|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Tax School Homepage | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

California Tax Topic 1 - California Tax Basics

Student Instructions: Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online Most forms are in Adobe Acrobat PDF format.

Material needed to complete the questions to this assignment:You will need California 540/540A Booklet to complete this topic. For answers to your California tax questions you can use the different sections in the state forms as index. You many also need IRS Publication 17 and other IRS information. 1. Unemployment compensation is taxable for California. True False 2. The penalty is ____ on the tax not paid when due plus 1/2% for each month, or part of a month, the tax remains unpaid.

A.

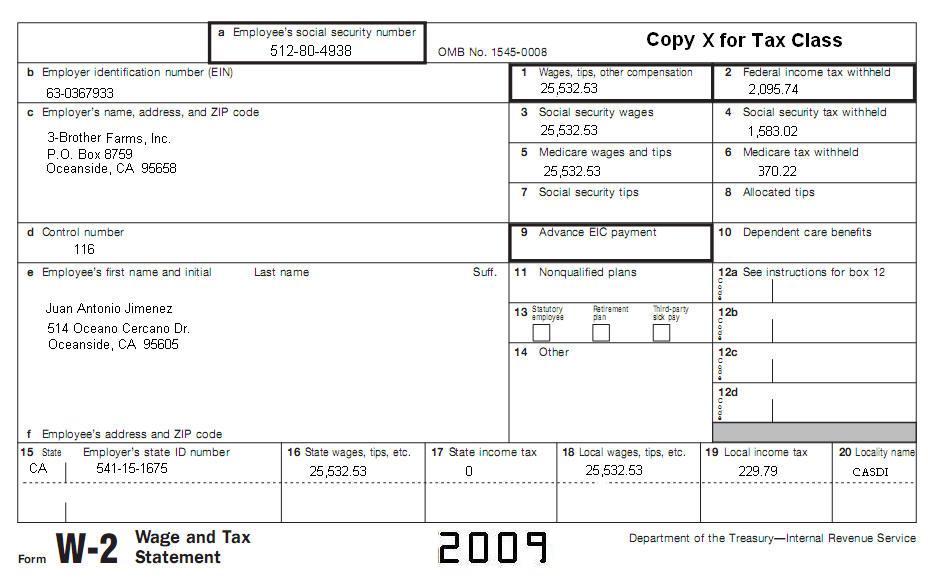

1%. Tax Return 1 Prepare a California Form 540A return for Juan Antonio and Maria Jimenez. Get all their basic information from the following W2, including income information. You may also need Federal IRS Form 1040A. Juan is married to Maria Jimenez (SSN 512-80-8221 Maria's). Neither Juan nor Maria can be claimed as dependents on another return. They have a daughter and her name is: Andrea Jimenez (D.O.B. born 9-16-1991 and ITIN* 900-56-9161). Andrea lived with them for all of the 2008 tax year. Juan and Maria are the only ones providing support for Andrea for all of 2009. 3. Look at the Form 540A you prepared for Juan and Maria. What is the amount on Form 540A, Line 18?

A.

$7,274. 4. Look at the Form 540A you prepared for Juan and Maria. What is the amount on Form 540A, Line 19?

A.

$21,896. 5. For California, you are considered single if A.

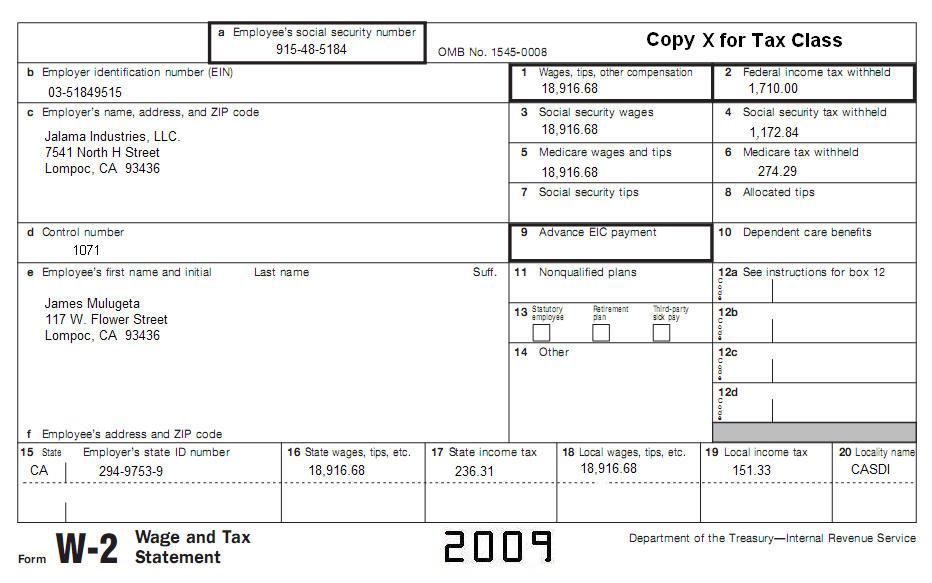

You were never married or an RDP. Tax Return 2 Get all their basic information from the following W2, including income information. Complete a Form 540A. Use the following attached W2, information on W2 is current.

Debra has her niece Tsehay Adaba, (D.O.B. born 8-23-2003 and SSN 610-04-1090) whom she would like to claim on her tax return. Tsehey didn't live with Debra. However, Debra provided more than half of Tsehay's support. No one else can claim Tsehay or Debra as a dependent. 6. Look at the Form 540A you prepared for Debra Libanos. What is the amount on Form 540A, Line 31?

A.

$58. 7. Look at the Form 540A you prepared for Debra Libanos. What is the amount on Form 540A, Line 47?

A.

$196. 8. For California, the first year you claim the blind exemption, attach a doctor's statement to the back of Form 540 or 540A indicating you or your spouse/RDP are visually impaired. True False Tax Return 3 Prepare a California Form 540A return for James Mulugeta. James, age 33, and is not married and has no children. He received the following in 2009:

James owed Sears & Roebuck (Department store) $1,600. He fell behind on the bill and could not pay. Sears offered to cancel $700 of the debt to have James settle the debt. James paid only $900 and the rest was forgiven. He paid rent at a government owned building that is exempt from tax. Get all their basic information from the following W2, including income information.

9. Look at the Form 540A you prepared for James Mulugeta. What is the amount on Form 540A, Line 13? A.

$18,917. 10. Look at the Form 540A you prepared for James Mulugeta. What is the amount on Form 540A, Line 19? A.

$16,778. 11. Round cents to the nearest whole dollar. For example, round $50.50 up to $51 or round $25.49 down to $25. If you do not round, FTB (California) will A.

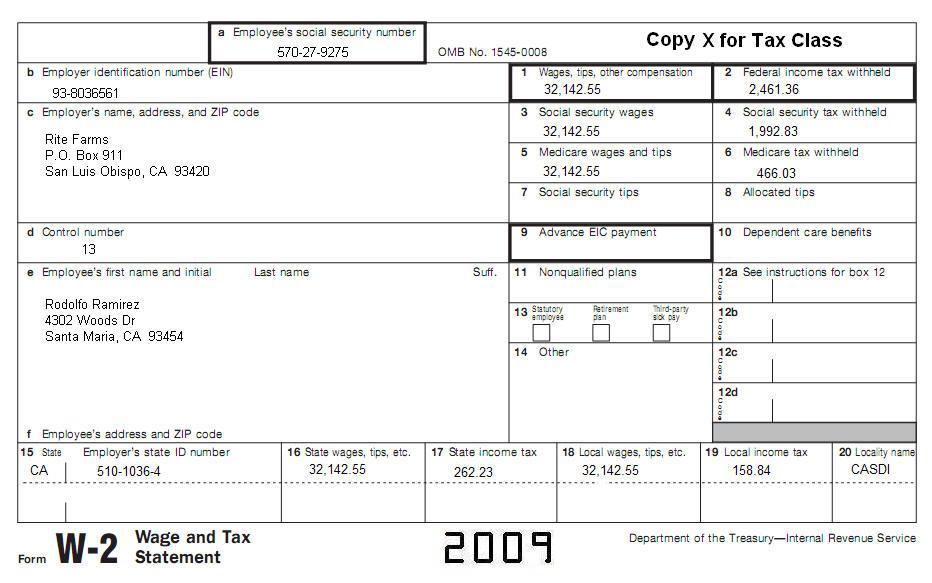

Process your return more quickly and accurately. Tax Return 4 Use California 540/540A Booklet to complete this topic. You may also need to refer to IRS publications (such as Instructions for Form 1040). Prepare a Federal Schedule A (Form 1040) return for Rodolfo Ramirez with the following deductible expenses.

Prepare a California Form 540 and Schedule CA return for Rodolfo Ramirez. Get all their basic information from the following W2, including income information.

They did not

itemize in 2008. Have your return prepared and ready to answer the questions. 12. Look at the Form 540 you prepared for Rodolfo and Anna Ramirez. What is the amount on Form 540, Line 18?

A.

$262. 13. Look at the Form 540 you prepared for Rodolfo and Anna Ramirez. What is the amount on Form 540, Line 31?

A.

$298. 14. For California, if married or an RDP and filing separate returns, you and your spouse/RDP must either both itemize your deductions or both must take the standard deduction.

True False

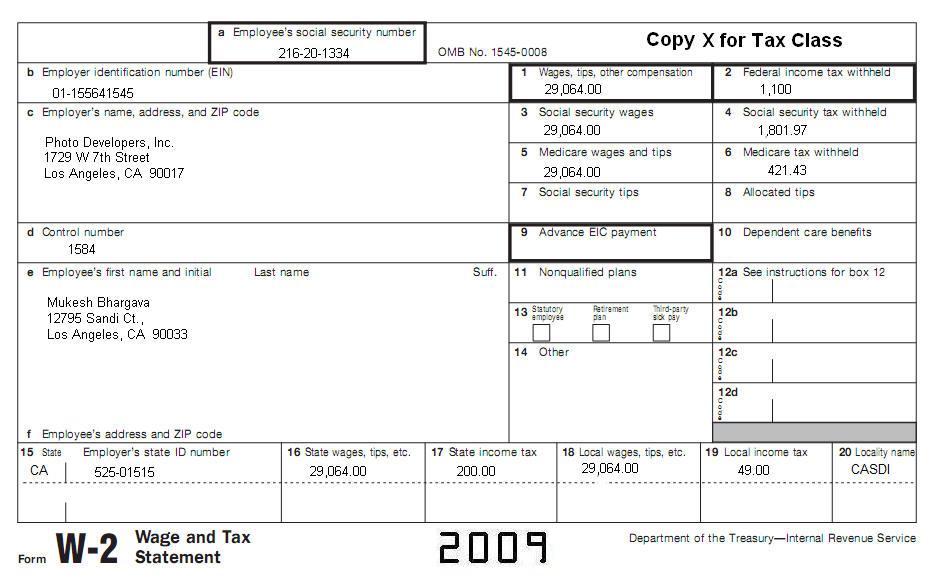

Tax Return 5 Complete a Schedule A for Mukesh (216-20-1334) and Sarita Bhargava (342-06-1213). Their property was exempt from property tax. Sarita did not work. They had the following medical expenses for the year:

Prepare a California Form 540 and Schedule CA for Mukesh Bhargava. Use the Schedule A that you filled out to complete the return.

15. Look at the Form 540 you prepared for Mukesh and Sarita. What is the amount on Form 540, Line 18?

A.

$9,530. 16. Look at the Form 540 you prepared for Mukesh and Sarita. What is the amount on Form 540, Line 31?

A.

$131. 17. For California, RDPs have the same legal benefits, protections, and responsibilities as married couples unless otherwise specified. True False

Tax Return 6 Complete a Schedule A, Form 540 and Schedule CA. Use the following expenses:

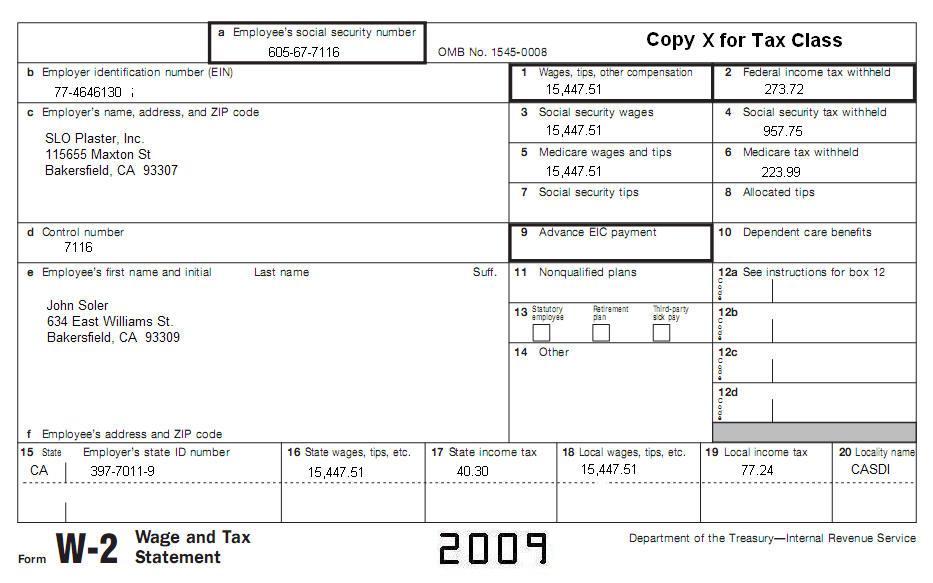

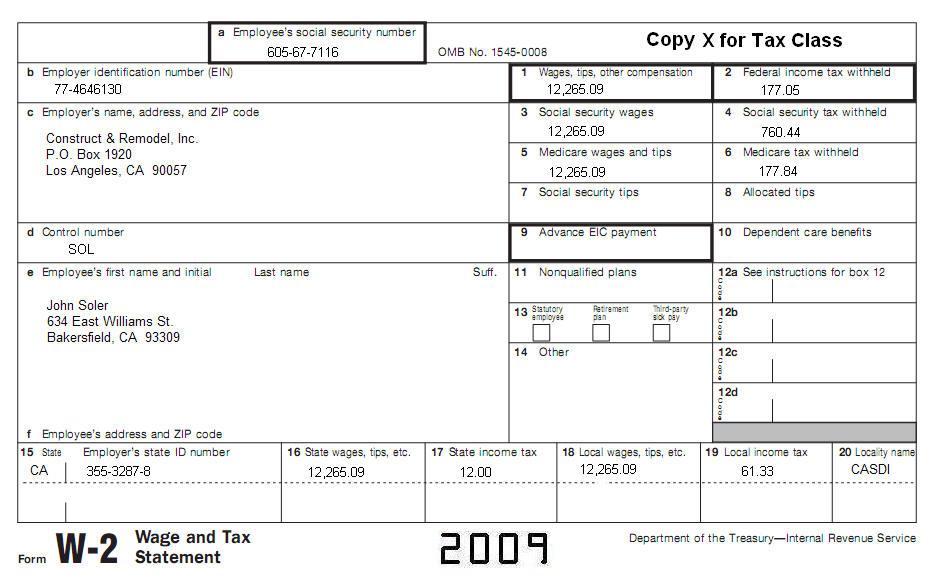

John is not married and has no children or other dependents. Use W2's that are included; all information is current.

18. Look at the Form 540 you prepared for John Soler. What is the amount on Form 540, Line 19?

A.

$3,637. 19. Look at the Form 540 you prepared for John Soler. What is the amount on Form 540, Line 31?

A.

$430. 20. If you did not itemize deductions on your federal tax return but still itemize deductions on your California tax return, first complete federal Schedule A (Form 1040) and then complete Schedule CA (Form 540). True False Tax Return 7

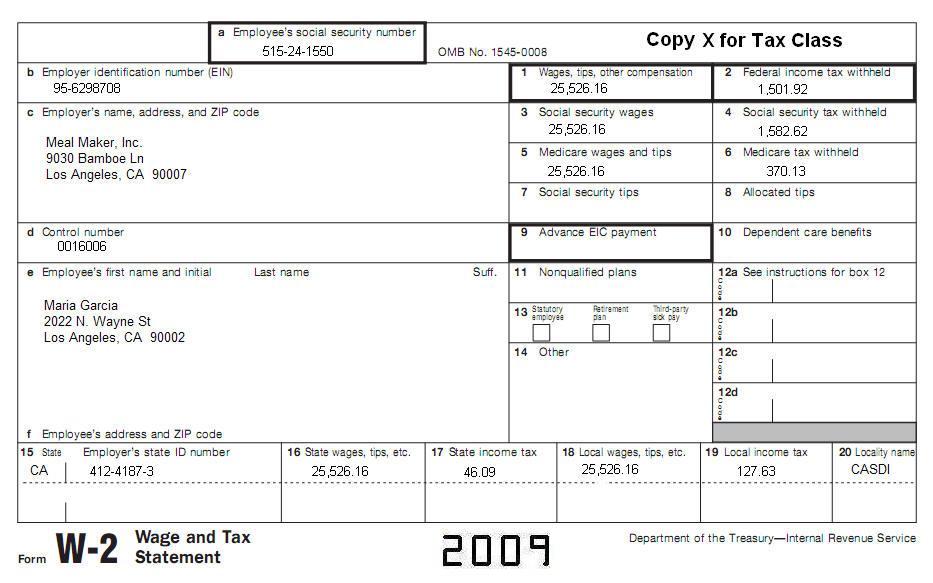

Complete a Schedule A, Form 540 and Schedule CA for Maria Garcia (Age 24).

She also has the following payments in 2008.

Maria is not married and she has no children or other dependents. Maria paid her mortgage interest for her home to an individual (not to a bank):

Maria won $1,500 as a result of her bets place at a casino. Her total expenses for betting expenses were a total of $1,768. Get all basic information from the following W2, including income information.

21. Look at the Form 540 you prepared for Maria. What is the amount on Form 540, Line 18?

A.

$11,217. 22. Look at the Form 540 you prepared for Maria. What is the amount on Form 540, Line 31?

A.

$290. 23. Your California deduction for investment interest may be different from your federal deduction. Use __________ to figure the amount to enter on line 41.

A.

FTB 3526. Tax Return 8

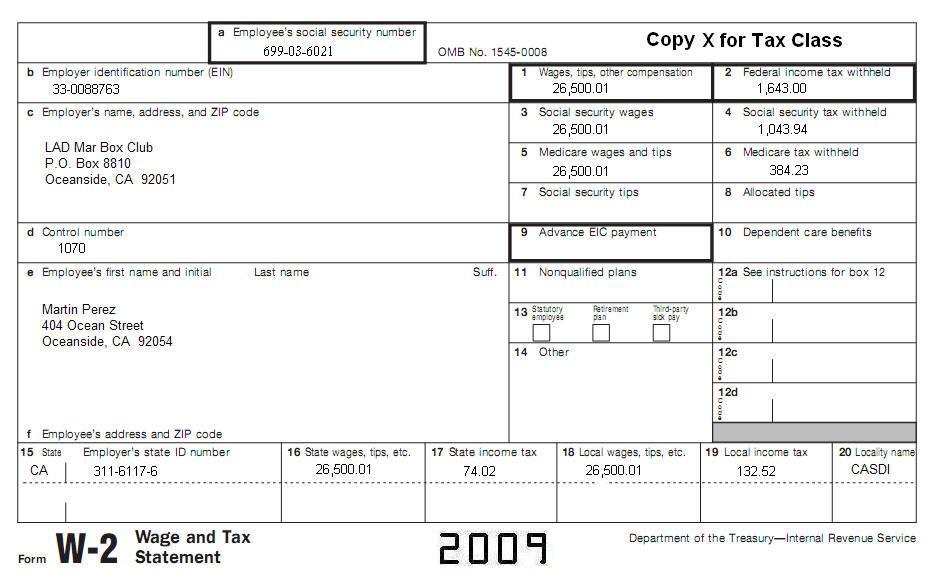

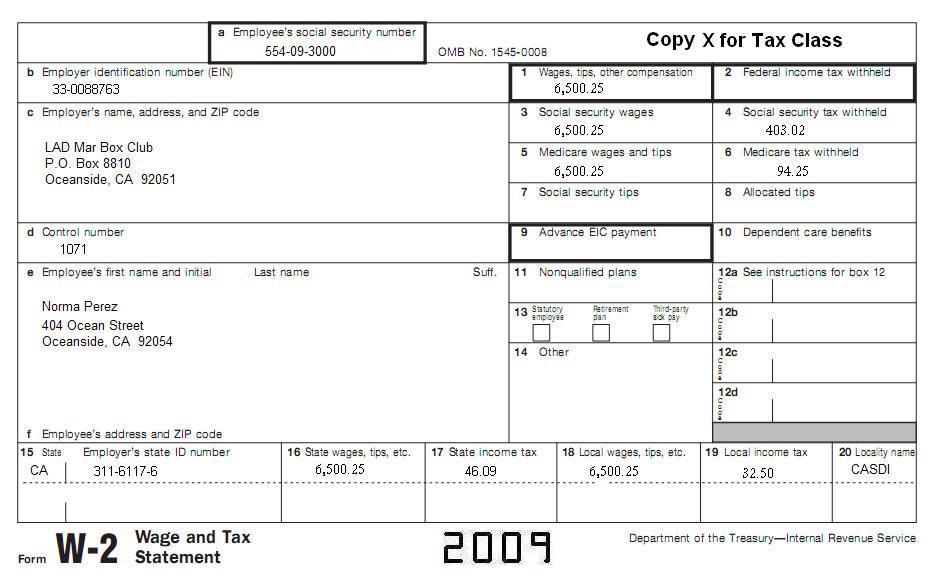

Complete a Form 8283, Schedule A, Form 540 and Schedule CA for Martin Perez (699-03-6021) and Norma Perez (554-09-3000). Martin claims his parents on his return. Paul Perez (SSN 580-16-6733). Lucy Perez (SSN 580-16-7683) . They had the following expenses for the 2008 tax year:

November 15, 2009, they donated the following items to Goodwill (1530 San Isidro Blvd, San Isidro, CA):

Additionally, they had the following in 2009:

Martin and Norma paid $ 14,400 in rent for the whole year. The property they rented from is exempt from tax.

24. Look at the Form 540 you prepared for Martin and Norma. What is the amount on Form 540, Line 18?

A.

$11,607. 25. Look at the Form 540 you prepared for Martin and Norma. What is the amount on Form 540, Line 40?

A.

$120. 26. If deducting a prior year charitable contribution carryover, and the California carryover is larger than the federal carryover, enter the additional amount as a positive number on line 41 of Schedule CA (Form 540). True False Tax Return 9 Complete a tax return for Joseph Cuevas and Sara S. Cuevas (her SSN: 670-82-6160). Their Children who lived with them all year are:

Joseph was the only person who worked in the family. Complete a California Form 540A (you may also need IRS Form 1040A) using the following W-2. All information on W-2 is current.

27. Look at the Form 540A you prepared for Joseph and Sara Cuevas. What is the amount on Form 540A, Line 18?

A.

$7,274. 28. Look at the Form 540A you prepared for Jose and Sara Cuevas. What is the amount on Form 540A, Line 70?

A.

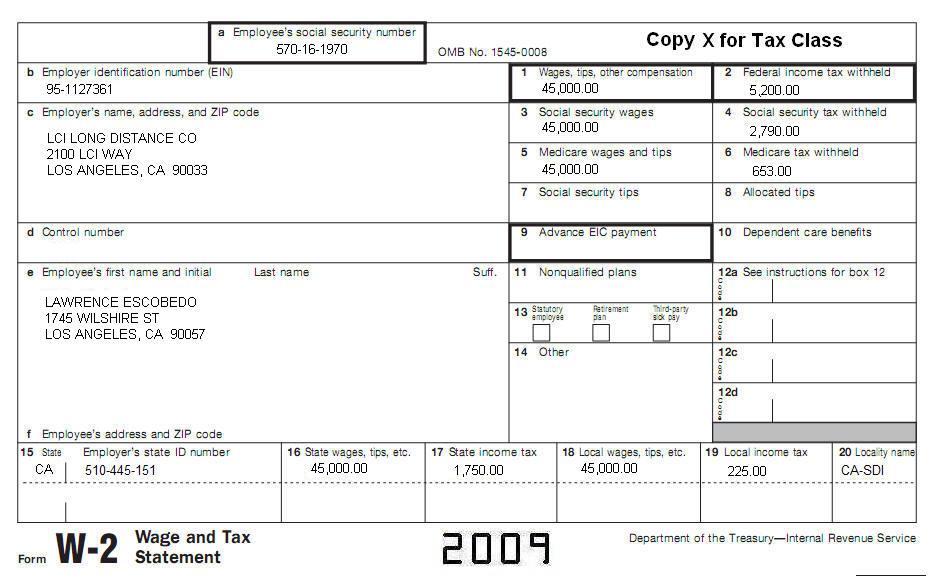

$0. Tax Return 10Complete a tax return for Lawrence Escobedo (570-16-1970) and Theresa Escobedo (502-39-4055). They got married December 31, 2009. Their Children who lived with them all year are:

Only Lawrence worked. Theresa did not work. Theresa attended school full time for 7 months in 2009. The school was not an on-the-job training course, correspondence school, night, or internet school. When she was in school they were taken care of by Happy Child, inc.:

In addition to their earnings, they had the following:

Complete California Form 540A and Form FTB 3506 (you may also need IRS Form 1040A). Use the following attached W-2. All information on W-2 is current.

29. Look at the Form 540A you prepared for the Escobedo household. What is the amount on Form 540A, Line 78?

A.

$700. 30. Look at the Form 540A you prepared for the Escobedo household. What is the amount on Form 540A, Line 91?

A.

$1,647. 31. For California, if you had qualifying expenses for care that was provided in 2008 that you paid in 2009, you may be able to increase your credit for 2009. True False Tax Return 11Andy Brown (SSN 572-03-3300) lives with Samantha Garcia (SSN 578-58-8471) with whom he has three children. Andy and Samantha are not married. The children are:

Andy's Income:

Andy and Samantha agreed that she would take care of the kids and that Andy would support the family. Forms you need to complete tax return: California Form 540A (you may also need IRS Form 1040A). Get all their basic information from the following W2, including income information.

32. Look at the Form 540A you prepared for the Brown family. What is the amount on Form 540A, Line 70?

A.

$1,270. 33. Look at the Form 540A you prepared for Brown family. What is the amount on Form 540A, Line 115?

A.

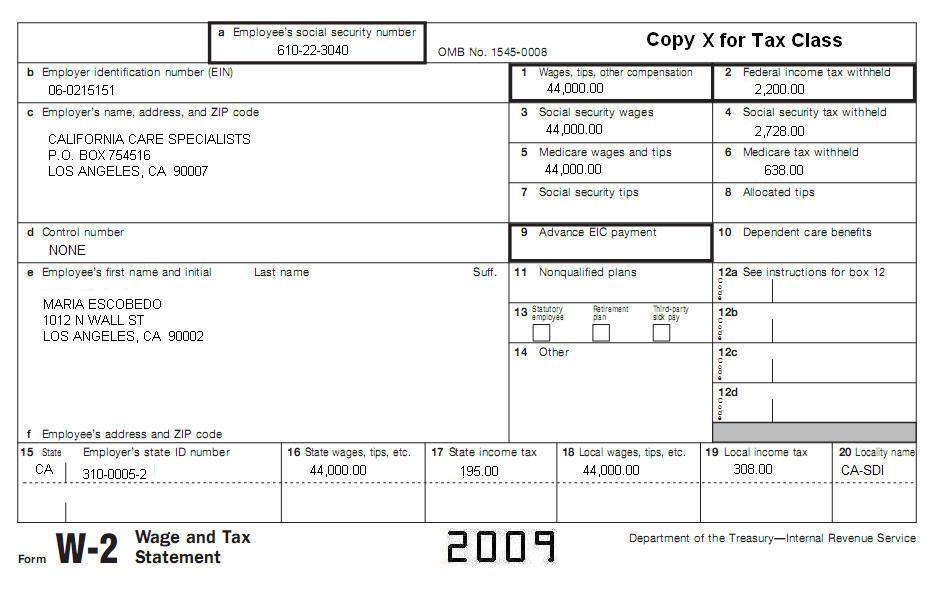

$0. Tax Return 12Complete Form 540 (you may also need Form 1040). Maria's family goes to school.

Maria is a not married. She provides a home for her son and daughter. She is the only one that can claim them. Maria provided for her family by herself. No one can claim her or her children as dependents. She paid rent all year for a of $9,600.00. Maria received a tax-free scholarship from Women for Education Inc. The amount she received was $3,000 towards her studies to get a nursing degree at the same community college her kids attend. All the money was for enrollment and attendance as specified by the school. Get all basic information from the following W2, including income information. Everything is current.

34. Look at the Form 540 you prepared for Maria Escobedo. What is the amount on Form 540, Line 64?

A.

$696. 35. Look at the Form 540 you prepared for Maria Escobedo. What is the amount on Form 540, Line 94?

A.

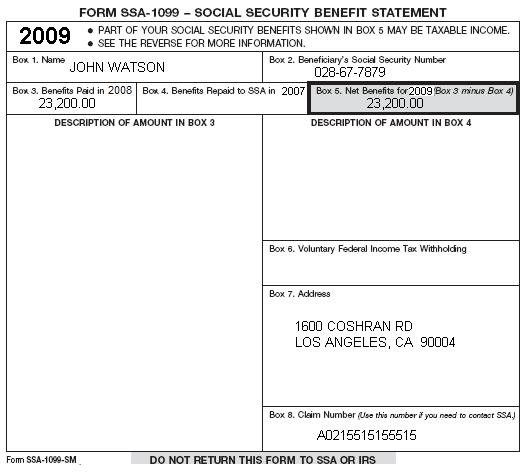

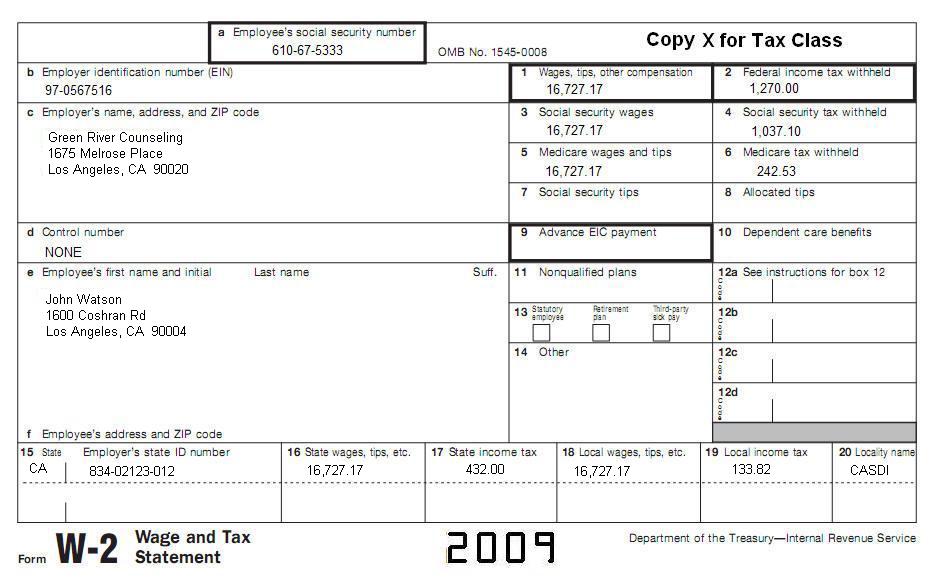

$140. 36. For California, if you received a distribution from a Coverall ESA, report the entire amount of the distribution on line 21f of Schedule CA (540). True False Tax Return 13Prepare a Form 540A for John Watson (you may also need IRS Form 1040A). Address information on W2 is current. Mr. Watson received Social Security benefits. Mr. Watson paid $ 6,000 rent for all of 2009. Mr. Watson's date of birth is April 6, 1942. Get all basic information from form, including income information.

37. Look at the Form 540A you prepared for John Watson. What is the amount on Form 540A, Line 14c?

A.

$11,600. 38. Look at the Form 540A you prepared for John Watson. What is the amount on Form 540A, line 70?

A.

$70. 39. For California, enter the amount of U.S. social security benefits or equivalent tier 1 railroad retirement benefits reported on federal Form 1040a, line 14b or Form 1040, line 20b because they are taxable for California. True False 40. As with federal, lottery losses are deductible for California up to lottery winnings. True False

41. For California, head of household is for unmarried individuals and certain married individuals or RDPs living apart who provide a home for a specified relative. Which of the following disqualifies you to use the head of household filing status. A.

You paid more than half the cost of keeping up your home for the year in

2009. 42. For California, you may be able to file as head of household if your child lived with you and you lived with your spouse/RDP during the entire last six months of 2009. True False 43. Use the same filing status for California that you used for your federal income tax return, unless you A.

Itemize your deductions. 44. For a child to qualify as your foster child for head of household purpose, the child must A.

Be placed with you by an authorized placement agency. 45. You must use the same filing status for California that you used for your federal income tax return unless in cases when a spouse is a member of the Armed forces or a nonresident for the entire year and no income from California source. According to federal law, if you are living together in a common law marriage that is recognized in the state where you now live or in the state where the common law marriage began you are considered married for tax purposes. You are considered married for California purposes if A.

You were married as of December 31, 2009, even if you did not live with

your spouse/RDP at the end of 2009. 46. You normally must use the same filing status for California that you used for your federal income tax return. However, if you filed a joint return for federal you may file separately for California, if either spouse was: A.

An active member of the United State armed forces or any auxiliary

military branch during 2009. 47. If you file a joint return for federal, you may file separately for California if either spouse was a nonresident for the entire year and had no income from California sources during 2009. However, if the spouse earning the California source income is domiciled in a community property state, community income will be split equally between the spouses. Therefore, they will not qualify for the nonresident spouse exception because A.

Both spouses were domiciled out of California. 48. For California, you are considered to be age 65 on December 31, 2009 if your 65 birthday is on (or before)

A.

December 31, 2009. 49. Fill in the circle on line 6 of Form 540 or 540A, if someone else can claim you or your spouse/RDP as a dependent on his or her tax return only if he or she will claim you. True False 50. Use your exemption credits to reduce your tax. Your exemption credits will be limited if you are Married filing jointly and your federal adjusted gross income (AGI) (540 line 13, 540A line 13) is more than A.

$244,785. 51. Raphael is filing Single for 2009. He has no dependents. The exemption amount that he claims from California may be limited. His total earnings from work (federal adjusted gross income) were $159,000 for the whole year. Figure his exemption amount for 2009.

A. $3,500 52. What are the California exemption amounts for 2009?

A. Personal and spousal exemptions $98. 53. Jeremy thinks that his exemption credits will be limited. He qualifies for the Head of household filing status. His federal adjusted gross income (540A line 12b) is $180,000. Over what amount does Jeremy need to make to even consider calculating his California exemption credit limitation worksheets? A.

$100,000. 54. Marie has 4 children that qualify as her dependents. No one can claim her or her children on someone else's return. Her total earning from work are $39,000. What is the total exemption amount that Marie will claim on her California return?

A. $99 55. In tax year 2009, if you are head of household and you would like to qualify for renter's credit, you would not qualify if your income is over what amount?

A. $34,412. 56. What is the 2009 exemption amount for California?

A.

$98 Personal exemption. 57. What is the California standard deduction amount for a single dependent who earned $4,000 from her job?

A. $

3,637 58. For California, if you and your spouse/RDP paid estimated taxes but are now filing separate returns, A.

Either you or your spouse/RDP may claim the entire amount paid. 59. You may make contributions to the California Seniors Special Fund or make other voluntary contributions of $1 or more in whole dollar amounts. The amount you contribute either reduces your overpaid tax or increases your tax due. You may contribute only to the funds listed and A.

Claim the amount you contributed as an itemize deductions expense. 60. For California, you may be entitled to claim a credit for excess State Disability Insurance (SDI) or Voluntary Plan Disability Insurance (VPDI) only if you A.

Had two or more California employers during 2009. 61. For California, this filing status is for unmarried individuals and certain married individuals living apart (considered unmarried) who provide a home for which you paid more than half of the upkeep for certain other persons. The qualifying person lived in your home for more than half of the year and you were not a nonresident alien at any time during the tax year 2009. You are entitled to use the A.

Single filing status. 62. If you were 65 of age or older by December 31, 2009, you should claim an additional exemption credit on line 9 Form 540A. For exemption purposes, you are considered to be 65 on December 31, 2009 if A.

Your 65th birthday is on January 1, 2010. 63. What is the California standard deduction amount for a single dependent who earned $3,100 from his job?

A.

$3,637 64. Generally you will not make any adjustments on line 14f (Form 540A). You should not make an adjustment solely because the pension was earned in another state. Federal and State laws require California residents to pay state income tax on all taxable pensions, regardless of where they were earned. True False 65. Registered Domestic Partners (RDP) who file a California tax return A.

Can file as married/RDP filing jointly. 66. California taxes interest earned from: A.

United States savings bonds. 67. Greg and Mona (file MFJ) won $10,000 from the California Lottery in 2009. Their wages from work include $12,000 from Mona's job and $18,000 from Greg's job. What is their total income that they will have to pay taxes on? A.

$30,000 just wages. 68. Allan received the following income in tax year 2009.

How much will he report on his California state return as taxable income? A.

$19,000. 69. Enter the amount of any state income tax refund shown on your federal form 1040, line 10. If you filed Form 1040A or Form 1040EZ in 2008, enter 0. True False 70. Enter the total of any employment compensation and/or paid family leave insurance benefits reported on federal Form (s) 1099-G and show on your federal return. These types of income are taxed by California. True False 71. Certain mutual funds are qualified to pay "exempt-interest dividends" if at least 50% of their assets consists of tax-exempt government obligations. True False 72. Same-sex married couples (SSMCs) or RDPs who file a California tax return as married/RDP filing jointly and have no SSMC adjustments or RDP adjustment between federal and California, combine their individual AGIs from their federal tax returns filed with the Internal Revenue Service (IRS). SSMC adjustments and RDP adjustments include A.

Dependent care assistance. 73. If there are no differences between your federal and California income or deductions, complete Schedule CA (540). True False 74. Do not make an adjustment to California income if you received A.

Sick pay received under the Federal Insurance Contributions Act and

Railroad Retirement Act. 75. California taxes long and short term capital gains as regular income. No special rate for long term capital gains exists. However, the California basis of assets may be different from federal basis due to differences between California and federal laws. If there are differences, calculate the amount on A.

Schedule G-1. 76. Adjustments to federal business income or loss you reported in column A generally are necessary because of the difference between California and federal law relating to depreciation methods, special credits, and accelerated write-offs. True False 77. For California, you may have to pay an additional tax if you received a taxable distribution from a qualified retirement plan before reaching age 59 1/2 and it was not rolled over into another qualified plan. True False 78. Like as for federal, you include as California taxable income grants paid to low-income individuals to construct or retrofit buildings to make them more energy efficient. True False 79. If you receive U.S. Social Security benefits or equivalent Tier 1 railroad retirement benefits, you need to complete the worksheet to calculate the California taxable amount. True False 80. This type of interest is taxed by California A.

Interest from Federal National Mortgage Association (Fannie Mae) bonds. 81. For California, decide whether to itemize your charitable contributions, medical expenses, interest paid, taxes, etc., or take the standard deduction. Your California income tax will be less if you take

A.

Your California itemized deductions. 82. Lucy will itemize her deductions for tax year 2009. She was single for all of 2009. Her total adjusted gross income was $150,000. Her total federal itemized deductions were $11,978 of which are the following amounts from federal Schedule A: line 5: $668.00, line 6: $950, line 8: $500, and line 14: $9,860. What are her total itemize deductions allowed for California?

A.

$11,978. 83. Miriam and her husband decide to itemize in tax year 2009. Their total deductible itemized deductions totaled to $8,500. Their Federal standard deduction for MFJ is $10,900 but their California standard deduction is only $7,384. For them it is a better benefit to claim the standard deduction for federal and

A.

Due to the conflict, not do a return for California at all. 84. Jeff, 27, is a single man who earned $24,000 in tax year 2009. His itemize deductions amounts are the following: $346 in General sales tax calculation (based on his living LA county), $200 deductible DMV motor vehicle tax. He had a total of $5,654 in medical expenses and after the limit he can deduct only $3,854 in medical expenses. A total of $4,400 in itemize deductions. Jeff decides that its best for him to itemize his deductions on his California return but not on federal. What should he do?

A.

Complete a federal Schedule A to calculate the results to enter on his

Schedule CA (540). 85. If you did not itemize your deductions on your federal income tax return but will itemize your deductions for your California Form 540/540A, first complete a sample federal Schedule A.

True False 86. Toby, age 25, is a single man. He will itemize his deductions for tax year 2009. His total adjusted gross income was $199,000. He takes care of his nephew and provided all the support for him and meets all the tests to qualify for the head of household filing status. His total itemized deductions are $27,591. The following amounts are from federal Schedule A: line 5: $1,221.00, line 6: $950, line 8: $500, line 10: $10,000,line 13: $450, line 14: $10,450, line 19: $3,000, and line 26: $1,020. What are his total itemize deductions allowed for California?

A.

$27,591. 87. What is the California Standard deduction amount for a dependent who earned $4,000 from her job.

A.

$4,300. 88. If you received a tax-free HSA distribution for qualified medical expenses, enter the qualified expenses paid that exceed 7.5% of federal AGI as an adjustment to your California itemized deductions. True False 89. If you receive a tax-free HSA distribution for qualified medical expenses, enter the qualified expense paid that exceed 7.5% of federal AGI as an adjustment to itemized deductions. To determine the amount of the California itemized deduction adjustment

A. Calculate the medical expense deduction for California. 90. Federal law allows a deduction for contributions to an HSA account. California conforms to this provision. True False 91. You may qualify to claim the 2009 credit for child and dependent care expenses if you (and your spouse/RDP) paid someone in California to care for your child or other qualifying person while you worked or looked for employment. True False 92. Care must be provided in California for one or more qualifying persons. You paid for care so you (and your spouse/RDP) could work or look for work. If you did not find a job and have no earned income, you still qualify for the credit. True False 93. Enter each qualifying person's SSN. Verify that the name and SSN match the qualifying person's social security card to avoid the reduction or disallowance of your credit. True False 94. There are differences between California and federal laws regarding the Child Care and Dependent Care Expenses credit. For example, California allows this credit only for care provided in California. In addition, the California credit is a percentage of the federal credit as modified by the California law. Furthermore, with the California credit

A. Federal adjusted gross income must be $100,000 or less to qualify for

the California credit contrary to federal with no AGI limit. 95. Tom and Rose both worked full-time and claim Naomi, their daughter, as a dependent. They paid $500 per month to have Juanita take care of Naomi while they were at work. Juanita gets paid on the 1st and the 15th of each month and she has been taking care of Naomi for about 5 years now. Naomi turned 13 years old June 31, 2009. Child care payments were a total of $6,000 for all of 2009. What was the amount of child care payments that they are allowed to count as qualified child care for Naomi.

A. $6,000. 96. Jorge and Lucy Duran are married and keep up a home for their two pre-school children. In tax year 2009, they claimed their children as dependents. Jorge earned $15,200 and Lucy earned $5,100. They paid $2,000 for each child in work related child care expenses. What is their credit for California?

A. $-0- 97. What is the percentage of the federal Child and Dependent Expenses Care credit that is allowed for California for taxpayers who earned less than $40,000?

A. 42% 98. You received $2,000 cash under your employer's dependent care plan for 2009. The $2,000 is shown in box 10 of your Form W-2. You incurred $900 of qualified expenses in 2009 for care of your 3-year-old dependent child. Count as employer paid benefits...

A. $0 99. Dependent care benefits are

A. Amounts an employer paid directly to you or to your care provider for

the care of your qualifying person, while you worked. 100. If, in the same month, both you and your spouse/RDP qualified as either full-time students or disabled,

A. Both are treated as having earned income of $250 (0r $500 for two

children) ion the month. 101. Generally, if you are married or an RDP, you must file a joint return to claim the child and dependent care expenses credit, unless

A. You lived apart from your spouse/RDP at all times during the last six

months of 2009. 102. The following is a true statement for nonresidents and part-year residents.

A. Part-year and non-residents must complete Schedule CA(540) to claim

their credit. 103. California taxes the state income tax refund received in 2009. True False 104. Enter on line 39 of Schedule CA (Form 540) state, local, foreign income taxes, and general sales tax. True False 105. FTB allows taxpayers to elect to claim either local general sales and use taxes or state and local income taxes as an itemized deduction. True False 106. FTB allows a deduction for foreign income taxes as an itemized deduction amount. True False 107. If you did not itemize deductions on your federal tax return, you cannot itemize deductions for California. True False 108. Federal estate tax paid on income in respect of decedent is not deductible for California. True False 109. Tax paid on generation skipping transfers is deductible under California law. True False 110. Your California interest expense deduction may be different from your federal deduction. A deduction is allowed for interest paid on any loan or financed indebtedness from a utility company to purchase energy efficient equipment and products for California residences. True False 111. Taxpayers are allowed a tax deduction for interest paid or incurred on a public utility company financed loan that is used to purchase and install energy efficient equipment or products, including zone-heating products for a qualified residence located in California. Federal law has an equivalent deduction. True False 112. You may claim expenses related to producing income taxed by California law but not taxed under federal law by entering the amount as a positive number on line 41. True False 113. If you took the deduction for private mortgage insurance (PMI) on Schedule A (Form 1040), line 13, then subtract the amount on line 41 of Schedule CA (540). True False 114. If you reduced your federal mortgage interest deduction by the amount of your mortgage interest credit (from federal Form 8396, Mortgage Interest Credit), A.

Increase your California itemized deductions by the same amount. 115. California conforms to federal law regarding student loan interest deductions except for a spouse/RDP of a non-California domiciled military taxpayer residing in a community property state. True False 116. During 2009, you paid $800 interest on a qualified student loan. Your 2009 MAGI is $135,000 and you are filing a joint return. For California, your student loan interest adjustment is

A.

$800. 117. During 2008, you paid $2,750 interest on a qualified student loan. Your 2008 MAGI is $135,000 and you are filing a joint return. For California, your student loan interest adjustment is

A.

$832. 118. Your California deduction may be different from your federal deduction. California limits the amount of your charitable qualified contribution deduction to _____ of your federal adjusted gross income.

A. 20% 119. If deducting a charitable contribution carryover of appreciated stock donated to a private operating foundation prior to 01/01/2002 and the fair market value allowed for federal purposes is larger than the basis allowed for California purposes, enter the difference as a positive number on line 41 of Schedule CA (Form 540). True False 120. Figure the difference between the amount allowed for California charitable contribution deductions using federal law and the amount allowed using California law and enter the difference as a negative number. True False

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Tax School Homepage |