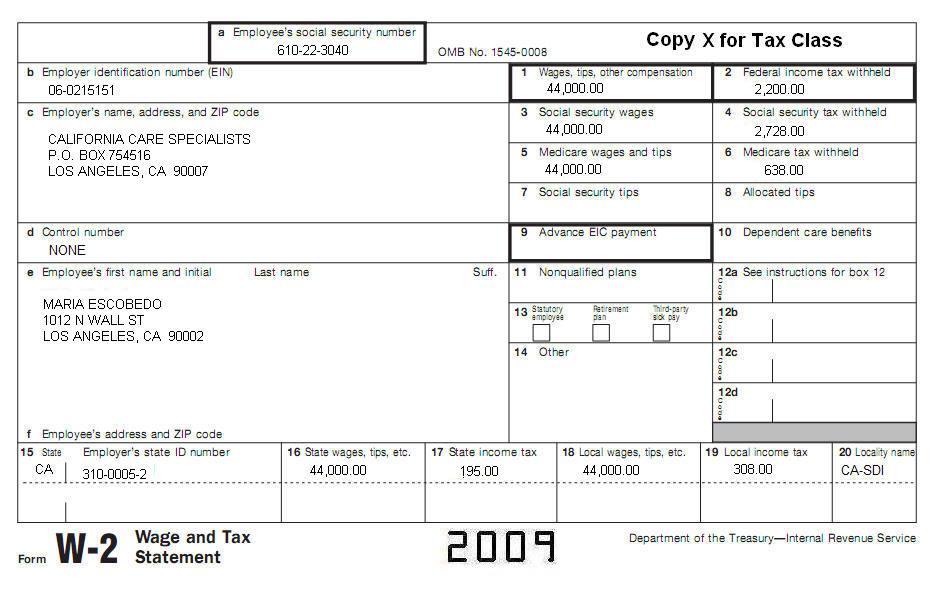

Complete a tax return for Lawrence Escobedo (570-16-1970) and Theresa Escobedo (502-39-4055). They got married December 31, 2009.

Their Children who lived with them all year are:

| Name: | SSN | DOB |

| Mario Escobedo | 603-19-2036 | February 18, 2002 |

| Cindy Escobedo | 603-18-2053 | April 10, 2000 |

Only Lawrence worked. Theresa did not work. Theresa attended school full time for 7 months in 2009. The school was not an on-the-job training course, correspondence school, night, or internet school. When she was in school her children were taken care of by Happy Child, Inc.:

| They paid Happy Child, Inc. $2,500 for each child for a total of $5,000. | |

| Happy Child, Inc., provider EIN 95-0906670. | |

| Care provided at: 2005 W 6th Street, Los Angeles, CA 90020. |

In addition to their earnings, they had the following:

| Bank interest income | $65.00 |

| Unemployment compensation | $450.00 |

Complete California Form 540A and Form FTB 3506 (you may also need IRS Form 1040A). Use the following attached W-2. All information on W-2 is current.

29. Look at the Form 540A you prepared for the Escobedo household. What is the amount on Form 540A, Line 78?

A. $700.

B. $140.

C. $301.

D. None of the above.

30. Look at the Form 540A you prepared for the Escobedo household. What is the amount on Form 540A, Line 91?

A.

$1,647.

B. $2,051.

C. $1,890.

D. $1,750.

31. For California, if you had qualifying expenses for care that was provided in 2008 that you paid in 2009, you may be able to increase your credit for 2009.

True False

Andy Brown (SSN 572-03-3300) lives with Samantha Garcia (SSN 578-58-8471) with whom he has three children. Andy and Samantha are not married.

The children are:

| Name: | SSN | DOB |

| Aaron Brown | 610-13-6440 | 8-16-1999 |

| Anna Brown | 604-13-6462 | 3-10-1998 |

| Leticia Brown | 611-12-4011 | 4-18-1996 |

Andy's Income:

| Bank interest income | $19.00 |

| Unemployment compensation | $220.00 |

Andy and Samantha agreed that she would take care of the kids and that Andy would support the family.

Forms you need to complete tax return: California Form 540A (you may also need IRS Form 1040A).

Get all their basic information from the following W2, including income information.

32. Look at the Form 540A you prepared for the Brown family. What is the amount on Form 540A, Line 70?

A. $1,270.

B. $976.

C. $434.

D. $1,026.

33. Look at the Form 540A you prepared for Brown family. What is the amount on Form 540A, Line 115?

A. $0.

B. $1,005.

C. $571.

D. $1,125.

Complete Form 540 (you may also need Form 1040).

Maria's family goes to school.

| * Maria's daughter, Leticia Gonzalez, paid $2,000 for tuition fees for herself to attend a qualifying community college full time. |

| * Her son, Raul Gonzalez, also paid $1,800 tuition fees to attend the same community college full time. |

| * Her children are her dependents and she claims them on her return. |

| * Leticia's SSN is 555-10-7500 and her date of birth January 20, 1991. |

| * Raul's SSN is 555-10-7501 and his date of birth February 20, 1992. |

| * This is the first year they attend college and they both are enrolled to pursue their degrees. |

Maria is a not married. She provides a home for her son and daughter. She is the only one that can claim them.

Maria provided for her family by herself. No one can claim her or her children as dependents. She paid rent all year for a of $9,600.00.

Maria received a tax-free scholarship from Women for Education Inc. The amount she received was $3,000 towards her studies to get a nursing degree at the same community college her kids attend. All the money was for enrollment and attendance as specified by the school.

Get all basic information from the following W2, including income information. Everything is current.

34. Look at the Form 540 you prepared for Maria Escobedo. What is the amount on Form 540, Line 64?

A. $696.

B. $335.

C. $0.

D. $641.

35. Look at the Form 540 you prepared for Maria Escobedo. What is the amount on Form 540, Line 94?

A. $140.

B. $0.

C. $195.

D. $315.

36. For California, if you received a distribution from a Coverall ESA, report the entire amount of the distribution on line 21f of Schedule CA (540).

True False

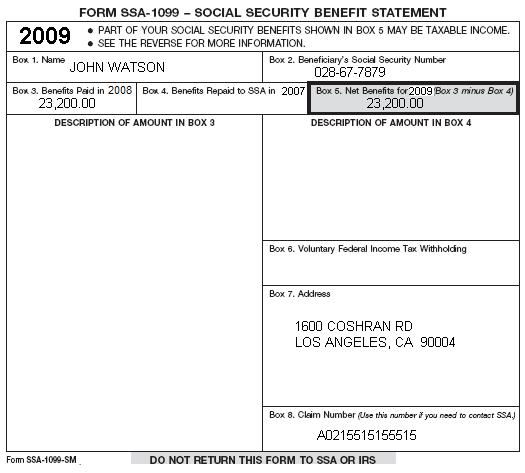

Prepare a Form 540A for John Watson (you may also need IRS Form 1040A).

Address information on W2 is current. Mr. Watson received Social Security benefits.

Mr. Watson paid $ 6,000 rent for all of 2009.

Mr. Watson's date of birth is April 6, 1942.

Get all basic information from form, including income information.

|

|

|

37. Look at the Form 540A you prepared for John Watson. What is the amount on Form 540A, Line 14c?

A. $11,600.

B. $1,664.

C. $23,200.

D.

$18,391.

38. Look at the Form 540A you prepared for John Watson. What is the amount on Form 540A, line 70?

A. $70.

B. $28.

C.

$66

D. None of the above.

39. For California, enter the amount of U.S. social security benefits or equivalent tier 1 railroad retirement benefits reported on federal Form 1040a, line 14b or Form 1040, line 20b because they are taxable for California.

True False

40. As with federal, lottery losses are deductible for California up to lottery winnings.

True False

![]()