|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Tax School Homepage | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Tax Topic 21 - Deducting Business Expenses

In this tax topic you will learn how deduct common business expenses and what is and is not deductible. In this tax lesson you'll also become aware of the specific expenses that are deductible. Business expenses are the costs of carrying on a business and they are normally deductible as long as the business is operated to make a profit. Here, you will learn what you can deduct, and how much to deduct when there are limits and when you can deduct the business expenses. In addition, you will encounter information on not-for-profit activities and the limitations imposed on them. Student Instructions:Print this page, work on the questions and then submit test by mailing the answer sheet or by completing quiz online. Instructions to submit quiz online successfully: Step-by-Step check list Answer Sheet Quiz Online Most forms are in Adobe Acrobat PDF format.

Material needed to complete the sections in this assignment:Please use IRS Publication 535 to complete this topic. Use the appropriate forms to complete a tax return for Xela Holling: Form 1040 (You may also need Form 1040 Instructions), Schedule A, Schedule C, Schedule SE, for this topic. Xela Holling enjoys making masks. She learned to make masks two years ago in November at the "Dia De Los Muertos" celebration while visiting her parent's home town Chichicastenango, in Guatemala. She fell in love with the different varieties of masks that she saw people wearing for the celebration. As a result she started making her own masks once she was back in the U.S. She would dedicate her weekends for her passion. Some weekends she is not able to dedicate it to her mask making work because she has to work overtime at her regular job. She does make money from the masks as word got around that she creates such beautiful work. Although her art is suitable for wear, most of her customers buy it for wall decoration and display. Once in a while she rents a small space at the local flea-market to display her art and sometimes even at the local museum and auctions. As a result of this, she makes numerous sales. She also displays her work online. She never imagined ever making money from something that she does not consider work. In 2009, she had the following from her mask making activities:

*Xela was forced to acquire a business license as she had received a penalty in 2009 for not having one. In addition, Xela pays a mortgage and had the following in 2009:

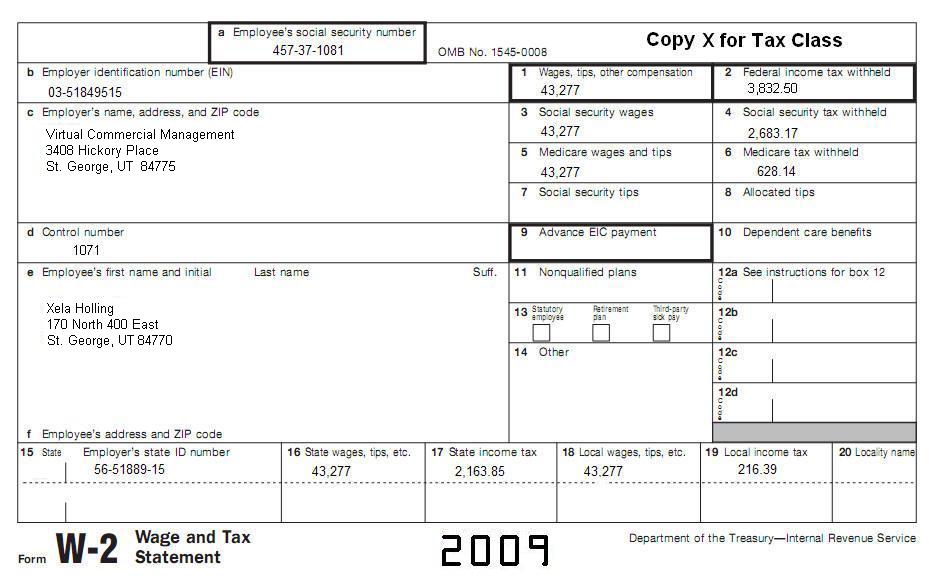

Xela was not married and did not have any dependents in 2009. Get all basic information from the following W2, including income information.

What is the amount Ms. Smith may deduct as real estate taxes on her commercial real estate for 2009?

A. $2,955. 10. Sandy and Buffy formed the S&B Partnership in November of 2009. They began business operations in December 2010. During 2010 they incurred the following costs:

What is the maximum dollar amount that S&B Partnership can elect to amortize as organizational costs?

A. $5,000. 11. Which of the following fringe benefits for meals is subject to the 50% deduction limit?

A. Meals furnished to your employees at the work site when you operate

a restaurant. 12. To figure percentage depletion, you multiply a certain percentage, specified for each mineral, by your gross income from the property during the tax year. Which of the following would not qualify for a percentage depletion deduction?

A. Natural gas well. 13. Michael James purchased a travel agency on July 1, 2010, and immediately took over the business. The purchase contract included the following items as part of the purchase price:

What is the proper amount of Michael's Internal Revenue Code 197 amortization expense for 2010 assuming Michael is a calendar year taxpayer?

A. $90,000. 14. In 2009, Rex, a sole proprietor of Bay View Wrecking, had gross income of $200,000, a business bad debt deduction of $6,000, and other expenses of $156,000. Bay View Wrecking employed the accrual method of accounting and used the specific charge-off method for bad debts. In 2010, Bay View Wrecking recovered $4,500 of the $6,000 previously deducted in 2009. What is the correct way for Rex to report this recovery?

A. Report $4,500 as "Other Income" on Schedule C in 2010. 15. The FX Partnership manufactures garden hoses for sale. In the month of January, its sales were $80,000. During that month, the partnership had:

What is the cost of goods sold for the FX Partnership for the month of January?

A. $79,585. 16. Matt and Jason, Partners in the M & J Partnership began business on June 15, 2009. The business incurred the following expenses prior to June 15th:

What is the cost of improvements?

A. $108,500. 17. Between November 1 and December 1, 2010, you paid a total of $52,000 in start-up costs to create a new business. The business opened its doors on December 15, 2010. Which of the following is a permissible election for treatment of the $52,000 in start-up costs you paid?

A. Amortize $52,000 over a

15-year period. 18. Richard, a self-employed attorney, began a fishing guide business in 2004. He reports income and expenses from this fishing guide activity on a Form 1040 Schedule C separate from his reported earnings as an attorney. The fishing guide business reported net losses each year while Richard's attorney business showed significant net earnings in each of the years from 2004 to 2009. In 2010 Richard's business as an attorney showed a net profit of $50,000. Richard's fishing guide business had the following income and expenses in 2010:

Richard has itemized deductions that he will report on Schedule A of his 2010 Form 1040. How much depreciation deduction can Richard report from his fishing guide business activity in 2010?

A. $(3,000). 19. John and George formed a partnership that began business on July 2010. They spent $4,000 in legal fees for negotiating and preparing the partnership agreement, $2,000 for accounting services setting up the partnership books, and $1,000 in commissions associated with acquiring assets for the partnership. They made a proper election to amortize organization expenses over a 180 month period. Assuming these are their only expenses in starting their partnership, what is the proper amortization expense for 2010?

A. $1,000. 20. As of December 31, 2009, Doyle, Inc. had incurred $6,000 in potential market feasibility costs, $3,600 in legal fees for setting up the corporation, $2,400 in advertising costs for the opening of the business, and $18,000 for the purchase of equipment. Doyle, Inc. began business operations on January 1, 2010. If Doyle, Inc. chooses to amortize its organizational and start-up expenses over the minimum 180-month period, how much can Doyle, Inc. deduct as an amortization expense in 2010?

A. $800. 21. An election to amortize may be made for qualifying costs of organization for a partnership. Which of the following is not considered a qualifying cost?

A. A cost incurred in the creation of the partnership and not for

starting or operating the partnership trade or business. 22. Alan is a sole proprietor of the SAFE Auto Towing Company. Alan paid Landslide Land, Inc., (unrelated), $24,000 for the entire year 2010 for the use of the garage where he operates his business. On September 1, 2010, Alan signed a contract to purchase the garage. His rent payments from September through December will be applied to his equity interest in the business. What is the rent expense deduction that Alan may take on his Schedule C for 2010?

A. $24,000. 23. On January 1, 2010, Carrie leased property for her business for 5 years for $6,200 per year. Carrie paid the full $31,000 during the first year of the lease. What is Carrie's rental deduction for the year 2010?

A. $31,000. 24. Jeanne incurred start-up costs for her new business, which opened October 1, 2010. The costs were for advertising of $1,000, a market analysis survey of $2,500, employee training costs of $6,000, and travel costs for securing prospective distributions of $2,500. What part of the amortizable costs may be deducted in 2010?

A. Up to $5,000. 25. The Flap Jack Partnership, guaranteed a $30,000 note for Elegant Restaurant, one of Flap Jack's customers, for a good faith business purpose. Elegant Restaurant filed for bankruptcy and defaulted on the loan after paying $10,000 of the note. Flap Jack Partnership paid the bank the balance of the note. What is the amount Flap jack Partnership can deduct as a bad debt?

A. $ 0. 26. Ellie operates a restaurant business and Joyce works as a waitress only Monday through Friday from 7 a.m. to 4 p.m. Ellie provides Joyce with a free breakfast and lunch each day, including Saturday and Sunday. Ellie values the breakfast at $5 a day and lunch at $7 a day. Ellie includes the value in Joyce's wages. How much can Ellie deduct every week for meals provided to her employee?

A. $30. 27. You buy an interest in a partnership for $20,000 using borrowed funds. The partnership's only assets include machinery used in the business valued at $60,000 and stocks valued at $15,000. In 2010 you paid $2,000 interest on the loan. How much interest is deductible as interest attributed to a trade or business?

A. $2,000. 28. Rudy, a plumber, paid the following taxes: $800 on the purchase of a new truck, $1,500 for the current year's property tax, $150 sales tax on miscellaneous office supplies, $600 sales tax on merchandise he purchased for resale. How much can he deduct as a tax expense.

A. $150. 29. The Pine Corporation has just opened for business and has elected to amortize its startup expenses. What is the minimum number of months over which the start up costs can be amortized?

A. 60 Months. 30. The Adams & Baker Partnership bought James' B&B restaurant, which was located in an exclusive section of town. The goodwill associated with the purchase of this business was valued at $60,000. Per Section 179, what is the number of years over which goodwill can be amortized?

A. 5 years. 31. When an employer reimburses an employee for meals under an accountable plan while the employee is away from home, the employer must:

A. Include 50% of the cost of meals as income to the employee. 32. In determining whether you are carrying on an activity for profit, all the facts and circumstances are taken into account. All of the following are factors to consider except:

A. you are carrying on two

different business activities. When you combine the income and

expenses together, you have a net profit. 33. Mark is an engineer for the Peterson LTD Partnership. Peterson has an accountable travel expense plan. Mark incurred $375 in travel expenses on a two-day business trip. When he returned to his tax home, he worked late and incurred $90 for meals. Mark gave his employer an adequate accounting within a reasonable time and did not have any excess reimbursement. What amount, if any, must be included in Mark's W-2?

A. $375. 34. Mark, a 50% partner in the X&Y Partnership, uses the percentage method to compute his depletion allowance for the gas and oil property owned by the partnership. His allocable share of the property is $100,000. The fair market value of the property is $100,000 also. 65% of his taxable income for 2010 equals $65,000. The percentage depletion rate is 15% for natural gas and oil sold. X&Y is a small producer, and the average daily production does not exceed the depletable oil and gas quantity. Mark's share of the gross sale of oil and gas deposits was $30,000. What is Mark's depletion deduction for 2010?

A. $4,500. 35. The J&M partnership paid liability insurance on its building of $2,200 for the year 2010. This represents a premium for one year. J&M also prepaid fire insurance premiums of $2,400. The premium paid was for 2010 and 2011. What is the amount of insurance that J&M may deduct for 2010?

A. $2,200. 36. In 2010, Mark paid his first quarter real estate taxes of $1,400 on his personal home. Mark paid real estate taxes on his unemployed brother-in-law's home of $800. During the year, Mark was assessed a tax for trash pick-up of $165. He also paid a tax of $250 for improvements made by the town in his development, which increased the value of his property. What is deductible on his Form 1040 for real estate taxes?

A. $1,440. 37. Which of the following costs qualify as business "start-up costs"?

A. Deductible interest. 38. Which of the following costs would qualify as business "organizational costs"?

A. State incorporation

fees. 39. All of the following can be amortized as organizational expenditures for a newly formed corporation except:

A. Organizational meeting expenses of the corporate directors. 40. There is a difference between capital and deductible expenses. The following is a deductible expense.

A. Cost of a motor vehicle you use in your business. 41. To be deductible, your employee's pay must be an ordinary and necessary expense and you must pay or incur it. The pay must be

A. Reasonable. 42. When you start a business, treat all eligible costs you incur before you begin operating the business as capital expenses. Generally,

A. You can recover the costs

for particular assets through depreciation, amortization or

depletion deductions. 43. These are the costs of carrying on a trade or business and they are usually deductible if the business is operated to make a profit.

A. Business assets. 44. If you use part of your home for business, you may be able to deduct expenses for the business use of your home. These expenses may include mortgage interest, insurance, utilities, repairs, and depreciation. To qualify to claim expenses for the business use of your home,

A. The business part of your home must be used exclusively and

regularly for the trade or business. 45. To be deductible, a business expense is helpful and appropriate for your business. It is an expense that is common and accepted in your field of business and it does not have to be indispensable to be considered necessary. To be deductible the business expense must be

A. Ordinary and necessary. 46. When you can deduct an expense depends on your accounting method. An accounting method is a set of rules used to determine when and how income and expenses are reported. The method you use must clearly reflect income. The two basic methods are

A. The ordinary method and the necessary method. 47. You generally can deduct premiums you pay for insurance related to your trade or business. One kind of insurance is life insurance covering your officers and employees. You can deduct as business expenses life insurance covering your officers and employees if

A. You pay for the plan for the whole tax year. 48. Under the uniform capitalization rules, you must capitalize the direct costs and part of the indirect costs for certain production or resale activities. These costs

A. Should be included in the

basis of property you produce or acquire for resale. 49. You are able to deduct the following expense as cost of goods sold from your gross receipts on Schedule C.

A. Factory overhead. 50. This debt is a loss from the worthlessness of a debt that was either created or acquired in your trade or business, or was closely related to your trade or business when it became partly or totally worthless.

A. A non-business bad debt. 51. An accountable plan, requires your employees

A. To have paid or incurred deductible expenses while performing

services as your employee. 52. You employee is considered to have accounted to you for car expenses that do not exceed the standard mileage rate. For 2010, the standard mileage rate for each business mile is

A. 50.5 cents per mile for the period January 1 through June 30, 2010.

53. To be deductible for tax purposes, expenses incurred for travel, meals, and entertainment must be ordinary and necessary expenses incurred while carrying on your trade or business. Generally, you also must show that they are

A. Directly related to or

associated with the conduct of your trade or business. 54. You pay your employee $18,000 a year. However, after you withhold various taxes, your employee receives $14,500. You also pay an additional $1,500 in taxes from your own funds. You should deduct the full $18,000 as wages. You can deduct the $1,500 you pay from your own funds as

A. Expenses for going into business. 55. As an employer you may have to make payments to a state unemployment compensation fund or to a state disability benefit fund. Deduct these payments as

A. Employee fringe benefits. 56. If you buy a franchise, trademark, or trade name, you can deduct the amount you pay or incur as a business expense only if your payments are part of a series of payments that are

A. Contingent on productivity, use, or disposition of the item. 57. The cost of repairing or improving property used in your trade or business is either a deductible or capital expense. The cost of repairs includes the costs of labor, supplies, and certain other items. An example of a repair would be

A. Reconditioning floors (but not replacement). 58. Unless you have deducted the cost in any earlier year, you generally can deduct the cost of materials and supplies actually consumed and used during the year. If you keep incidental materials and supplies on hand, you can deduct the cost of the incidental materials and supplies you bought during the tax year if

A. You do not keep a record of when they are used. 59. The cost of making improvements to a business asset are capital expenses if the improvements

A. Add to the value of the asset. 60. Under the general rule, all of the following require you to capitalize rental expenses EXCEPT?

A. You produce real or tangible personal property for sale to

customers. 61. All of the following qualify for the depletion deduction EXCEPT:

A. Oil and gas.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Back to Tax School Homepage |